Europe

Colt Adds Equiduct Connectivity

Officials say that connectivity to Equiduct─alongside the other venues to which Colt already provides connectivity─will support firms' best execution requirements while expanding Colt's regulatory services.

ESMA Preps Financial Instruments Reference Data System Launch

The Financial Instrument Reference Data System (FIRDS) will go live on July 17, 2017.

ESMA Fines Moody’s €1.24M for Credit Ratings Breaches

ESMA says that between June 2011 and December 2013 Moody’s failed to explain decisions for 19 ratings.

ESMA Grants Approval to Bloomberg European Trade Repository

Bloomberg set to open trade repository for Europe for OTC and exchange-traded derivatives reporting.

Red Deer, Westminster Ally for MiFID II Research Solution

The end-to-end solution will remove potential conflicts in research valuation and payment.

London Stock Exchange Bolsters Fixed-Income Presence with Citi Yield Book, Indices Acquisitions

$685 million deal for analytics platform and indices business first acquisition by LSEG since collapse of Deutsche Börse merger.

LSE Bolsters Fixed Income Arsenal with Citi Deal

Acquisition aims to boost FTSE Russell’s appeal to fixed income clients and “enhance and complement” LSE’s Information Services data and analytics offering.

Euronext Continues Diversification Drive into Foreign Exchange with FastMatch Acquisition

Euronext to acquire 90 percent stake in spot FX trading network FastMatch as exchanges continue their move into investment bank domain

Legacy Systems, 'Army of No' Top Hurdles for Buy Side

C-Level panel identifies legacy technology and culture, deep-rooted in many firms, as the biggest hurdle to business transformation.

Silverfinch Adds Module to Address MiFID II

The new module will make it easier for firms to collect and aggregate the datasets required for MiFID II compliance.

Indata Adds API Layer to iPM Epic Solution

Using big data technology, the Epic Data API toolkit is available to Indata users to connect systems and data sources.

UPDATE: Liquidnet Acquires OTAS Technologies

The trading network adds OTAS' analytics system to its buy-side trading platform.

Liquidnet Acquires OTAS for Best Execution Analytics

OTAS analytics will be folded into Liquidnet’s VHT platform to “deliver market context directly to the trader at the point of execution.”

Tradeweb APA Signs BNP Paribas, Credit Suisse, Morgan Stanley, Societe Generale for Mifid II Reporting

Four institutions join Deutsche Bank, Goldman Sachs, JPMorgan on APA Mifid II reporting service.

RSRCHXchange Introduces Desktop Application via OpenFin

The new application is available to all RSRCHXchange clients, and it will connect to the firm’s existing platform.

Linedata Releases New Version of Global Hedge Platform

The new version includes improved order management features and Mifid II compliance tools.

NovaSparks Adds SIP FPGA Handler

NovaSparks has added support for Nasdaq's two Securities Information Processor feeds.

UPDATE: Moody’s Buys Company Data Vendor BvD for €3 Billion

Bureau van Dijk’s platform will be integrated into Moody’s Analytics’ suite of risk management solutions.

Misys Releases AI Functionality for Trade Validations

The component helps financial institutions spot booking errors, anomalies and unusual activity with machine learning.

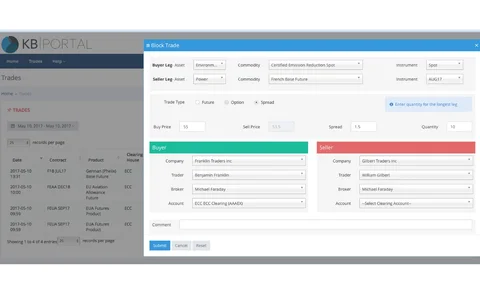

After ECC, EEX Clearing Rollout, KB Tech Eyes Data Deals

KB Tech's initial deal with ECC covers post-trade and clearing-related data, though, this may expand to other areas in future.

Future of Equities Is Survival of the Fittest as Mifid II Accelerates Market Structure Changes

The importance of adaptability for equities market participants is only set to increase as Mifid II changes the landscape, says TradeTech panel.

Horizon Expands Platform with Algo Trading Templates

The new strategy templates are fully customizable, giving in-house capabilities to an outsourced solution.

Cinnober Acquires Surveillance Vendor Ancoa Software Out of Administration

UK-based surveillance technology provider bought out of administration after failing to secure necessary funding.

Systematic Internalizers: An Ambitious Regulation Caught in the Crossfire

The SI regime has proven to be the most fragile piece of regulation, as its legal loopholes have triggered a series of political events and has been established as the market’s most notorious law.