Data Management

Updata Drills IIR Energy for Analytic Tools

UK-based technical analysis software vendor Updata has partnered with Houston, Texas-based supply-side energy market data provider IIR Energy to develop a new set of analytical tools for energy traders and analysts that leverage IIR Energy data covering…

ICD Chooses Volante for Data Integration

Institutional Cash Distributors Technology will use Volante Designer to help it integrate Swift Fin, Bank Administration Institute 2 and proprietary messages in XML and other formats

Herd Instinct: Financial Firms Combat Information Overload with Social Networking Tech

As financial firms deal with ever-increasing levels of information, some are starting to look at a fusion of different technologies to harness true value from the noise. As innovative uses of concepts that have traditionally been associated with social…

Nanospeed Adds FPGA Eurex Data Support

London-based startup hardware provider Nanospeed has added support for the T7 trading architecture utilized by Deutsche Börse’s Eurex derivatives market to its FPGA-accelerated Nano-TG ultra-low-latency trading gateway for futures and options markets,…

Bucharest Exchange Readies Index Expansion

The Bucharest Stock Exchange plans to launch two new indexes plus supporting data this year and to revise its existing Bucharest Stock Exchange Trading Index (BET) index family, in a move to turn its indicators into more accurate representations of the…

The Opaqueness of IBOR

Anthony says that asset managers have to be wary of vendors pitching an IBOR solution. There are legitimate choices out there, but even though the term is old, the field of third-party providers is rapidly growing, and there may be imposters.

The data governance culture -- webcast

Inside Reference Data gathered leading industry experts for a webcast on March 6, 2014 to discuss how financial trading firms are managing data governance considerations in light of increased management focus.

FactSet Wraps Revere Schema Integration

FactSet Research Systems has completed the integration of data from San Francisco-based research and industry classification provider Revere Data, after acquiring the vendor six months ago for an undisclosed sum, and is now conducting research to…

Bloomberg, Markit Seal PMI Data Distribution Deal

Bloomberg has announced that it will begin distributing Markit's Purchasing Managers' Index (PMI) surveys via the Bloomberg Professional terminal service from Mar. 24, to provide subscribers with real-time access to Markit's PMI indicators of business…

Carbon Market Data Rolls out Kazakh Emissions Database, Adds EU Data

London-based emissions data vendor Carbon Market Data has launched a new database of Kazakh companies and their carbon emissions, to provide its clients with information on the country's emissions trading scheme, which started in January 2013.

Stoxx Names Former Banker Andreetto Sales Head

European index provider Stoxx has hired Matteo Andreetto as global head of sales, based in London, with responsibility for the strategic positioning of the vendor's indexes, and for leading sales activities with sell-side and buy-side clients.

Redline Bows Osaka Data Handler

Low-latency market data technology and trading gateway provider Redline Trading Solutions has released support for low-latency market data from the Osaka Securities Exchange's J-Gate trading system in Redline's InRush 3 ticker plant.

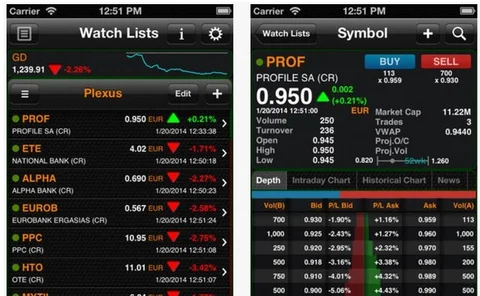

Profile Software Readies Market Data Mobile App

Athens-based technology provider Profile Software has launched a new mobile app, dubbed Plexus, which allows users to monitor real-time data and news on their iPhone and iPad devices.

Thomson Reuters Launches KYC Managed Service

Thomson Reuters has launched a central hub for know-your-client data to make it easier and cheaper for financial firms to manage their regulatory requirements

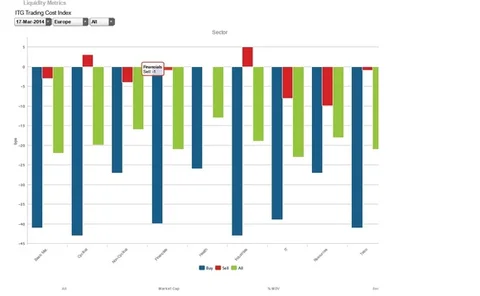

ITG Launches Trading Cost Index, App

Agency brokerage and trading technology provider ITG unveiled a new index today, Wednesday, March 19, that tracks daily transaction costs across different regions and assets, to provide portfolio managers and traders with a quick, aggregate view of…

Consultancy D-fine Deploys SuperDerivatives DGX Terminals

German quantitative and technical consulting firm D-fine is rolling out data, pricing and risk management software vendor SuperDerivatives' DGX data and news terminal to its consultants, freeing them from inflexible fee schedules offered by other…

Markit Debuts Securities Finance Data Platform

Markit has announced the launch of a new platform geared towards data provision for securities lending.

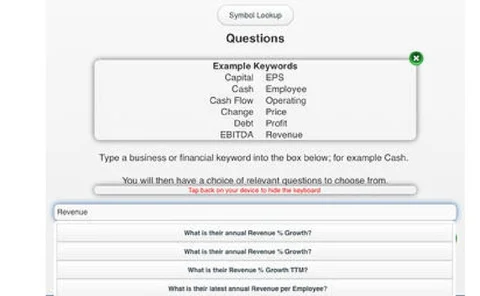

9W Search Bows Mobile Company Data Query App

Financial search engine provider 9W Search has launched a mobile app for iPad, iPod Touch and iPhone devices and Android tablets and smartphones, to make it easy for investors to obtain answers to any question about US public company data.

EDI, Beast Apps Partner on Fixed-Income Derived Data

Algorithms provided by the Beast Apps are using data from Exchange Data International to derive 11 data fields that are available in a new feed

Muscat Securities Market Rolls Out DirectFN Apps

Oman stock exchange the Muscat Securities Market has adopted real-time data apps by Dubai-based market data and financial technology provider DirectFN, in an effort to boost transparency on its capital markets.

Bloomberg Formalizes Third-Party Partner Program Amid Growth

Data and technology provider Bloomberg has announced a formal structure around its partner program, operated by its Enterprise Solutions division, which allows third-party vendors to integrate Bloomberg data into their platforms and connect to…

Dickey to Direct OPRA

Market data industry veteran Steve Dickey has been appointed director of the Options Price Reporting Authority, which manages the OPRA consolidated feed of US exchange-traded options quote and trade data.

Deutsche Börse Launches Economic Indicators Alert Feed

Deutsche Börse has launched AlphaFlash Risk Signal, a notification feed that helps automated traders and other market participants improve their risk management by informing them of upcoming economic indicators, and alerting them when the releases are…

How Many Utilities Does the Industry Need?

The industry will not see the full benefits of the utility model if it becomes spread thinly across a multitude of rival offerings