MarketAxess

The good, the bad, and the ugly of financial democratization

From crypto and Web3 to Robinhood and Reddit, democratization underscores it all. While it’s a largely benign concept that aims to level the playing field between institutions and individuals, it’s also really hard to get right.

SEC sets its sights on fixed-income platforms with Reg ATS revamp

US regulator’s mammoth January proposal has something in it for most US trading systems, but Jo suspects it will be the definitions of exchanges that hit the hardest.

People Moves: MarketAxess, FCA, Cowen, IQ-EQ, and more

A look at some of the key "people moves" from this week, including Nash Panchal (pictured), who joins MarketAxess as chief information officer.

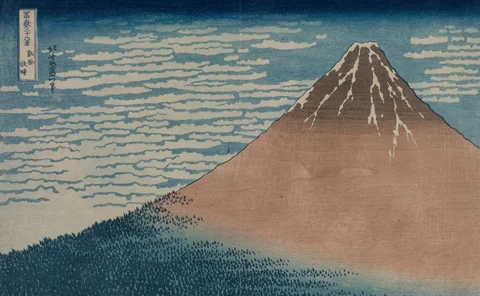

An EU Consolidated Tape: Advancements made in 2021, but still far to go in ’22

The second half of the year saw some long-awaited progress in the mission to fill the void of a consolidated tape in the European Union.

Waters Wrap: An EU consolidated tape—a story of market data costs & reality

After the European Commission released its proposal for an EU consolidated tape last week, Anthony explores some of the unanswered questions that still linger and what the greatest roadblocks appear to be.

Top venues mull offering joint EU consolidated tape for bonds

Market participants worry a venue-led CT could be of low quality, with CT data used to create expensive additional products.

BST Awards 2021: Best buy-side AI platform or tool—MarketAxess

Product: Composite+

Competing CTPs won’t work, warn EU firms, calling for single tape provider

As the industry awaits upcoming EC proposals, some firms are voicing concerns that mandating multiple CTPs could create fresh problems around data fragmentation and connectivity costs.

People Moves: Canoe Intelligence, Transcend, Clear Street, Gresham Technologies, and more

A look at some of the key "people moves" from this week, including Vishal Saxena (pictured), who joins Canoe Intelligence as chief technology officer.

Waters Wrap: Cloud, AI, Interop: The evolutions driving fixed-income progress

Anthony believes these advancements will provide the opening for Big Tech firms to created outsized influence that will change financial technology forever.

MarketAxess builds out flagship e-trading platform for loans functionality

The platform operator plans to extend its all-to-all corporate bond trading expertise to the loan market, which lags other fixed-income instruments in both tech adoption and the level of transparency.

Charles River, Wave Labs team up for enhanced OEMS

The strategic partnership will involve a three-part integration including system connectivity, combined visualization and the creation of client feedback loops.

Waters Wrap: Can interop connect the bond market better than consortiums? (Yes)

Anthony says that if trading firms want to take advantage of new datasets in fixed income and advancements in machine learning, they’re going to first have to embrace interoperability.

T+1—A Step in the Right Direction

Next-day or T+1 settlement of fixed income trades might seem a pipe dream, but there are few insurmountable operational or technology reasons why such a move cannot happen. As is invariably the case with the capital markets, the regulators hold the key,…

As fixed income edges toward automation, the interop movement is cutting in

Valantic FSA, a European solutions provider, wants to remake the fixed-income tech scene in interoperability's image, taking on incumbents like Ion Group.

People Moves: LedgerEdge, JP Morgan, MarketAxess, Enfusion, and more

A look at some of the key people moves from this week, including Michelle Neal (pictured), who has joined enterprise software vendor LedgerEdge as CEO of US operations.

New entrants want to feed bond market’s hunger for data

In the absence of a consolidated tape for debt securities in the EU, vendors with different approaches to distributing fixed-income market data are emerging.

Broadway Technology 2.0: Post-Ion split, the vendor reimagines its future

Broadway will look to build out its fixed income trading workflows, grow its as-a-service offering, lean into the low-code movement, while considering new asset classes to expand into—all while once again competing with Ion.

This Week: SimCorp/JP Morgan; SGX/TNS; Barclays/MarketAxess and more

A summary of some of the past week's financial technology news.

Symphony suspends Sparc pending registration talks with CFTC

The comms provider may have to register its RFQ workflow and messaging tool as a Sef, or perhaps permanently shut down the business line.

Waters Wrap: Big Tech takes control of cutting-edge encryption (And consortium flat circles)

In addition to growing their cloud presence in the capital markets, Big Tech companies are, unsurprisingly, taking the lead on encryption and security in the cloud. Anthony sees positives and negatives. He also looks at bank-led consortiums.

Citi, other banks set to ink ‘Octopus’ deal for new multi-bank CLO platform

Sources say initiative is designed to fend off higher fees and disintermediation in case established multi-dealer platforms start trading CLOs.