Opinion

Waters Wrap: Can interop connect the bond market better than consortiums? (Yes)

Anthony says that if trading firms want to take advantage of new datasets in fixed income and advancements in machine learning, they’re going to first have to embrace interoperability.

Market data hopefuls await deadline with bated breath

August 9 is when regulators could approve the governance plan for the new system of datafeeds in the US. Jo says this would be an important step forward for those hoping to create new businesses under the regime.

Waters Wrap: Google-Symphony—Something to see here?

Anthony wonders if there are any tea leaves to be read as a result of Symphony migrating its platform from AWS to Google Cloud.

Waters Wavelength Podcast: Episode 239 (The ‘E’ in ESG and quarantine woes)

Wei-Shen and Tony talk about climate migration and opportunities that might come about from a data perspective.

Waters Wrap: On outages, teamwork & greed (And ESG innovation & consultants)

Anthony examines a proposed protocol in Europe that would help keep liquidity flowing if there’s a major exchange outage. He also discusses innovation in the realm of ESG, and Esma’s new data analytics platform.

Regulators must find a balance with artificial intelligence

There's rapid digital transformation underway in the industry and regulators must get with the game plan while not over-regulating the use of AI.

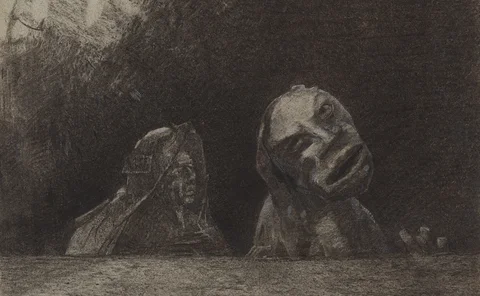

Waters Wrap: A blockchain problem (And an alt data problem)

Anthony first looks at the alternative data industry and connects to QAnon, before explaining why there needs to be more hard numbers in the world of blockchain.

Disinformation campaigns coming to a Wall Street near you

Rebecca examines the tangled web woven between Reddit, meme stocks, and QAnon, and asks how well prepared data providers looking to jump on the meme stocks bandwagon are to recognize organized disinformation campaigns.

Symphony’s Seven-Year Itch

After seven years and half a billion dollars in funding, Symphony has made strides but arguably has not delivered the “big win” of living up to its early hype as a Bloomberg-killer. Max asks how long its investors will continue to back the venture,…

Waters Wavelength Podcast: Episode 238 (Trying to get back on track)

Wei-Shen and Tony talk about how the pandemic has changed their habits and how they’re trying to do something about it.

Waters Wrap: Broadway Technology, Symphony, and new beginnings (And other new CEOs)

Anthony takes a look at some major CEO changes from the last year, and what those moves might mean for clients of those vendors.

Now that Oats is scrapped, regulators will have to (Cat)ch up

Retiring Oats is a milestone on the long and winding road to Cat implementation, but the SEC must make some major decisions in a very short timeframe before the Cat journey is over.

The Symphony-Cloud9 tie-up hints at a new tune for the comms provider

Anthony talks with Brad Levy about the company’s acquisition of Cloud9, its plan for future acquisitions, the possibility of an IPO, his thoughts on Big Tech providers, and more.

Waters Wrap: ESG’s growing influence on market data consolidation (And exchange data)

Anthony explains why he thinks ESG will play a major role in the anticipated market data consolidation that’s to come. He also looks at moves made by some exchanges to cut out the data vendor middleman.

Waters Wavelength Podcast: Episode 236 (Market data, ESG, and interoperability)

Wei-Shen and Tony talk about WatersTech’s three biggest stories of the week.

The ESG Holy Grail doesn’t exist… yet

As buy-side firms strive to stand out in a maturing ESG-driven market, they will look for data in areas where coverage is still poor.

Waters Wrap: ‘Exponential technologies’ & the changing face of trading (And interop)

Evolutions in the realms of cloud, AI, and surveillance/encryption are making the possibility of a decentralized trading ecosystem more real. Anthony looks at how progress in these areas—as well as the interoperability push—will forever change the…

Waters Wrap: When will Big Tech providers turn sights on the market data space? (And deep learning)

In recent years, the major cloud providers have expanded their service offerings specific to capital markets firms. Some industry observers believe it’s just a matter of time until they get involved in market data M&A activity.

Waters Wavelength Podcast: Episode 235 (Privacy and hybrid remote work)

Wei-Shen and Tony discuss the trade-offs between privacy and remote working and some of the concerns app interoperability could bring about.

Waters Wrap: Market data & consolidation—a never-ending timeline (And rise of the fees)

While last week it was announced that Exegy and Vela are merging, Anthony says that the deal is only a sign of what’s to come in the market data space. He also poses some questions about the LSE raising its Sedol fees.

Waters Wavelength Podcast: Episode 234 (Vaccine shots and anxiety)

Wei-Shen and Tony once again talk about mental health at the workplace and how firms should encourage their staff.

Waters Wrap: The responsibility of information intake & dissemination (And phonies abound)

As Anthony tries to explain, information is an ecosystem that every single person plays an active part in.

Waters Wavelength Podcast: Asian exchanges

Keiren Harris, a strategy-based market data consultant and founder of DataCompliance, joins the podcast to talk about exchanges in Asia and their data strategies.

Waters Wavelength Podcast: Episode 232 (AI networking and virtual conferences)

On this episode of the Wavelength Podcast, Wei-Shen brings on Annie Wu, who works on all of WatersTechnology’s events, to chat about the challenges of running a virtual event.