Data

Re-Defining Managed Services

The advancement of real-time as a criteria for reference data is driving changes in the use of managed services in the space

Cost, Latency, Regulation: IMD's Editor on Hot Topics at IMD Events

Inside Market Data editor Max Bowie reflects on the themes from recent conferences, and predicts that the impact of regulation will be high on the agenda at next week's European Financial Information Summit and other upcoming IMD conferences.

Update: OPRA Data Issue Halts Options Exchanges

The Options Price Reporting Authority was forced to cancel a software upgrade for its feed of consolidated US options quote and trade data on Monday Sept. 16, after the upgrade caused issues with calculation of the national best bid and offer price,…

IRD's Editor on Fatca's Effects on Data Operations

Inside Reference Data editor Michael Shashoua updates developments with Fatca tax regulation and how that will affect data operations

OTC Markets Grows Disclosures News Service

New York-based over-the-counter equities marketplace OTC Markets is rolling out new features as part of its OTC Disclosure & News Service to make it easier for investors to research privately-held companies whose equity is traded on the exchange's OTCQX,…

EPFR Brings on Badolato in HK

Fund flows data provider EPFR Global has hired Elizabeth Badolato as business development manager in Hong Kong to expand the vendor's presence in Asia, reflecting the growth of its client base in the region, which was previously supported from the vendor…

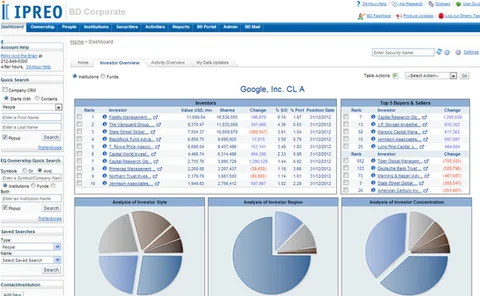

Ipreo to Market FactSet Data to Corporates

Company data and investor relations service provider Ipreo has struck a deal with FactSet Research Systems to distribute the FactSet workstation and the vendor's FactSet for Microsoft Excel spreadsheet add-in to corporate clients, as part of Ipreo's…

T2S Will Increase Settlement Costs, Push CSD Consolidation, Sibos/SIX Survey Finds

A survey of attendees at Sibos 2013 in Dubai found that participants expect settlement costs to increase, thanks to the Target2-Securities (T2S) project. Bob Almanas of SIX Securities Services discusses the company's preparations for T2S

SIX FI's Kevil Goes West

SIX Financial Information has relocated sales executive Kimberly Kevil from the US East Coast to the San Francisco Bay Area to support large and important clients on the West Coast, and to lead sales in California and Mexico, and reporting to Barry…

UTP Participants Propose Adding Odd-Lot Trades to Tape

The Securities and Exchange Commission is inviting comments on proposals by the exchange participants in the UTP (Unlisted Trading Privilege) consolidated tape of quote and trade data in Nasdaq-listed stocks to include odd-lot trades on the UTP last sale…

EPFR Debuts ChartBook Fund Flows Analysis, Commentary

Boston-based fund flows information provider EPFR Global will at the end of this month launch a new weekly commentary service, dubbed ChartBook, which describes market trends and trade ideas based on the vendor's fund flows data, to make it easier for…

MNI Indicators Builds BRICs

MNI Indicators, the macroeconomic data division of Deutsche Börse's Market News International, has released new consumer and business confidence indicators for Brazil, India and Russia, expanding on its existing MNI China consumer and business sentiment…

Open Platform: The Search for Clarity

In an environment where the only constant is constant change, reliable data becomes more valuable than ever. But with unprecedented volumes of data and unrivalled access to data, finding ways to gain clarity from these data volumes is even more critical,…

Axioma Adds Credit Suisse HOLT Fundamental Data

Risk management and index analytics provider Axioma has integrated fundamental factor data from Credit Suisse's HOLT fundamental analysis, idea generation and benchmarking platform into the Performance Attribution module of Axioma Portfolio Analytics and…

NYSE Tech, First Derivatives Ally for As-a-Service Offerings

NYSE Technologies, the data and technology arm of NYSE Euronext, is working with Northern Ireland-based data management software vendor First Derivatives to develop a suite of historical data-as-a-service solutions, dubbed Tick as a Service, that will…

Swift Helps BAML Cut Cost of ISO 20022 Migration in Japan

Bank of America Merrill Lynch will benefit from a period of free messaging after becoming an early adopter of SwiftNet for its connection to the Japan Securities Depository Centre

Raising Fatca Stakes

Data operations necessary for compliance with the US foreign accounts tax law, even with a delayed deadline, still need a lot of work, Michael Shashoua reports. Firms are considering the structure of their data repositories and approach to client…

Misys Enriches Products With Swift Data

The software and services vendor is using additional data from SwiftRef to improve the accuracy and consistency of payments and reduce the need for manual intervention

Estimize Launches ‘Select Consensus' Weighted Estimates

New York-based crowd-sourced estimates data provider Estimize has launched a weighted consensus estimates service, dubbed Select Consensus, which aims to refine the vendor's current consensus estimates by identifying factors that make a contributor's…

Chi-X Canada Bows "Retail Professional" Intermediate Data Fee Tier

Alternative trading system Chi-X Canada has introduced a new tier of market data fees for professionals such as investment advisors serving retail investors, developed with the assistance of market data and technology product management and marketing…

ETFGuide Targets Institutional Investors with ETF Research

San Diego, Calif.-based investment research provider ETFGuide is planning to begin distributing its research on exchange-traded funds via trading and brokerage platforms to reach a broader audience of institutional investors and financial advisors beyond…

SimCorp Names Colson to European Post

The portfolio management software maker has hired Emmanuel Colson, recently of Thomson Reuters, as co-head of its Western European unit

Deutsche Börse Sets up Vienna Data, Trading Access in Interxion Datacenter

German exchange group Deutsche Börse has expanded its European connectivity network by adding an access point at European datacenter and hosting provider Interxion's datacenter campus in Vienna.