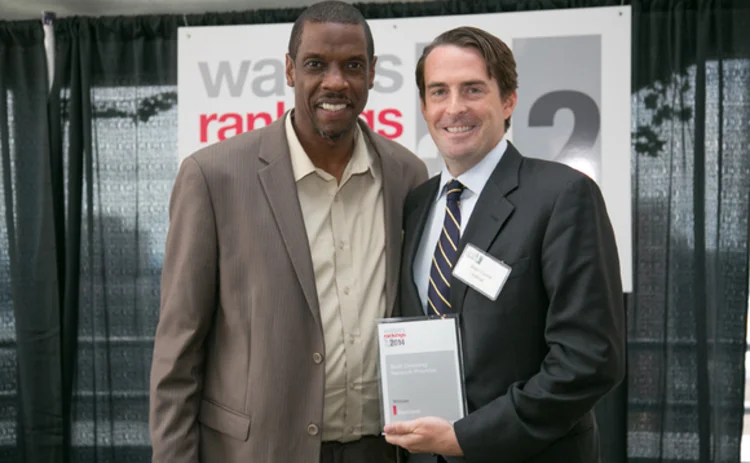

Waters Rankings 2014: Best Crossing Network Provider — Instinet

In addition to its US equities staple, CBX offers buy-side traders access to US options as well as listed stocks in Japan and Hong Kong. It is designed to “sweep” outstanding order flow in the staging blotter of Instinet’s Newport execution management system (EMS), and also incorporates a smart order router and a suite of algorithms from Execution Experts, the firm’s specialist algo trading business that provides institutional investors with an extensive range of standardized and customized multi-asset class strategies. CBX is also capable of sweeping reciprocal liquidity pools, and supports limit, iceberg, hidden, and pegged specialty order types, too.

But perhaps most impressive about these dark pool venues is their design to specific market requirements—for example, “indicative fill” messaging as required in the Japanese market, and a unique US options model that, unlike other dark pools in the asset class, does not require a negotiation process before anonymous trades are made. The latter options functionality has continued to be refined since its initial launch in 2010—in the wake of Instinet’s foundational acquisition of Torc Financial’s technology platform a year earlier—and has grown in importance for options traders and market-makers as the space has further fragmented in the years since.

In some ways, the award for Instinet is a long-time coming—having been narrowly outdone by Liquidnet and NYSE Euronext in 2012 and 2013, respectively. Whether greater attention on low-latency trading produces further regulation for dark pools in coming years or not, CBX’s victory proves that the need for an expertly designed crossing network not only remains, but has grown substantially since Continuous Block Crossing—as the matching system was originally called—was introduced more than a decade ago, in 2003.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@waterstechnology.com or view our subscription options here: https://subscriptions.waterstechnology.com/subscribe

You are currently unable to print this content. Please contact info@waterstechnology.com to find out more.

You are currently unable to copy this content. Please contact info@waterstechnology.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@waterstechnology.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@waterstechnology.com

More on Awards & Rankings

American Financial Technology Awards 2025 winner’s interview: Connamara Technologies

Connamara Technologies’ recent win in the AFTAs on the back of its EP3 platform

Buy-Side Technology Awards 2025 winner’s interview: CompatibL

The chairman of CompatibL discusses the reasons for the firm’s success in the Best buy-side AI platform category of the Buy-Side Technology Awards 2025.

AFTAs 2025: Best data provider—Allvue Systems

Product: Private Credit Intelligence

AFTAs 2025: Best IT team—TCW Group

Team: TCW Group’s Investment Technology Team; Project: Engineering Solutions—ABF and insurance launches during Aladdin stabilization

Buy-Side Technology Awards 2025 winner’s interview: 73 Strings

73 Strings’ win in the BST Awards 2025 Best middle-office platform category

AFTAs 2025: Most cutting-edge IT initiative—J.P. Morgan

Project: Vida Beta One

Buy-Side Technology Awards 2025 winner’s interview: S&P Global Market Intelligence

S&P Global Market Intelligence’s success in the first year the Best private markets data provider category has been on offer.