Data Management

Moscow Exchange Preps Unified Data Policy

The Moscow Exchange is expected to approve a new fee policy document within the next two months that will standardize the contract terms and costs of market data usage by its trading members, data vendors and other users, exchange officials say.

MarketPsych Readies Revamped V2.0 of TRMI Sentiment Indexes

Los Angeles-based behavioral finance and analysis provider MarketPsych is preparing to launch a new version of its Thomson Reuters MarketPsych Indexes (TRMI) machine-readable news service, which will incorporate sentiment on global equity indexes and…

CNSX Mulls ITCH Feed, Continues Equinix Migration

Canadian exchange group CNSX Markets is considering rolling out new versions of its market data feeds based on Nasdaq OMX's ITCH protocol in a bid to grow its membership base of market makers, algorithmic traders and low-latency trading firms.

Confluence Taps SunGard Vet Byrne for EU Sales

Pittsburgh-based fund data management software vendor Confluence has hired former SunGard executive Hugh Byrne as managing director of sales, responsible for driving Confluence's strategic sales and growth strategy in Europe.

S&P Real-Time Debuts FPGA OPRA Feed

The Real-Time Solutions division of S&P Capital IQ (formerly QuantHouse, prior to its acquisition by S&P in 2012) has unveiled QuantFeed FPGA for OPRA, a hardware-accelerated version of its consolidated datafeed that delivers additional processing power…

Charles River to Enter the IBOR Fray

Later this year Charles River is set to unveil a module that will allow its buy-side clients to manage their investment book of record (IBOR) activities. The IBOR functionality will be deployed along with version 9.2 of the Charles River Investment…

Thomson Reuters, Cambridge Associates Aggregate Private Fund Benchmarks

The financial information provider and global investment firm have collaborated on a jointly-developed online platform to provide benchmark pricing on a range of alternative funds.

Thomson Reuters Adds Cambridge Assocs Fund Performance Benchmarks

Thomson Reuters is to begin making private fund performance benchmark data from investment firm Cambridge Associates available via its Eikon data desktop to provide "a next-generation benchmarking system for the [financial] industry," officials say.

Markit Expands European Pricing Data Service

The data services provider has more than doubled the number of European asset-backed securities pricings it offers

SIX Data Supports Hessegim Bond Analytics

Fixed-income software vendor Hessegim is using a web-based application program interface to integrate SIX's reference data into its new bond analytics tool

Analyzing direct and indirect global networks to understand true risk exposure -- special report

What you don’t know can hurt you: Analyzing direct and indirect global networks to understand true risk exposure

Barchart Adds EDI Historical Equities Data to OnDemand Cloud

Chicago-based data and analytics provider Barchart has begun making end-of-day and historical equity price data from reference data provider Exchange Data International available to clients of its Barchart OnDemand cloud data service.

Hessegim Adds SIX Bond, Reference Data

Israeli fixed income analytics software provider Hessegim Software has added global fixed income pricing and reference data from SIX Financial Information to its Prafis analytical tool.

RepRisk Preps ESG Country-Sector Risk Matrixes

Swiss environmental, social and governmental (ESG) risk data provider RepRisk is preparing to add country-sector matrixes to its company database of ESG information, enabling banks, asset managers and pension funds to view the ESG risks relating to…

Morningstar Names Charlson to Head Alternatives Research

Chicago-based data and investment research provider Morningstar has appointed Josh Charlson director of alternative funds research, responsible for the vendor's alternative investment research analyst team and for editing the vendor's Alternative…

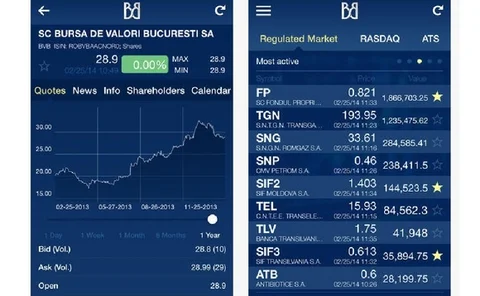

Bucharest Stock Exchange Dials up Mobile Data App

The Bucharest Stock Exchange announced it has launched a new mobile app that allows investors to access market data information more efficiently anywhere, anytime via Apple and Android smartphones.

Prague Stock Exchange Preps Dividends Index Data

The Prague Stock Exchange is preparing to launch a new index that reflects the payment of dividends by its individual constituent stocks, in a move to provide investors with a more accurate picture of return levels and to boost the allocation of the…

IRD Awards Vote Closes April 11

April 11 is the last day to vote for Inside Reference Data and Inside Market Data awards. The awards will be presented on May 21.

Style Research Incorporates RavenPack News Indicators

Global investment research and portfolio analysis application provider Style Research has integrated Spanish news analytics provider RavenPack’s Company Sentiment and News Volume Indicators into its web-based Enterprise platform to enable fund of fund…

Growth in Reference Data Spend Continues to Slow

Following double-digit increases between 2006 and 2011, growth of spend on pricing, reference and valuation data slowed to under 8% in 2012 and 2013, according to research by Burton-Taylor International Consulting

The Power of Names

The difference between disruptive and emerging technologies.

Thomson Reuters Unveils Benchmark Rates Subsidiary

Thomson Reuters will this week unveil a new business, Thomson Reuters Benchmark Services (TRBS), set up as a regulated entity that can provide benchmark rate and index calculation and administration services separately from its parent’s in-house rates…

Interactive Data Adds Bloomberg Open Symbology

The pricing and data services company joins a growing number of providers offering Bloomberg's securities identification system

Fidessa Preps BMV Feed, Further LatAm Growth

Trading technology and market data vendor Fidessa is integrating a new market data feed from the national stock exchange of Mexico, Bolsa Mexicana de Valores (BMV), into its trading platform, as part of ongoing plans to expand its coverage in Latin…