United States (US)

Market data for private markets? BlackRock sees its big opportunity

The investment giant’s CEO said he envisions a far bigger private market business in 2025.

FX automation key to post-T+1 success, say custodians

Custody banks saw uptick in demand for automated FX execution to tackle T+1 challenges.

People Moves: State Street, Broadridge, Tradeweb and more

A look at the past month’s people moves in the capital markets technology and data space.

As US options market continued its inexorable climb, ‘plumbing’ issues persisted

Capacity concerns have lingered in the options market, but progress was made in 2024.

Expanded oversight for tech or a rollback? 2025 set to be big for regulators

From GenAI oversight to DORA and the CAT to off-channel communication, the last 12 months set the stage for larger regulatory conversations in 2025.

In 2025, keep reference data weird

The SEC, ESMA, CFTC and other acronyms provided the drama in reference data this year, including in crypto.

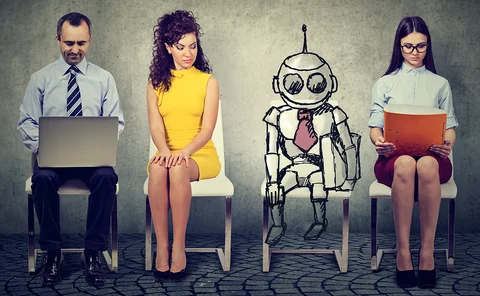

Asset manager Saratoga uses AI to accelerate Ridgeline rollout

The tech provider’s AI assistant helps clients summarize research, client interactions, report generation, as well as interact with the Ridgeline platform.

LSEG rolls out AI-driven collaboration tool, preps Excel tie-in

Nej D’Jelal tells WatersTechnology that the rollout took longer than expected, but more is to come in 2025.

From no chance to no brainer: Inside outsourced trading’s buy-side charm offensive

Previously regarded with hesitancy and suspicion by the buy side, four asset managers explain their reasons for embracing outsourced trading.

The Waters Cooler: ’Tis the Season!

Everyone is burned out and tired and wants to just chillax in the warm watching some Securities and Exchange Commission videos on YouTube. No? Just me?

It’s just semantics: The web standard that could replace the identifiers you love to hate

Data ontologists say that the IRI, a cousin of the humble URL, could put the various wars over identity resolution to bed—for good.

IEX, MEMX spar over new exchange’s now-approved infrastructure model

As more exchanges look to operate around-the-clock venues, the disagreement has put the practices of market tech infrastructure providers under a microscope.

T. Rowe Price’s Tasitsiomi on the pitfalls of data and the allures of AI

The asset manager’s head of AI and investments data science gets candid on the hype around generative AI and data transparency.

Too ’Berg to fail? What October’s Instant Bloomberg outage means for the industry

The ubiquitous communications platform is vital for traders around the globe, especially in fixed income and exotic derivatives. When it fails, the disruption can be great.

New data granularity rules create opportunities for regtech providers

As evidence, Regnology increased its presence in North America with the addition of Vermeg's Agile business—its 8th acquisition in three years—following a period of constriction and consolidation in the market.

BNY uses proprietary data store to connect disparate applications

Internally built ODS is the “bedrock” upon which BNY plans to become more than just a custodian bank.

FactSet launches conversational AI for increased productivity

FactSet is set to release a generative AI search agent across its platform in early 2025.

Removal of Chevron spells t-r-o-u-b-l-e for the C-A-T

Citadel Securities and the American Securities Association are suing the SEC to limit the Consolidated Audit Trail, and their case may be aided by the removal of a key piece of the agency’s legislative power earlier this year.

Chief data officers must ‘get it done’—but differ on what that means

Voice of the CDO: After years of focus on data quality, governance, and compliance, CDOs are now tasked with supporting the business in generating alpha and driving value. How can firms put a value on the CDO role?

In a world of data-cost overruns, inventory systems are a rising necessity

The IMD Wrap: Max says that to avoid cost controls, demonstrate the value of market data spend.

After acquisitions, Exegy looks to consolidated offering for further gains

With Vela Trading Systems and Enyx now settled under one roof, the vendor’s strategy is to be a provider across the full trade lifecycle and flex its muscles in the world of FPGAs.

Enough with the ‘Bloomberg Killers’ already

Waters Wrap: Anthony interviews LSEG’s Dean Berry about the Workspace platform, and provides his own thoughts on how that platform and the Terminal have been portrayed over the last few months.

BofA deploys equities tech stack for e-FX

The bank is trying to get ahead of the pack with its new algo and e-FX offerings.

As NYSE moves toward overnight trading, can one ATS keep its lead?

An innovative approach to market data has helped Blue Ocean ATS become a back-end success story. But now it must contend with industry giants angling to take a piece of its pie.