Project Condor: Inside the data exercise expanding Man Group’s universe

Voice of the CTO: The investment management firm is strategically restructuring its data and trading architecture.

Voice of the CTO

Last year, WatersTechnology spoke with eight senior technologists from eight different tier-one banks. Those interviews were conducted on background to get an honest understanding of the challenges they were facing. Nearly all of those challenges still exist today—you can find those articles here.

For this year’s series, we wanted to drill into interesting projects from five different institutions: four global systemically important banks (G-SIBs), one large buy-side firm, and one large exchange. The aim is to highlight specific projects at a variety of large institutions to show how these firms are preparing for an unknown future as technological innovation rapidly evolves.

Part 2: Bank of America’s 3Rs (click here)

Part 3: Deutsche Bank explores GenAI (click here)

Part 4: Citi’s all-encompassing risk platform (click here)

Part 5: ING’s Global Data Platform (click here)

The subsequent Voice of the CTO articles will be published each of the following Wednesdays. For more information on the methodology of this series, please scroll down to the bottom of the page.

As it burns millions of miles away, the sun is slowly losing its mass and its gravitational pull. It drifts further from the Earth by about 0.6 inches per year. And due to tidal forces, the moon also puts about an inch-and-a-half of additional distance between itself and us every earthly revolution. In parts of space where objects are not gravitationally bound to one another, mysterious dark energy pushes galaxies further apart, toward a future universe that—one day—will be unable to sustain life.

Back on Earth, on the bank of the River Thames, a team of data scientists and analysts within one of the largest hedge funds in the world are overseeing an expansion of their own universe. Several floors up, Barry Fitzgerald, Man Group’s co-head of front-office engineering, explains that “expanding the universe” is shorthand for increasing the scope of a project, and the firm’s newest undertaking, Project Condor, will see the firm mimic the celestial rearrangement slowly unfolding in outer space.

Project Condor—so named for the bird’s large wingspan—entails the investment manager restructuring its trading and investment tools to better integrate data and manage risk of portfolios more effectively by homogenizing internal workflows across a number of different asset classes. Fitzgerald says the retooling of the data architecture is a long-overdue makeover for parts of the business where the future was not a priority during development.

Man AHL, the fund’s systematic trading business, was founded on “futures trend following,” Fitzgerald tells WatersTechnology. “You essentially get the price of futures and if the price is going up, you trend follow it up, and if the price is going down, you trend follow it down. There’s obviously huge nuance, but it isn’t hugely complicated. From day one, this was with technology. You ran that on a computer, and you worked out if there was a trend or not a trend. Tech was a minimum requirement from day one.”

As Man AHL grew beyond futures to equities, options, and bonds, the complexity and risk profiles of portfolios also grew. Condor, which has been underway for a year, grew out of Man Group’s desire to have definitive, coherent views of those risk profiles across multiple asset classes.

With Condor, Fitzgerald and his team do not want to revamp their tech stack only to be hemmed in later by limitations unknowingly built in. He says the company needs to allow for greater flexibility by factoring in asset classes that don’t yet exist—a tall order, but it’s happened before. When the first trading architecture was designed, there was no such thing as cryptocurrencies.

“The challenge for building something like Condor is that we want it to allow us to trade in lots of different ways, but also ways we haven’t thought about yet,” he says. “You want to bake in a bit of flexibility into it. The balance is, if you bake in too much flexibility, it’s just completely generic and doesn’t mean anything to anyone.”

Man Group’s universe has already expanded since its formation more than 200 years ago, initially as a sugar brokerage. After adopting other commodities like coffee and cocoa, the firm diversified its interests to include financial services in the late 20th century. With more than $150 billion in assets under management today, Man Group has made a point of emphasizing its focus on alternative data to both bolster its existing offering and maintain an edge over competitors.

Last year, Man Group’s then-head of data, Hinesh Kalian, told WatersTechnology that the alt data vendor space had matured as investors grew more discerning about their dataset choices. Due to the short lifespan of these datasets, asset managers are often frustrated to find they’ve lost their value as soon as they’ve been integrated with their systems.

