Opinion

Open Platform: Open Systems, Open Source, Open APIs… Open Opportunities?

Andrew Miller, managing director of consultancy Net Effect, outlines the opportunities offered by—and barriers to adopting—truly open systems.

Golden Copy: The €64,000 Question

ESMA fine of DTCC for neglecting reporting is curiously low

Dan DeFrancesco: License to Build

Licensing is the key to open source continuing to prosper.

April 2016: ‘A Changeable Marketplace’

Anthony discusses the need to be agile, especially in changing marketplaces with constantly shifting regulatory regimes.

Max Bowie: Data ‘Sandboxes’: Learning Through Play

Like the sandboxes of childhood, today’s developer “sandbox” environments promote innovation through experimentation—thankfully, Max says, just as in those carefree childhood days, without the fees and administrative burden usually associated with data…

Michael Shashoua: Seeking Smarter Applications

Compliance technology and artificial intelligence make more inroads among financial data management operations, with opposite levels of disruption to the industry, Michael writes.

John Brazier: The Buy Side Has Never Had It So Good

The buy side has plenty of options for bond trading, it's a matter of making the right decisions.

Waters Wavelength Podcast Episode 11: Future of Exchanges, Bussmann Departure, Apple-FBI Closure

The guys look at how trading venues have evolved, what's in store for the former UBS CIO and the fallout from the end of the Apple-FBI battle.

Know Your Vendor: The Risky Business of Third-Party Relationships

Dan discusses a recent feature looking at how firms deal with vendor risk.

Opening Cross: Digging for Gold in the Data Sandbox

The emergence of "sandbox" organizations and development environments are fostering a climate of innovation.

Golden Copy: Long Road to Disruption

Will the industry's data management advances stay confined to merely upgrading current methods?

Barclays Point Fixed-Income Users Worry About Bloomberg Port Conversion

A recent survey found that the fixed-income community has major concerns about the sunsetting of Barclays' Point platform.

Waters Wavelength Podcast Episode 10: Markit-IHS Merger, FIA Boca

Dan and Anthony look at the Markit-IHS merger and recap Anthony's trip to FIA Boca.

R.I.P. Vendors: Can Open Source Fundamentally Change the Way Third Parties Operate?

The rise of financial firms' adoption of open source could force vendors to make an adjustment.

Opening Cross: To Ensure Data Quality, Keep Long Leases on Short Leashes

Sell-off-and-lease-back strategies require supreme—award-winning, even—confidence in your partners.

Some Thoughts After FIA Boca

Anthony looks at three topics that were repeatedly on delegates' lips during the conference.

Golden Copy: ‘Regtech’ Challenges

Who drives regulatory compliance data into real time, and how, will influence its future

Waters Wavelength Podcast Episode 9: Cyber Risk North America, Deutsche Börse-LSE Deal

Dan shares his thoughts on Cyber Risk North America and the agreement between Deutsche Börse and LSE.

IRD's Editor on Machine Learning

StockViews and Bloomberg moves are just the latest additions to a growing field

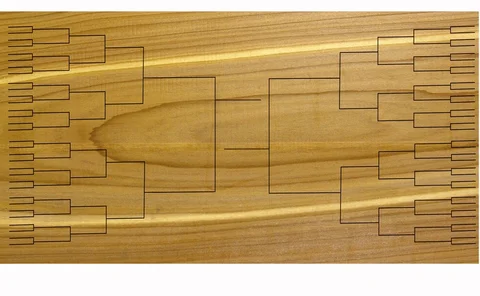

March Madness: The Financial Technology Trends Tournament

Dan analyzes eight of the biggest trends in the space.

Opening Cross: Raising a Glass to Market Data’s Master Mixologists

Cocktails are an art. So is market data.And those who perform their task exceptionally deserve recognition.

Institutional Investors Give Mixed Message on Cybersecurity

In a recent survey, institutional investors said they both care very deeply about cybersecurity, but aren't making a significant investment on prevention technologies.

Golden Copy: Learning to Master the Machines

More machine learning efforts are arriving for financial data management, but are they well guided?

Waters Wavelength Podcast Episode 8: Consolidation of Risk Platforms, Open Source

Dan and Anthony analyze mergers on the buy side for vendors of risk platforms and the usage of open source in financial services.