AI

This Week: Ice, FCA, HSBC, UBS & more

A summary of the latest financial technology news.

This Week: Six/Sustainalytics, Nice Actimize, SmartStream, and more

A summary of the latest financial technology news.

This Week: Bloomberg; Charles River, DTCC, SmartStream & More

A summary of the latest financial technology news.

Barclays (and others) strive for machine learning at quantum speed

Embryonic work on quantum neural networks raises hope of faster, more accurate models

Waters Wrap: Google’s cap markets play portends a shift in trade tech philosophies

According to Google’s Phil Moyer, the capital markets are shifting from a world where location determined liquidity, to one where accessibility will be the main differentiator for exchanges. Anthony explores what this could mean for trading firms going…

Eliminating the human touch: Examining RBC’s tech infrastructure evolution

The Canadian bank’s tech infrastructure unit is using Kubernetes as it looks to become a “truly end-to-end digital enterprise.”

This Week: Bloomberg/HSBC, Refinitiv/Microsoft, IBM, Jump Trading, & more

A summary of the latest financial technology news.

Waters Wrap: Data ownership & storm clouds brewing

Thanks to technological advancement, firms are finding new ways to monetize data. While the question of “who owns the data” was never a pressing one in the past, Anthony says that there are reasons to believe that will soon change.

How NN IP uses machines to read the market—and itself

Dutch manager being acquired by Goldman uses machine learning to ‘augment’ its analysts

Waters Wrap: Mid-tier market data providers look to reinvent themselves

Anthony loves when his opinions spark debate. Following responses to a recent column on consolidation among mid-market data technology vendors, he provides something of a case study, which looks at how Exegy is evolving after its acquisition of Vela.

What the hell is Web3, anyway?

The next iteration of the internet is upon us, with the potential to deliver radical shifts to every industry, including banking. The movement, which is currently buoyed by the prospects of blockchain and virtual reality, has implications for computing,…

The bank, the vendor, the turrets and the golf day

After DBS switched suppliers, a row broke out, raising questions about entertainment and influence

2021: The year when Big Tech ‘Googled’ the financial markets and liked the results

Now that cloud has become widely adopted by financial firms, Big Tech companies are seeking to leverage their other services to become more ingrained in the workflows of the capital markets.

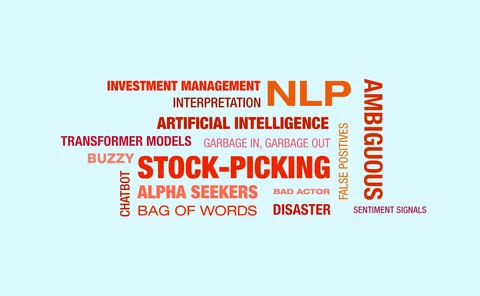

Machine learning & NLP in the capital markets: Some examples from 2021

To show how ML and NLP are spreading across the industry, WatersTechnology highlights 20 stories from the last 12 months that feature unique uses of AI.

Waters Wrap: The biggest disruptors facing the capital markets as we head into 2022

In Anthony’s mind, eight topics will dominate the headlines in the New Year. They are…

Slow burn to a big bang: How the new wave of tech is changing market data platforms

For decades, market data platforms have been critical components of financial firms’ trading infrastructures. But with changing user needs and emerging technologies gaining ground, will the platforms of the past be replaced by upstart challengers—or can…

UK regulatory consultation hopes to bridge gaps in AI adoption

The industry forum looks to inform recommendations for the safe use of AI in financial firms.

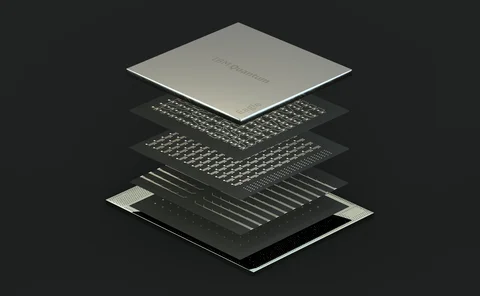

IBM eyes ‘seamless integration’ of quantum, classical computing

Blending classical and quantum computing could reduce the cost of quantum calculations and eliminate the need to understand hardware specifics, IBM says.

NLP for investment management: quants face a grab bag of words

Training models to interpret text can be dull; but doing it poorly can be costly.

The future of algo trading: Using deep learning to more accurately predict equity market volumes

OpEd by Sam Clapp, Mizuho Americas equities, and Don Hundley, Japan head of Mizuho equities electronic trading

Waters Wrap: Nasdaq, Quandl and the next phase of the alt data craze

Anthony looks at how Nasdaq's Quandl strategy ties into other trends spreading through the market.

Waters Wavelength Podcast: IBM’s Likhit Wagle on modernizing mainframes

IBM’s general manager of global banking and financial markets joins the podcast to talk about the importance of modernizing mainframes.

Waters Wrap: CME & Google—the first domino falls

Anthony explores some of the unanswered questions—and potential ripple effects—that come with the new partnership between CME and Google.

Vendors push voice data across the trade lifecycle

Through partnerships and acquisitions, communications vendors are integrating voice data into different parts of the trade lifecycle to offer more sophisticated analytics and easier user interfaces.