“We talk about alpha decay, so you have a good idea of what makes money, but there tends to be a lifespan,” Fitzgerald says. “We do have things we’ve traded for 20 years, but more and more, especially with alternative datasets, there’s a lifespan of it being very useful for six months, and then either lots of people are trading it so the value gets removed, or a better dataset has come out and you [pivot] to that. You’re constantly running to stand still.”

Local robot makes good

In a post-Condor world, the analysis of several alternative datasets would be compressed, streamlined, and fed to Man Group’s portfolio managers in an easy-to-parse format. But this will require a new skillset.

Leonor Chabannes, head of solutions engineering at Man Group, was hired by Fitzgerald in 2022 and joined Man GLG, Man Group’s discretionary subsidiary that covers every aspect of the non-systematic trading experience.

Discretionary portfolio managers have different approaches to data analysis compared to quantitative portfolio managers. Chabannes noted that the different ways of thinking about trading across the firm has meant that Condor must be designed in a way that fits both approaches.

It’s not enough to just compute large amounts of data; it also needs to be presented to portfolio managers clearly. Each portfolio manager has a preferred way of absorbing information, but Chabannes says the personalization is not so specific that data solutions for each team are overly detailed, resulting in an unwieldy tech estate.

She explains that as long as the core tools and processes are the same, portfolio managers are able to ingest hundreds of datasets, an increasingly common need as dataset research advances technologically.

“You’ve gone from a portfolio manager who is basically only using their Bloomberg Terminal and a couple of Excel spreadsheets, to people who are ingesting lots of data and trying to really improve their view on the company using more tech and more data,” Chabannes says.

The combination of Condor and Man Group’s artificial intelligence solutions was a match that felt predestined. At a conference hosted by Bloomberg last April, Man Group CTO Gary Collier said he foresaw generative AI “underpinning” workflows at the firm.

We get much better results from ChatGPT by giving it the same documents that you’d give to a human and then teaching it how everything works

Barry Fitzgerald, Man Group’s co-head of front-office engineering

Almost a year on from that statement, it was an apt prediction. Though, Fitzgerald adds, it was not quite as plug-and-play as the team at Man Group had expected.

“At the start of this, there was an idea that you’d get all your code and point ChatGPT at it, and you’d be able to chat to it, and it would do things with your code. But what we’ve found over time, especially in our current project, is it’s a bit like you’ve got a new intern, and you need to teach them,” he says. “We get much better results from ChatGPT by giving it the same documents that you’d give to a human and then teaching it how everything works.”

The caveat that Man Group chatbots should be as qualified as Man Group interns notwithstanding, Fitzgerald and Chabannes note that there is no shortage of use cases for the technology across the trading and portfolio construction parts of the business.

Fitzgerald explains that portfolio managers need up-to-date information on many entities in order to allocate capital within client portfolios, so they often tune in to earnings calls and listen for forward-looking statements or indicators of progress. Prior to the advent of GenAI, shortcutting this process would have involved a form of natural-language processing that would pick up on words and terms that might refer to the future, such as future-tense verbs or phrases like “next year.”

This process would be complicated and ultimately save no time, but with GenAI, portfolio managers are able to input whole transcripts and ask the AI to extract any forward-looking statements. By automating this process, portfolio managers can save enough time to cover multiple companies without having to rely on an inexact science.

Another significant time-saver comes in systematic bond trading. Unlike equities, bonds have large prospectuses that tell investors all the bonds’ specific terms. Fitzgerald explains that prior to using generative AI, the workflow would include an initial scan by a human to pick out relevant terms, and then a second scan by a different human to cross-check their accuracy.

“The first layer we can now do with GenAI, and we can measure the accuracy versus humans,” Fitzgerald says. “Then we still have the second layer that’s checking—because it’s important data to us—but it has sped up something from a predominantly manual process to one that’s half-automated.”

Fitzgerald says Man Group doesn’t train its own large language models—rather, the investment manager uses “big commercial models.” The process of finding “the right partnerships and contracts” was laborious, as Man Group had to make sure its own data wasn’t used for training purposes not specific to Man Group. As a result, signing that commercial contract “took quite a lot longer, as our legal and compliance teams needed to get comfortable with what is essentially a brand new use case.”

