Regulation

Esma won’t soften regulatory expectations for cloud and AI

CCP supervisory chair signals heightened scrutiny of third-party risk and operational resilience.

ICE to seek tokenization approval from SEC under existing federal laws

CEO Jeff Sprecher says the new NYSE tokenization initiative is not dependent on the passage of the US Clarity Act.

Why UPIs could spell goodbye for OTC-Isins

Critics warn UK will miss opportunity to simplify transaction reporting if it spurns UPI.

Re-examining Big Tech’s influence over the capital markets

Waters Wrap: A few years ago, it seemed the big cloud providers were positioning themselves to dominate the capital markets tech scene. And then came ChatGPT.

Pressure mounts on Asia to fall in line for T+1

With the US already on a T+1 settlement cycle, and the UK and EU preparing for the shift in 2027, there’s pressure for Asia to follow suit. But moving may involve more risks than expected.

Brokers must shift HFT servers after China colocation ban

New exchange guidance drives rush for “proximity colo” in nearby datacenters.

Banks split over AI risk management

Model teams hold the reins, but some argue AI is an enterprise risk.

New EBA taxonomy could help banks track AI risk

Extra loss flags will allow banks to track transversal risks like geopolitics and AI, say experts.

Risk managers question US reach of Dora third-party list

Some EU subsidiaries included, but regulator control over cloud providers could still be limited.

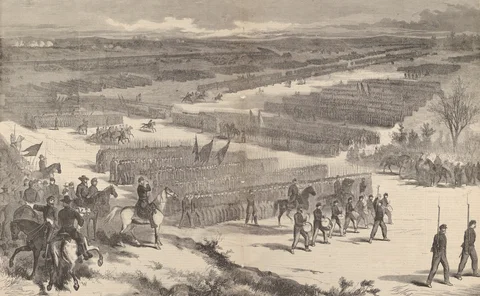

Where have four years of Cusip legal drama gone?

The IMD Wrap: The antitrust case against Cusip Global Services has been a long, winding road. Reb recaps what you might have missed.

2026 will be the year agent armies awaken

Waters Wrap: Several AI experts have recently said that the next 12 months will see significant progress for agentic AI. Are capital markets firms ready for this shift from generative AI to agents?

Despite regulatory thaw in US, major questions remain globally for 2026

From crypto and tokenization to the CAT to consolidated tapes to T+1’s advancement, the regulatory space will be front and center in the New Year.

Will overnight trading in equity markets expand next year? It’s complicated.

The potential for expanded overnight trading in US equity markets sparked debate this year, whether people liked it or not.

Waters Wavelength Ep. 342: LexisNexis Risk Solutions’ Sophie Lagouanelle

This week, Sophie Lagouanelle, chief product officer for financial crime compliance at LNRS, joins the podcast to discuss trends in the space moving into 2026.

Citadel Securities, BlackRock, Nasdaq mull tokenized equities’ impact on regulations

An SEC panel of broker-dealers, market-makers and crypto specialists debated the ramifications of a future with tokenized equities.

FIX Trading Community recommends data practices for European CTs

The industry association has published practices and workflows using FIX messaging standards for the upcoming EU consolidated tapes.

Interview: Linda Middleditch, Regnology

Regnology’s Linda Middleditch discusses its acquisition of Wolters Kluwer’s FRR business

Tokenized assets draw interest, but regulation lags behind

Regulators around the globe are showing increased interest in tokenization, but concretely identifying and implementing guardrails and ground rules for tokenized products has remained slow.

Waters Wavelength Ep. 341: Citi’s Pitts and Topa

This week, Citi’s Michele Pitts and Marcello Topa join Wei-Shen to talk about UK and EU T+1.

Why source code access is critical to DORA compliance

As DORA takes hold in EU, Adaptive’s Kevin Covington says that it is shining a light on the criticality of having access to source code.

Nasdaq’s blockchain proposal to SEC gets mixed reviews from peers

Public comment letters and interviews reveal that despite fervor for tokenization, industry stakeholders disagree on its value proposition.