Development

The next phase of AI in capital markets: from generative to agentic

A look at some of the more interesting projects involving advanced forms of AI from the past year.

Trust though transparency: The need for explainable AI

In this guest column, Broadridge’s Mary Beth Sweeney tells the story of BondGPT’s creation and the company’s endeavor to ensure that any user inquiries are met with traceable answers from the service.

Nasdaq to deploy Calypso on AWS, expanding cloud partnership

The platform is the latest piece of tech to move to AWS as the exchange operator looks to offer more cloud-native services.

The great disappearing internet—and what it could mean for your LLM

AI-generated content, bots, disinfo, ads, and censorship are killing the internet. As more of life continues to happen online, we might consider whether we’re building castles atop a rotting foundation.

Generative AI brings testing times for modelers

Flagstar’s lead model validator offers some tips for safely integrating LLMs into risk models.

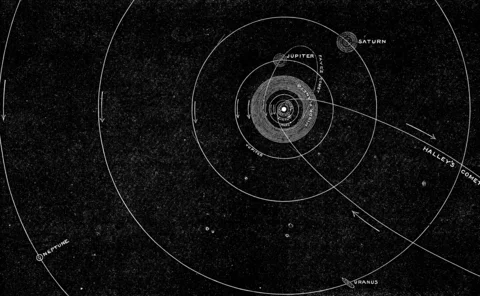

Messaging’s chameleon: The changing faces and use cases of ISO 20022

The standard is being enhanced beyond its core payments messaging function to be adopted for new business needs.

Standard Chartered’s AI Factory applies the ‘repeatability’ principle

The AI Factory will be a library of transversal services of AI capabilities for the bank to use, like a tree that continually bears fruit.

NZX outlines plans to bolster fast-growing dark pool

Since launching one year ago, NZX’s dark book has 5.5% of the exchange’s total turnover, and price improvement per trade on average is 11 basis points, but the exchange has more in store.

Agentic AI comes to Bloomberg Terminal via Anthropic protocol

The data giant’s ubiquitous terminal has been slowly opening up for years, but its latest enhancement represents a forward leap in what CTO Shawn Edwards calls, “the way we should talk to the world.”

Project Condor: Inside the data exercise expanding Man Group’s universe

Voice of the CTO: The investment management firm is strategically restructuring its data and trading architecture.

MarketAxess, S&P partnership aims for greater transparency in fixed income

CP+, MarketAxess’s AI-powered pricing engine, will receive an influx of new datasets, while S&P Global Market Intelligence integrates the tool into its suite of bond-pricing solutions.

Fitch claims 20% developer productivity boost using AWS GenAI tools

The vendors have expanded an existing deal to include new Amazon tools that have helped Fitch modernize its infrastructure and applications.

In 2025, keep reference data weird

The SEC, ESMA, CFTC and other acronyms provided the drama in reference data this year, including in crypto.

FCA to publish bond tape tender details by end of January

Market participants must wait a month longer than expected for the regulator’s draft tender document, which will see several bidders vie for the chance to build the UK’s long-awaited consolidated tape for bonds.

South Africa’s equity markets court HFTs with tech upgrades

Competition for flow has driven innovation in connectivity, risk, and data provision.

Facing platform shutdown, former IEX Cloud head buys its assets in 11th-hour bid

Tim Baker, Pedro Aguayo, and a silent partner have come together to purchase IEX Cloud’s assets days before the exchange was to retire all its products on August 31.

What happens when genAI meets low code?

GenAI is all the rage today, but not long ago, low-code and no-code development had a moment. If developers combine these technologies, can they make programming more efficient?

Bulletproof building: DTCC, AWS debut app resiliency prototype

The cloud provider and industry utility have jointly released a prototype and guidelines for building resilient financial services applications.

FactSet lays out AI blueprint for discoverability, workflows, and innovation

The data provider is utilizing generative AI and large language models to provide a conversational interface in FactSet Workstation that will complement AI-powered workflows and products.

Waters Wavelength Podcast: Bill Murphy on getting the foundations right

Bill Murphy, managing partner at Cresting Wave, is back to discuss the foundations necessary to leverage emerging technologies in the long run.

Data projects underpin Cboe’s growth strategy

APAC expansion and strong indices performance are stepping stones in the Chicago-based exchange’s development.