Chabannes says the firm employs a variety of different fail-safes to prevent inaccuracies, which have plagued generative AI models since their creation. These gaffes, or “hallucinations,” prompted Man Group head of risk engineering Vlad Mereuta to say of ChatGPT at a conference in October: “I will not trust it to do anything from a risk perspective.”

“We ask our AI tools to quote any sources they used to derive that information,” Chabannes says. “There’s always an additional layer of human checking.”

Where condors dare

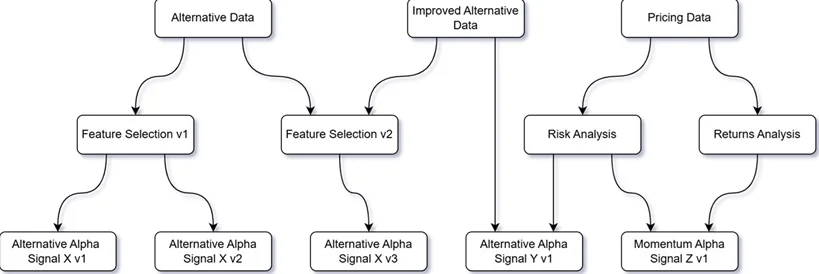

The revitalization of Man Group’s trading technology starts on the data level with a re-examining of the firm’s workflows. The firm creates Directed Acyclic Graphs, or DAGs, to represent workflows wherein each part of the workflow is managed in a specific order, so the computers don’t try to do everything at once and produce the wrong results.

These DAGs then tessellate together as they are employed for more complex trading strategies. Fitzgerald describes the workflows as akin to baking a birthday cake.

Buying the ingredients must come first, but baking the sponge layers and making the icing are tasks that, while ultimately linked, are not dependent on each other, so they can be completed simultaneously. After they’re complete, the icing goes on the sponge, at which point the candles can be placed on top. The firm uses DAGs to complete multiple tasks within the same workflow at the same time, which means that highly complex trading strategies do not take much longer to execute than simple orders.

Fitzgerald says Man Group uses DAGs mostly in equities trading because the system was a good fit for the high number of trades made there.

“That’s the motivation behind Project Condor,” he says. “We have a very good way of trading futures, [and] we have a very good way of trading equities. We feel that if we can have a really coherent way of looking at all of them at once, then that will provide us a platform for the future.”

