News

Linedata Partners with InvestSoft for Fixed Income, Derivatives Analytics

Linedata has entered into a partnership with InvestSoft Technology where Linedata will provide InvestSoft's BondPro analytics engine for fixed income and credit derivatives to its asset management clients.

Tick Data Bows Cloud Data Storage, Access

Historical tick-level trade and quote data provider Tick Data has introduced cloud-hosted options to allow firms without large IT and storage infrastructures to access and run analytics on the vendor's full tick history.

Numerix Integrates with Cameron Tec for Structured Product RFQ System

Numerix's calculation engine can now be used to translate a request for quotation from a client and price the relevant product, before the price is converted into a Quote FIX message by Cameron Tec and returned to the client

Kynetix Unveils Trade Exception Software for New LME Clearing House

New software will identifiy exceptions between the trade information held by London Metal Exchange members and the records held by its new clearing house, which will use messaging standards based on the FIX protocol

Fidessa Upgrades IMS to Version 14, Adds Compliance

London-based Fidessa has upgraded its Investment Management System (IMS) to version 14, bolstering its reporting capabilities and adding new compliance functionality.

SS&C Signs Two for Global Wealth Platform

SS&C Technologies has announced that both Vancity Investment Management and the Lucie and Andre Chagnon Foundation have selected its Global Wealth Platform (GWP).

TPI Enlists Matriks as Turkish Data Distributor

Turkish data vendor Matriks Bilgi Dagitim Hizmetleri has signed a deal with Tullett Prebon Information (TPI), the data arm of interdealer broker Tullett Prebon, to distribute TPI's over-the-counter prices on global commodities to its client base of…

Fincad Updates F3 Valuation, Analytics Platform

Canadian over-the-counter derivatives pricing and risk management software vendor Fincad will roll out a new version of its F3 enterprise valuation and risk analytics platform in the coming weeks, with increased support for foreign exchange derivatives,…

Imatchative Goes Live with Inaugural Product AltX

San Francisco-based startup Imatchative has launched AltX, an online platform that allows institutional investors to connect with hedge funds for due diligence and capital allocation purposes.

Bloomberg Acquires RTS RealTime Systems

Bloomberg has acquired low-latency connectivity and trading support provider RTS RealTime Systems to expand its exchange connectivity through RTS’ existing global network of datacenters.

ITRS Names Former FTSE Exec Warren CEO

ITRS Group, a London-based provider of real-time systems monitoring and management technology, has hired Guy Warren as chief executive, replacing Kevin Covington, who will continue to serve as a senior advisor to ITRS after more than five years as CEO.

ITRS Names Warren CEO

Guy Warren has been named CEO of ITRS Group, a provider of performance monitoring and management technology. He replaces Kevin Covington, who will remain as a senior adviser to ITRS.

MDX Tech Taps CFSI as Canadian Agent

UK market data connectivity supplier MDX Technology has appointed Toronto-based consulting services startup Collaborative Financial Services Inc (CFSI) as its sole agent in Canada, as part of its ongoing expansion into North America.

SoftSolutions Implements MillenniumIT Protocol for Borsa Italiana Bond Markets

London Stock Exchange-owned Borsa Italiana has rolled out Italian fixed income connectivity and trading software provider SoftSolutions' connectivity suite to support the implementation of the new data protocol from LSE-owned exchange technology provider…

Abacus Rolls Out File Transfer Solution for Buy-Side Firms

Abacus Group has launched a new service designed to help hedge funds and private equity firms to automate routine file transfers.

StatPro Gives Asset Managers Access to Nasdaq Index Data on Revolution

Portfolio data and analytics software vendor StatPro is to make more than 41,000 indexes in the Nasdaq Global Index Family available to asset managers via its cloud-based Revolution analytics desktop platform, as a result of joining Nasdaq OMX's Elite…

BNP Paribas Opens Reporting Tool to Agency Lending Clients

BNP Paribas Securities Services has announced that its agency lending clients can now access its interactive reporting solution, Data Navigation Analysis (DNA), and gain better oversight and control over their lending activities.

Numerix, CameronTec Partner for Structured Products RFQ System

Numerix and CameronTec have announced a joint project that allows clients to institute a FIX-based request-for-quote system for over-the-counter structured products, returning a quote in seconds.

Credit Benchmark Raises $7M, Unveils Consensus Ratings Service

London-based Credit Benchmark, a startup provider of consensus credit rating data, has raised $7 million to support the ongoing production rollout of its data service by funding new hires and the opening of a new office in New York.

SGX Moves Forward with HKEx Partnership, Opens Local Derivatives Office

The Singapore Exchange has opened its "liquidity hub" point of presence (PoP) in Hong Kong Exchanges and Clearing's datacenter-the first step in a series of moves to facilitate closer cooperation between the exchanges, including setting up PoPs in each…

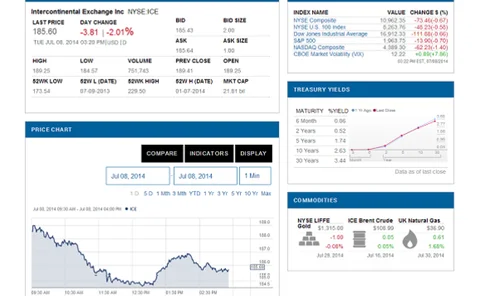

ICE Taps Morningstar for NYSE Web Data

IntercontinentalExchange is rolling out financial data and web components from Chicago-based data and investment research provider Morningstar to make market data available online via the New York Stock Exchange's redesigned website.

SGX Unveils PoP at HKEx, Opens Local Derivatives Office

The Singapore Exchange has opened its "liquidity hub" point of presence (PoP) in Hong Kong Exchanges and Clearing's datacenter--the first step in a series of moves to facilitate closer cooperation between the exchanges, including setting up PoPs in each…

SS&C GlobeOp Gains UK Regulatory Approval for Depositary Lite

SS&C GlobeOp has gained full UK Financial Conduct Authority (FCA) approval for its Depositary Lite service, the provider has announced.

MarkitSERV Connects to KRX for Swaps Clearing

MarkitSERV, Markit’s electronic trade processing service for over-the-counter (OTC) derivative transactions, has connected to Korea Exchange (KRX) for the clearing of interest-rate swaps.