News

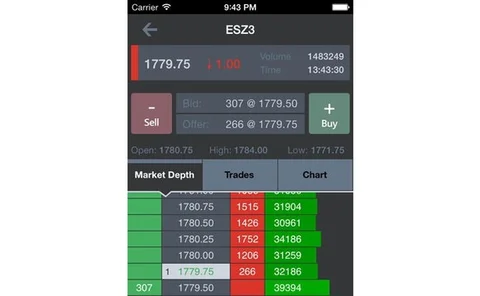

Barchart Adds iPhone Data-Trading App

Chicago-based data vendor Barchart has released a mobile version of its Barchart Trader desktop application for Apple iPhone devices, to accompany the terminal and Android versions unveiled last year (IMD, Sept. 6, 2013; Nov. 6, 2013).

FIX ‘Adopts’ MMT Post-Trade Data Standards

Standards body FIX Trading Community-the organization formerly known as FIX Protocol Ltd, which governs the development of the FIX Protocol-has adopted the Market Model Typology post-trade reporting initiative as a FIX standard, adding support for MMT in…

Indata Launches iPM Epic with Eye Toward Big Data Challenges

Portfolio management systems provider Indata is looking to tackle the challenge of big data with the launch of iPM Epic.

Marco Polo New World Appoints Christian Robertson CEO

Trading solutions provider Marco Polo New World has appointed Christian Robertson as its CEO to lead the firm into new global markets and lines of business, while expanding its existing platform and revenues.

Thomson Reuters Adds Twitter Sentiment Analysis Tool to Eikon

Thomson Reuters has added a news sentiment data tool to its flagship desktop platform Thomson Reuters Eikon, including sentiment analysis of Twitter feeds.

Icap Aims for London-based SEF

Interdealer broker Icap has filed an application to run a swap execution facility (SEF) based in London, but overseen by the US Commodity Futures Trading Commission (CFTC).

Calypso Unveils DTCC Interface to Support EMIR Reporting

San Francisco-based Calypso Technology has released an interface to the Depository Trust and Clearing Corp’s (DTCCs) Global Trade Repository (GTR) service, a repository holding global OTC derivatives transaction data, to assist firms with their European…

Bloomberg Embeds OneMarketData for Trade Analytics

Bloomberg has integrated tick database and complex event processing system provider OneMarketData’s OneTick CEP engine into its EMSX execution management system, an integrated component of the vendor’s Bloomberg Professional terminal, to provide users…

Thomson Reuters Focuses on Search in Latest Eikon

Thomson Reuters will this week roll out the fourth iteration of its Eikon next-generation data desktop, with new features designed to make it easier for users to access the platform’s content and analytics, and to more tightly integrate the product into…

VWD Expands Bonds, Ratings Content to Meet Fixed Income, Risk Demand

Frankfurt-based data vendor VWD has released version 3.4 of its Market Manager desktop application in an effort to tap into increased demand from savings banks, treasury departments and insurance companies for flexible bond calculations and for more…

Quartet FS Readies Historical Analysis, Sentinel Update

In-memory analytics technology provider Quartet FS is preparing to launch a new version of its ActivePivot data aggregation and analytics engine that will enable users to carry out historical data analysis following breaches in performance indicators…

Telx Eyes New York Hosting Space Expansion

Datacenter and hosting provider Telx is expanding its available datacenter space in New York City and the NY metro area, to meet demand for hosting space in the city, with plans to grow its datacenters at 32, Avenue of the Americas and 60 Hudson Street…

BSB International Gets New CEO

Marwan Hanifeh has been named CEO of BSB International, an asset management software provider based in Louvain-la-Neuve, Belgium. He replaces CEO and company founder Jean Martin, who stepped down on Jan. 29.

Bats, Direct Edge Receive SEC Merger Approval

Bats Global Markets and Direct Edge have announced that the US Securities and Exchange Commission (SEC) has given the green light for their planned merger.

New Warsaw Stock Exchange Indexes Up Focus on Small, Mid-Cap Stocks

The Warsaw Stock Exchange will start publishing two new price indexes─the WIG50 and WIG250─in March, replacing existing smaller, more selective index families, in a move to boost its coverage of small and medium-sized companies listed on its Main Market.

Broadridge IM Business Boosts Ref Data Expertise with SmartStream, Paladyne Hires

Former SmartStream exec Lou Longhi and former Paladyne MD Jonathan Cross have joined Broadridge's recently created Investment Management business, where they report to its president, Bennett Egeth

Hausman to Lead IDC Ref Data as Hepsworth Heads to Europe

Andrew Hausman has been appointed president of pricing and reference data at Interactive Data, as Mark Hepsworth leaves the role to head the company's business in Europe

Freedom Index Co Bows Aussie, Africa Indexes

Startup not-for-profit index provider the Freedom Index Company-which launched last year to offer free and independent indexes to the asset management community-is planning to add Australian indexes to its family of free-of-charge products, and is now…

Canadian Doctors' Fund Taps QuoteMedia Data Terminals

MD Physician Services, an asset manager and investment advisory subsidiary of the Canadian Medical Association that serves Canadian doctors and their families has signed a three-year deal with Phoenix, Ariz.- and Canada-based data provider QuoteMedia to…

Wiener Börse Inks Data Deal to Distribute Kazakh Exchange Prices

Wiener Börse, the Vienna Stock Exchange, has signed an agreement with the Kazakhstan Stock Exchange (KASE) to allow data vendors to obtain price data from the Kazakhstan market via the Austrian exchange's Alliance Data Highway datafeed.

Traiana Partners Confisio for Cypriot Emir Reporting

Traiana has announced a strategic alliance with Confisio Managed Services, which will see the two firms launch a service for Cyprus-based clients who are required to report transactions due to incoming European Market Infrastructure Regulation (Emir)…

HSBC Chooses Thomas for Major Client Data Project

David Thomas has left Barclays Capital, where he was global head of client data, to take responsibility for creating a shared services model for client data at HSBC

SmartStream Tackles Intraday Liquidity Management

The software vendor has upgraded its Transaction Lifecycle Management Cash and Liquidity Management product by enabling users to monitor, manage and report on their intraday liquidity positions

Itaú Chooses Omgeo to Automate Post-trade Processing

Itaú Asset Management has replaced faxes, emails and spreadsheets with Omgeo's central matching platform and settlement instructions database