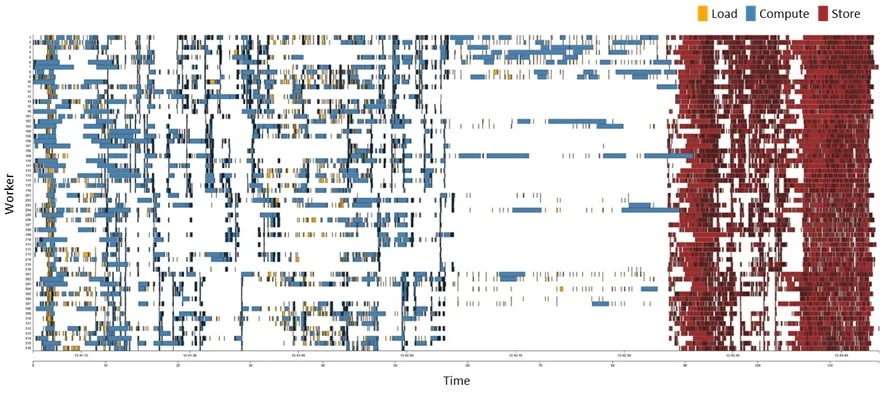

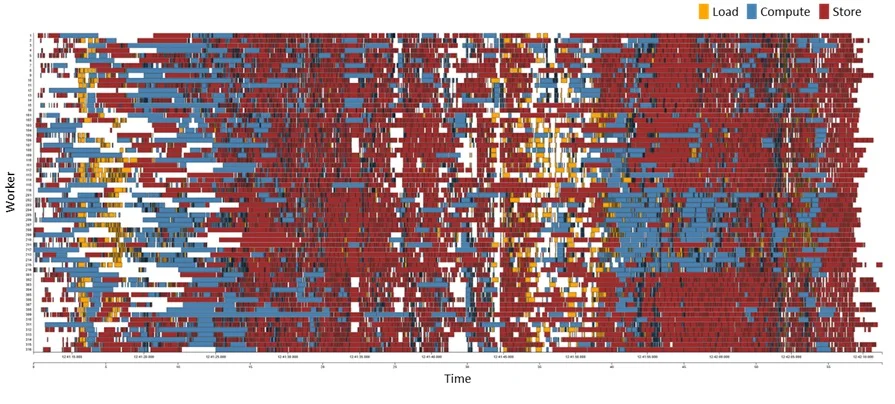

Parallel, synchronous tasks can be run on different computers, by different people. Task construction like this is a system used by many large investment banks. The DAG workflow, visually, takes the form of a horizontal line of different colored blocks, which correspond to separate functions.

In between the colored blocks is white space, and the length of the white space corresponds to the additional time it takes to complete that workflow. Once all the various functions have been ordered in the best way, the next job for Fitzgerald’s team is to cut down the extra time and complete the tasks faster.

“If we trade something every 10 minutes and it takes 12 minutes to run? Obviously a big problem,” he says. “If it takes eight minutes to run, that’s a bit close on a day where, for whatever reason, it runs a little bit slower. If you get it to run in five minutes, you’re probably like, ‘Okay, we’re good here.’”

If there are errors or if the data looks funny, the structure is methodical enough to allow researchers to pinpoint the exact node where something went wrong.

For Fitzgerald, it’s clear that Man Group’s expansion of its trading universe can’t be achieved through grit alone. He estimates that Condor will be totally complete in two years. And it’s through tools like Condor that his team will plumb the depths of the investment cosmos.

“We have lots of different builders, and we’re giving them new, fancy tools, and hopefully we aren’t constraining them,” he says. “We’re not building a house; we’re building the tools to build the house.”

Methodology

The “Voice of the CTO” series is based on interviews conducted by WatersTechnology with six heads of technology from a selection of tier-one international trading firms that took place earlier this year. For clarity, the term “CTO” in the title of the series is a catchall that includes chief operating and investment officers, and various other heads of capital markets technology—people who handle budget and direction of strategy.

This is our second Voice of the CTO series and we are looking for feedback. If you have any comments or questions, please get in touch: anthony.malakian@infopro-digital.com

Further reading

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@waterstechnology.com or view our subscription options here: https://subscriptions.waterstechnology.com/subscribe

You are currently unable to print this content. Please contact info@waterstechnology.com to find out more.

You are currently unable to copy this content. Please contact info@waterstechnology.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@waterstechnology.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@waterstechnology.com

More on Data Management

Vendors are winning the AI buy-vs-build debate

Benchmarking: Most firms say proprietary LLM tools make up less than half of their AI capabilities as they revaluate earlier bets on building in-house.

Private markets boom exposes data weak points

As allocations to private market assets grow and are increasingly managed together with public market assets, firms need systems that enable different data types to coexist, says GoldenSource’s James Corrigan.

Banks hate data lineage, but regulators keep demanding it

Benchmarking: As firms automate regulatory reporting, a key BCBS 239 requirement is falling behind, raising questions about how much lineage banks really need.

TMX eyes global expansion in 2026 through data offering

The exchange operator bought Verity last fall in an expansion of its Datalinx business with a goal of growing it presence outside of Canada.

AI-driven infused reasoning set to democratize the capital markets

AI is reshaping how market participants interact with data, lowering barriers to entry and redefining what is possible when insight is generated at the same pace as the markets.

Fintechs grapple with how to enter Middle East markets

Intense relationship building, lack of data standards, and murky but improving market structure all await tech firms hoping to capitalize on the region’s growth.

Where have four years of Cusip legal drama gone?

The IMD Wrap: The antitrust case against Cusip Global Services has been a long, winding road. Reb recaps what you might have missed.

LSEG files second motion to dismiss lawsuit with MayStreet co-founder

Exchange group has denied abandoning the MayStreet business in a new filing, responding to allegations put forward by former MayStreet CEO Patrick Flannery.