News

Gibraltar Stock Exchange Readies Market Data for Phase Two of Launch

GSX Limited (GSX), Gibraltar's recently launched stock exchange, is planning to launch new market data feeds in late 2015 or early 2016, after receiving authorization from the Financial Services Commission of Gibraltar to commence its operations this…

Nasdaq Promotes Four to Support Growth Across its Market Technology and Listings Units

Nasdaq has announced a series of appointments in order to maximize future growth potential across its Listing Services and Market Technology businesses.

Russia's Cinimex Extends Ties with Misys

The Russian provider has joined Misys' InFusion Partner Program after an existing 12-year relationship.

eFront Partners Methys for African Integrations

The alternative investments software provider will use South Africa-based tech consultancy Methys for all new integrations on the continent.

Sinara Expands Data Integration Offering

UK-based data software vendor Sinara Consultants has expanded its consulting services to include analyzing, designing and enhancing clients' market data repositories and data warehouses.

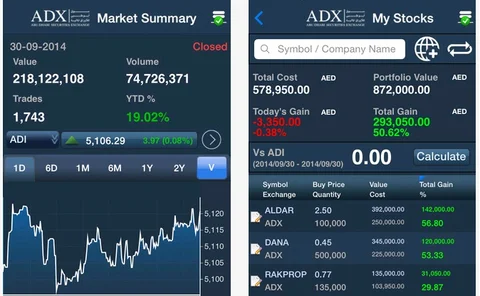

Abu Dhabi Exchange Dials DirectFN Mobile Data Apps

The Abu Dhabi Securities Exchange (ADX) has rolled out mobile data apps for smartphones and tablets from Dubai-based market data and financial technology vendor DirectFN, to increase market transparency and become more technology smart.

Metamako Taps Covington to Drive European Expansion

Metamako, an Australian provider of low-latency switch appliances for high-frequency trading, has enlisted data industry veteran Kevin Covington to set up a European infrastructure to support an expansion of its business into the region.

Low-Latency Startup Metamako to Launch European Operations

Metamako, the Australian startup that provides ultra-low latency tools to exchanges and proprietary trading firms, has announced it will expand its services to Europe with the help of Kevin Covington, managing director and founder of Change Alley, a…

CTA, UTP Revisit Consolidated Tape Fees

The Consolidated Tape Association (CTA) and the Unlisted Trading Privileges (UTP) Plan, which together oversee the collection and distribution of the consolidated tapes of quote and trade data for US equity markets, have proposed new fee policies for the…

Lucena Enables Trading from Analytics via Interactive Brokers Integration

Atlanta, Ga.-based decision support analytics provider Lucena Research is integrating direct trading capabilities from US brokerage firm Interactive Brokers into the vendor’s QuantDesk predictive analytics platform, to enable joint customers among…

American Financial Technology Awards 2014 Extension

We will be extending the deadline for entry into this year's American Financial Technology Awards (AFTAs) by one week, until Friday, October 17, 2014. The site will close at midnight, October 18.

State Street TruCross/FX Platform Goes Live

State Street Global Markets has announced that its TruCross/FX foreign exchange (FX) spot benchmark execution platform, overseen by State Street Global Markets' agency FX unit, is now live.

Kx Names Quill Global Head, Sales Engineering

Tick database provider Kx Systems has promoted Fintan Quill from senior engineer to global head of sales engineering, expanding his prior role beyond just North America and to cover more technical sales and support the vendor's push into new industries,…

TeraExchange Claims First Bitcoin Swap Trade

Swap execution facility (SEF) operator TeraExchange has said that the first ever Bitcoin derivative trade has taken place on its venue.

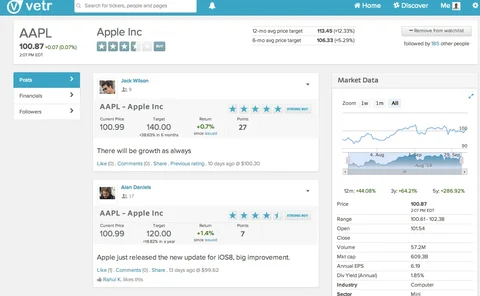

Post-Launch and Funding, Vetr Eyes Institutional Clients for Crowd-Sourced Ratings

Crowd-sourced stock ratings provider Vetr has completed the second stage of a $1 million investment round, and is now focusing on attracting more users and contributors to its portal, to make its content more appealing to institutional traders and hedge…

WorkFusion's ‘Automation Notification' Boosts Data Extraction Options

New York-based software-as-a-service vendor WorkFusion has launched new "automation recommendation" functionality on its WorkFusion data extraction platform to automatically notify customers when the software is able to automate data extraction processes…

SimCorp Poll: Only 23 Percent on Buy Side Can Perform Intraday Calculations

Investment management solutions provider SimCorp has released a poll that surveyed 60 executives from North American-based capital market firms about performing intraday calculations on the impact of position-driving events.

MDSL Taps Ex-Deutsche Bank Data Exec DeMaio as COO

UK-based cost and inventory management software vendor MDSL has hired Lou DeMaio, former global head of market data service delivery at Deutsche Bank, as Americas chief operating officer to spearhead growth of the vendor's MDX (Market Data Expert)…

eClerx Launches KYC Solution

Knowing your customer is a major priority for firms in an age of strict regulation and massive fines, says eClerx principal Alan Paris.

ITRS Adds Bloomberg B-Pipe Monitoring to Geneos

ITRS Group, a provider of performance monitoring technology for real-time systems, has launched an interface that provides monitoring support for customers of Bloomberg's B-Pipe real-time market data feed within ITRS' Geneos monitoring platform via a new…

FICO Updates Analytic Model Management Tool

FICO has announced the release of Model Central 5.0, an updated version of its analytic-model management solution.

BATS Pushes MMT for BXTR Reporting

Pan-European equity exchange BATS Chi-X Europe has made the Market Model Typology a key component of its BXTR trade reporting service, to help boost market transparency and contribute to creating the underlying conditions to support a European…

Standard Bank Selects Eagle for Data Management, Accounting

Standard Bank South Africa will use Eagle Investment Systems' accounting and enterprise data management platform, taking the services on a hosted basis through the vendor's private cloud, Eagle Access.

SS&C Debuts Integrated Platform Offering

SS&C Technologies has announced the release of an integrated technology platform that spans the front, middle and back offices, aimed specifically at hedge funds.