State Street

Vendors Continue to Move Products, Services to the Cloud: Some Examples

Last year, most (if not all) financial technology providers either completed or started major projects that involved moving their products and services to the cloud. WatersTechnology looks at 15 of the more interesting cloud-migration initiatives from…

This Week: Pimco/Man Group, Microsoft & Others, Cboe, Trumid/Goldman Sachs, Fenergo, & More

A look at some of the past week’s financial technology news.

Waters Wrap: App Interop in 2020 (And Tony’s Fave Stories From Last Year)

Anthony takes a look at some of the major projects that involved application interoperability from last year. The list includes feats by Goldman Sachs, BlackRock, Barclays, ICE, State Street, Refinitiv, and FactSet.

This Week: Jyske Capital/SimCorp; Vestrata; NICE Actimize/FACEPOINT; Anna/Gleif; SS&C, ING, and more

A summary of some of the past week's financial technology news.

ICE ‘Bonds’ Acquisitions into Fixed-Income Powerhouse

In this profile of the Intercontinental Exchange, Lynn Martin explains how the company’s ICE Data Services unit is creating a unified offering with fixed income data at its core, after a series of acquisitions that began with its purchase of IDC in 2015.

State Street’s Milek on the Front-Office Data Challenge

Marko Milek says the trend of outsourcing data management is becoming more mainstream.

People Moves: Liquidnet, Quandl, State Street, CloudMargin, Greenwich Associates, Mediant, GLMX

A look at some of the key people moves from this week, including Steven Nichols (pictured) who has been appointed head of NLP and unstructured data at Liquidnet.

Waters Wrap: Goldman’s Marquee Move a Sign of Larger Industry Shift (And Refinitiv’s API Rebrand)

Anthony explores changing concept of a trading platform, and what that might mean for the future of tech development.

This Week: State Street/Simcorp, Bloomberg, ACA, Broadridge & More

A look at some of the past week’s financial technology news.

People Moves: DTCC, State Street, Xoriant, Esma, Atomyze, Canoe Intelligence, BCS

A look at some of the key "people moves" from this week, including Lisa Hershey (pictured) who has been appointed managing director and chief compliance officer at the Depository Trust & Clearing Corporation (DTCC).

Waters Wrap: Banks Increasingly Lean on Vendors for 'Moonshots' (And Office Space Concerns & Symphony's KYC Play)

Anthony says that plenty of innovative projects are currently underway in the capital markets, it's just that banks are relying more heavily on vendors for those moonshots.

Investors Turn to Raw Data Over Ratings in ESG Alpha Hunt

Quants are using data on product returns and employee welfare to pick winners.

Dash Plans Redesigned OEMS Release for Q4

Blaze 7 will feature an enhanced, integrated suite for options volatility traders.

This Week: BNY Mellon, ASX, DTCC, SteelEye/UnaVista & More

A summary of some of the past week’s financial technology news.

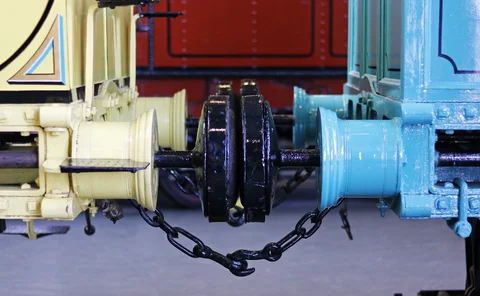

Data Integration, Interop Drive State Street’s Alpha Platform Strategy

The bank and Charles River are planning the next phase of enhancements to the Alpha trading platform.

This Week: MEMX, Sifma, Bloomberg, State Street, Digiterre, Infosys

A summary of some of the past week’s financial technology news.

Simm May Come with a Side Benefit—A Common Data Standard

Buy-side firms using AcadiaSoft for Simm calculations must adopt the ORE XML data format.

Charles River Pushes Ahead with Azure Cloud Migration

The vendor has, however, seen some clients pause their migration plans due to the Covid-19 outbreak.

This Week: State Street/Microsoft; Refinitiv/Global Relay; SimCorp/Anima; TSE & More

A summary of some of the past week's financial technology news.

State Street Incorporates Charles River into Outsourced Trading Service

State Street will also integrate BestX equity TCA into its outsourced trading desk.

People Moves: Capitolis, State Street, BTON Financial and DTCC

A look at some of the key 'people moves' from this week.

Fuzzy Data Stalls ESG Alpha Hunt

Quants searching for ESG signals have reached very different conclusions. Mostly they blame the data.

For the App Interoperability Movement, 2020 will be a Big Year

While progress was made in the desktop application interoperability space in the last year, Anthony Malakian says 2020 is likely to see some major developments that will help to push this movement forward.