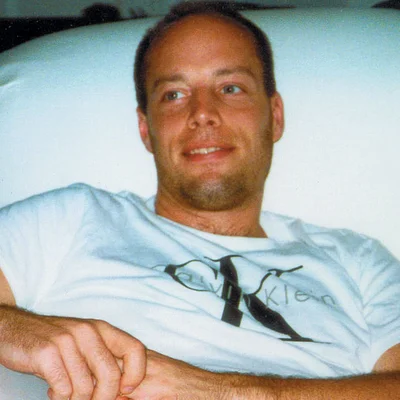

David Rivers—A Memorable Editorial Voice

It took considerably more than one beer for me to persuade David Rivers to abandon the security of the Dow Jones Capital Markets Report (and an occasional Wall Street Journal byline). The proposition was that he should join a small publishing company and launch a newsletter on the business of foreign exchange—not FX rates, mind you, but the FX business. Characteristically, David was anxious (and, also characteristically, his anxiety animated his whole body). But he agreed, and in the summer of

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@waterstechnology.com or view our subscription options here: https://subscriptions.waterstechnology.com/subscribe

You are currently unable to print this content. Please contact info@waterstechnology.com to find out more.

You are currently unable to copy this content. Please contact info@waterstechnology.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@waterstechnology.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@waterstechnology.com

More on Comment

Waters Wavelength Ep. 340: The sad state of journalism

What does this episode have to do with financial technology? Nothing, really. Happy Thanksgiving.

In Absentia: Remembering Sandra Villena and finding her killer

Sandra Villena, a 32-year-old market data professional on the rise, was murdered while on vacation in October 2022. Nearly a year later, her friends and family are still seeking justice, while they learn how to live with the absence that now fills their lives.

In Absentia: Recordando a Sandra Villena y en búsqueda de su Asesino

Sandra Villena, una profesional de datos de mercado de 32 años con gran promesa, fue asesinada mientras estaba de vacaciones en octubre de 2022. Casi un año después, sus amigos y familiares todavía buscan justicia, mientras aprenden a vivir con la ausencia que ahora llena sus vidas.

Demystifying private markets liquidity in 2023

Private markets are being democratized at an alarming rate, and the new entrants’ structures could be misleading. Time to cut through the noise.

Understanding investor overlap across late-stage private stocks

Investing in private markets is no longer just for venture capitalists and private equity funds. But as demand for stakes in these companies grows, so does the overlap in who is investing, as well as calls for more consistent valuations.

People Moves: DTCC, Octaura, Baton Systems, and more

A look at some recent people moves in the capital markets tech and data space.

American unicorns: When primary rounds are distant, secondary markets provide clarity

Unlike in the public markets, valuations of so-called ‘unicorn’ start-ups might only be updated following funding rounds. What if investors want insights more frequently?

Beware the duty of care! Why a level playing field for responsible data sharing in financial services is essential

By Elise Soucie, associate director, technology and operations division, at the Association for Financial Markets in Europe (Afme)