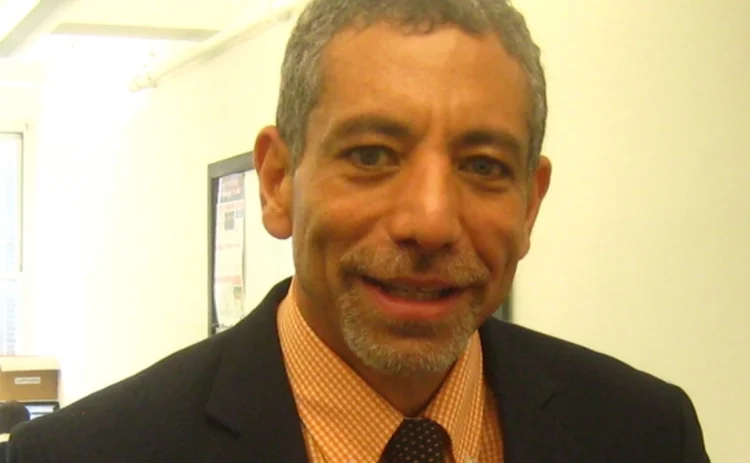

60 Seconds with Emilio Mercado of Simplified Financial Information

What does your company do?

Simplified Financial Information answers the growing need that market data professionals have to better manage risk and market exposure by understanding the impact of volatile and unpredictable conditions. We are doing this by building a complete solution for capturing usage, simulating and playing back high-volume data, and integrity testing client trading-related applications.

What does your job entail?

While I would like to say I do everything, I spend the majority of my time directing and orchestrating the marketing, technology, business development and strategy for the firm I started four months ago. My work entails scouting new clients while keeping the team and investors up to speed.

What trends do you see in the market?

Greater client acceptance of managed services.

How has the regulatory environment affected business?

It is creating new opportunities for us in providing solutions such as risk and reporting, whereas providing intra-day visibility has been difficult.

What do you do to unwind?

Run! I clocked 1,250 miles in 2011, 1,350 miles in 2012, and am on track for another 1,200 miles this year.

Who is the most influential person in your business life? Why?

Thirty-five years ago, I worked with a district manager at Red Lobster who taught me two lessons. He emphasized how important people are and to acknowledge and enable them. And he taught me to fill in the gaps in my management teams. These two vital things take you out of your comfort zone and make the team successful.

What is your favorite part of your job?

Building solutions that solve major client problems at a compelling price point.

What was your first car?

It was a 1974, tan, three-on-the-column Plymouth Duster! It was the last car I owned where I could actually see the ground through the engine compartment.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@waterstechnology.com or view our subscription options here: https://subscriptions.waterstechnology.com/subscribe

You are currently unable to print this content. Please contact info@waterstechnology.com to find out more.

You are currently unable to copy this content. Please contact info@waterstechnology.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@waterstechnology.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@waterstechnology.com

More on Emerging Technologies

MarketAxess and DirectBooks partner, MSCI debuts AI connectors, and more

The Waters Cooler: Canton’s consortium advances cross-border collateral mobility, TRG Screen launches a market data ROI calculator, and Trading Technologies provides direct connectivity to India in this week’s news roundup.

24X files for exemption from SIP rule to take part in overnight trading

The exchange, which began operating in mid-October last year, plans to offer the overnight session in the second half of 2026.

HSBC gives 31,000 engineers an AI coding assistant

CEO Georges Elhedery said the bank is re-engineering its end-to-end processes and enhancing customer experiences with new AI tools.

Bloomberg Terminal’s agentic play shows rapid change in trading tech

Waters Wrap: The data giant’s conversational AI interface might seem novel, but others say having one is becoming a bare minimum in the world of trading technology.

AllianceBernstein enlists SimCorp, BMLL and Features Analytics team up, and more

The Waters Cooler: Mondrian chooses FundGuard to tool up, prediction markets entice options traders, and Synechron and Cognition announce an AI engineering agreement in this week’s news roundup.

CompatibL’s unique AI strategy pays dividends

CompatibL’s unique approach to AI and how its research around cognitive bias and behavioral psychology have improved the reliability of its AI-based applications.

Market participants voice concerns as landmark EU AI Act deadline approaches

Come August, the EU’s AI Act will start to sink its teeth into Europe. Despite the short window, financial firms are still wondering how best to comply.

Ram AI’s quest to build an agentic multi-strat

The Swiss fund already runs an artificial intelligence model factory and a team of agentic credit analysts.