Goldman Sachs

Goldman Adds Ian Smith to Head GSET in APAC

Goldman Sachs has hired Ian Smith as head of GS Electronic Trading (GEST) for the Asia-Pacific (APAC) region.

DTCC, Global Banks Prepare Comprehensive Data Utility

The post-trade services provider, working with some major global firms, plans to create a single utility addressing legal entity, know-your-customer and other compliance data needs

Former Morgan Stanley Exec Appointed Interactive Data CEO

Stephen Daffron will replace Mason Slaine as president and chief executive of the data vendor on September 20

SEC Chief to Summon Industry Heads After Tech Outages

Mary Jo White, chair of the US Securities and Exchange Commission (SEC), has said that she will convene a meeting of senior industry executives after an outage at Nasdaq OMX halted trading for three hours on Thursday.

Goldman Sachs Faces Losses After Technical Glitch Sent Erroneous Trades

Goldman Sachs could face losses after a glitch in its trading system sent erroneous trades at the opening of the US equity options market yesterday.

Aleynikov's Ripple Effect

This week Michael Lewis brought a national spotlight to the Goldman Sachs case against Sergey Aleynikov. Will this change the way programmers conduct business in the future?

Burning Issues: Could an Instant Message Be Worth a Thousand Bloomberg Terminals?

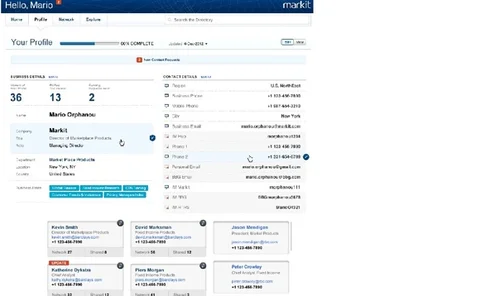

Max Bowie takes a well earned vacation this week, leaving Faye Kilburn to discuss Markit's Open Federated Chat, a potential alternative to Bloomberg's Instant messenger

Waters Rankings 2103: Best Sell-Side Clearing Provider — Goldman Sachs

In 2012, Goldman Sachs finished second to JPMorgan in this category, less than one percentage point away from dethroning the five-time champ. This year, Goldman has gone one better, narrowly edging out JPMorgan in a category that was again keenly…

REDI Now Independent of Goldman

Goldman Sachs has sold REDI, with its REDIPlus execution management system (EMS), to a consortium of investors, including Bank of America Merrill Lynch (BAML), Barclays, BNP Paribas, Citadel and Lightyear Capital. Even with the sale, Goldman will still…

Goldman to Offer TT Hosting to Futures Clients

Goldman Sachs has added TTNet, the hosting solution from Chicago-based Trading Technologies (TT), to its suite of futures trading systems offered to the firm's institutional clients.

E-Trading Corporate Bonds: Act Two?

In part one of his two-part feature on the electronic trading of corporate bonds, Jake Thomases traveled back in time to understand why an early explosion of credit trading platforms disappeared almost as soon as it arrived. In part two, he asks whether…

Three FCMs Join MarkitSERV Credit Centre

Citi, Bank of America Merrill Lynch (BAML) and Goldman Sachs have signed up to MarkitSERV Credit Centre, Markit's pre-trade credit-checking facility for over-the-counter (OTC) derivatives transactions.

Bloomberg Screws Up with Spying Scandal, But the End Ain't Near

Bloomberg has certainly suffered an embarrassing episode recently, but Anthony says no one should expect a sea change in the terminal market anytime soon.

Goldman Sachs Eyes Internal Messaging Services

After the discovery that Bloomberg's reporting staff were monitoring information from terminals—including JPMorgan's $6 billion “London Whale” trading debacle last year—Goldman Sachs is reportedly considering reduced reliance on the ubiquitous market…

Post ‘Hash Crash,’ Social Media Traders Experience Trust Issues

The financial markets are abuzz with the potential of social media as an input to trading decisions. But in the wake of the impact of recent Twitter hacks on the markets, should traders be more careful about the weight they assign “social” data sources?

Latency Hardware: Threading the Needle

From proprietary field-programmable gate arrays (FPGAs) to flexible kill switches, North American Trading Architecture Summit panelists say good strategy always fits the right hardware to purpose.

Buy Side Still Not Ready for June 10 Swaps Deadline

Apparently one set of guinea pigs wasn't enough. Even though Category 1 swap participants─swap dealers and the largest hedge funds─have been clearing most of their interest rate and credit default swaps since March 11, Category 2 participants─a group…

After Lsoc Implementation, Talk of Algo-Enabled Portability

The legally-segregated, operationally-comingled (Lsoc) paradigm is designed to bring greater protection to futures on a customer and ecosystem basis. Futures Commissions Merchants (FCMs) and clearinghouses are pondering a pair of technology issues as…

Omgeo Adds Three to Board

Edward Hazel, Richard Taggart, and Susan Cosgrove replace John Devine, Peter Johnston, and Donald Donahue, who are stepping down from the post-trade services provider's leadership.