News

IBOR Breakfast Briefing: Projects Should Make a Firm Feel ‘Small’

Jon Rushman, professor of practice in the finance group at Warwick University Business School, said in his keynote address to an investment book of record (IBOR) breakfast briefing hosted by Waters, that the central idea behind an IBOR is making a…

Fitch Solutions to Add Pre-LEIs to Unrated Entities

The data and analytics vendor currently includes pre-legal entity identifier codes for the entities rated by Fitch Ratings and now plans to do the same for its sets of unrated data, including credit default swap pricing data

Markit Selected by ASIFMA for Hong Kong Electronic Equities Compliance

The financial information provider's Counterparty Manager technology will be deployed by buy-side and brokerage members of the Asia Securities Industry and Financial Markets Association ahead of new Hong Kong Securities and Futures Commission (SFC) rules…

Perseus Launches London Metro Microwave Data Network

New York-based low-latency network provider Perseus Telecom has launched a new microwave data distribution service that allows customers to connect wirelessly to major London financial markets.

Object Trading Adds OpenMAMA Interface to FrontRunner

Trading technology and data platform provider Object Trading is adding support for NYSE Technologies' OpenMAMA messaging layer framework-the open-source version of its Middleware Agnostic Messaging API-to its Frontrunner direct market access suite, to…

Euroclear Confirms UK T+2 Settlement from Next Year

Euroclear UK and Ireland has said it is coordinating with a number of UK venues to ensure that shortened local settlement cycles will be in effect from 2014, in line with regulatory mandates.

ICE, DTCC Announce Closure of NYPC

The IntercontinentalExchange (ICE) and the Depository Trust and Clearing Corporation (DTCC) have announced that New York Portfolio Clearing (NYPC) will be wound down, with interest-rate futures listed on NYSE Liffe US moving to ICE Clear Europe.

Icap Appoints COO

Inter-dealer broker Icap has announced that Ken Pigaga will take on the role of global chief operating officer.

Execs Exit Iress in Canada, South Africa

Australia-headquartered data and trading technology provider Iress Market Technology last week announced the departure of two senior executives at its subsidiaries in Canada and South Africa.

Aite Report: Alternative Data, Visualization, Historical Analysis Top Buy-Side Wish List

Hedge funds and asset managers are integrating middle-office datasets into their front-office portfolio management workflows to support investment decisions, and are seeking more interactive ways to view and manipulate data, according to a report…

Eze Adds Workflow and Reporting Enhancements to Tradar 5.1

Eze Software Group has released version 5.1 of its Tradar PMS portfolio management system for the buy side.

BATS Chi-X Touts 2014 Data Price Cap, BXTR Reporting as Basis for EU Tape

BATS Chi-X Europe has pledged not to increase market data fees in 2014 for its US and European subscribers, following several well-publicized fee increases at regional exchanges, including the London Stock Exchange, which notified clients in October of a…

Infront Re-org Boosts Data Quality, Service

Norwegian market data and trading technology provider Infront has increased its focus on market data quality following a recent revamp of its client services team that has also allowed the company to provide its customers with quicker and better answers…

Wall Street Horizon Creates Historical Event Analytics

Woburn, Mass.-based corporate earnings and event data provider Wall Street Horizon is developing a number of new products based on its historical dataset of information on corporate earnings releases and other single-stock events, to support the back…

ICE and CME Receive Trade Repository Approvals

Intercontinental Exchange Group and the CME Group have both received regulatory approval to operate a Trade Repository (TR) for the reporting of swaps and futures trade data under the European Market Infrastructure Regulation (EMIR).

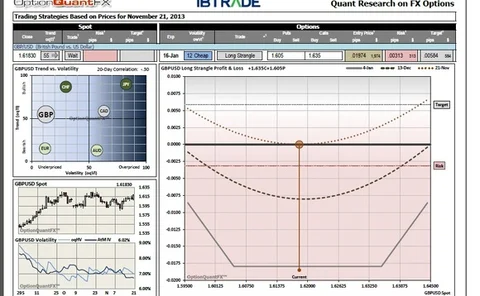

FX Bridge Preps Options Volatility Commentary

Foreign exchange spot and options trading platform provider FX Bridge Technologies is rolling out two new subscription-based FX volatility measures designed to help traders and investors identify trading opportunities in FX options and less common…

BAML, Goldman Sachs Join Eurex Clearing for IRS

Bank of America Merrill Lynch (BAML) and Goldman Sachs have joined Eurex OTC Clear as clearing members for interest-rate swaps (IRS).

FNZ Taps Euroclear UK to Automate its Fund Settlement Process

Custody provider FNZ has entered a strategic partnership with central securities depository Euroclear UK and Ireland to integrate its fund settlement process.

CLS Adds Iwadare to Board

CLS Group has announced that Hirochika Iwadare, general manager of the global markets trading division at Bank of Tokyo Mistubishi UFJ, has been elected to the CLS Group Holdings board of directors.

Equinix Calls Karl for Americas President Role

Datacenter and hosting provider Equinix has hired Karl Strohmeyer as president of the Americas, responsible for the vendor's management, strategy and growth plan in the region.

Redline Opens Chicago Office

Woburn, Mass.-based low-latency ticker plant and trading gateway provider Redline Trading Solutions has opened a sales and support office in Chicago at 111 West Jackson Boulevard.

Morningstar Names Ewan Morningstar IM Europe MD

Chicago-based data and investment research provider Morningstar has hired Simon Ewan as managing director of Morningstar Investment Management Europe, the vendor's investment advisory and outsourced portfolio management division.

Traiana Expands Regulatory Reporting With UTI Tool

Traiana, the New York-based provider of post-trade services owned by UK interdealer ICAP, has expanded its regulatory reporting suite of solutions with a Unique Trade Identifier (UTI) management tool using the Harmony network.

Société Générale Deploys Etrali on Paris Trading Floor

Etrali Trading Solutions has announced that the Paris trading floor of Société Générale will use its OpenTrade communications system from December, following on from similar implementations in Moscow and New York.