BlackRock

BlackRock calls for blockchain to fix futures processing snags

The asset manager wants the industry to move faster in adopting a “single source of truth” model.

Waters Wrap: Snowflake’s cloud plans and what they mean for the interop movement

Upstart Snowflake hopes to be the global data network that brings true interoperability between data and trading platforms across the capital markets. Anthony says it’s an audacious plan, but one worth watching.

Market data plans revive proposals to move odd lots onto Sips

Consultation on democratizing odd lots data closes next week, but more solutions to order protection concerns may be needed.

One versus many: Firms question viability of UK CT model

Market participants and industry groups are challenging the UK government’s approach to a competitive framework for the consolidated tape.

This Week: KPMG/Volante Technologies, LiquidityBook, Northern Trust & more

A summary of the latest financial technology news.

Buy-Side Technology Awards 2021 Winner's Interview: BlackRock (front-office platform)

BlackRock won the best integrated front-office platform category in the 2021 BST Awards, thanks to its Aladdin platform.

Where have all the blockchain startups gone?

Building a startup is hard. Building a blockchain startup is harder. More than 10 current and former financial blockchain builders and users detail their experiences of trying to cut their teeth on a once-darling tech, and the lessons they’re still…

One view to rule them all: Buy side firms seek to unify their data

Asset management firms still struggle to consolidate their data so that it speaks the same language across different business lines. Some new SaaS-based investment management vendors are aiming to solve this.

Banks offer crypto clearing but, shhh, don’t tell

Top dealers clear crypto futures for select clients despite smorgasbord of risks

In the race to institutionalize crypto, participants eye familiar tech ‘wrappers’ for new assets

Despite the development of digital assets overall, and interest in cryptocurrencies remaining strong among individual investors and niche firms, widespread institutional adoption remains muted. Wei-Shen Wong looks at the tools being developed to support…

Machine learning & NLP in the capital markets: Some examples from 2021

To show how ML and NLP are spreading across the industry, WatersTechnology highlights 20 stories from the last 12 months that feature unique uses of AI.

Waters Wrap: The biggest disruptors facing the capital markets as we head into 2022

In Anthony’s mind, eight topics will dominate the headlines in the New Year. They are…

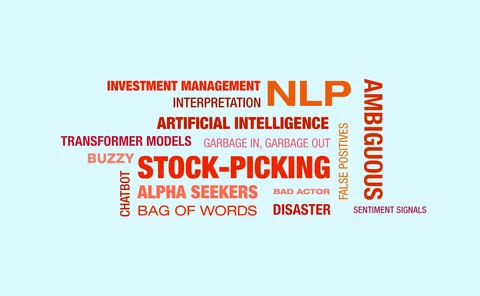

NLP for investment management: quants face a grab bag of words

Training models to interpret text can be dull; but doing it poorly can be costly.

The perfect climate risk metric does not exist

Buy-side risk survey 2021: Even the keenest searches fail to find a reliable system of climate disclosure.

BST Awards 2021: Best integrated front-office platform—BlackRock

Product: Aladdin

BST Awards 2021: Best buy-side risk management initiative over the last 12 months—BlackRock

Product: Aladdin Climate

Interoperability: Banks struggle with just how much they want for flagship platforms

For all the talk of interoperability within the capital markets, Wei-Shen wonders just how far firms are willing to go.

People Moves: Calastone, Securitize, Esma, State Street and more

A look at some of the key people moves from this week, including Ahsan Raza (pictured), who has joined Calastone as chief financial officer.

Murky road ahead for consolidated tape plan administrator in the US

The business unit of the new equities data plan could revolutionize pricing and accessibility in the public feeds of NMS data, say hopefuls to the role, but litigation and lack of clarity obscure the path forward.

BlackRock to grant funds power to track climate risks

The Aladdin platform, which holds trillions of dollars, aims to show whether funds are burning the Earth or saving it.

Waters Wrap: Owning the data & doing something unique with it—the ultimate alchemy

Based off of Max Bowie’s recent deep-dive feature, Anthony says that the world of alt data M&A—and the factors that drive these deals—is likely to change in the near future. For an analogy, just look to sushi.

Alt data’s second inning: Brace for a long M&A game

The alternative data sector is still relatively nascent, and as such buy-side firms have struggled with how best to incorporate these non-traditional sources of information. While sources say that there will be continued M&A in the market, how those…

Confusion remains over SEC’s market data efforts

Jo ponders some of the important pieces of the regulator’s National Market System modernization that remain obscure.