Fixed income

NATAS 2015 Keynote: Fixed Income Electronifcation Turns on Strategy Engines, Better Symbology

Morgan Stanley's Maged Hassan shares his thoughts on future technology enhancements.

Thomson Reuters Rolls Out AskTRPS Price Challenge Tool

Enhancement to provide quick resolution to evaluated pricing challenges.

Codestreet Adds New CFO & COO, Looks to Expand Liquidity Services

David Kubersky signs on as COO, while Jeff Tagliabue takes over as CFO.

Benchmark Upheaval

MiFID II Causing Concern About Pricing Data

MarketAxess Adds Four Dealers to its European Platform

The Australia and New Zealand Bank (ANZ), the Canadian Imperial Bank of Commerce (CIBC), Mizuho, and Toronto-Dominion (TD) have joined the MarketAxess system.

Tradeweb Introduces Trade Data Reports and Axes for European ETFs

Enhancements are expected to increase transparency and improve trading in Tradweb's European platform.

Notebook: Some More Industry Feedback on Fixed-Income ETFs

Industry experts give their thoughts on the fixed-income ETF space.

Notebook: Some More Industry Feedback on Fixed-Income ETFs

Industry experts give their thoughts on the fixed-income ETF space.

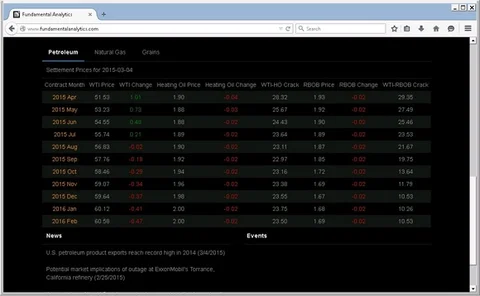

TT Integrates Fundamental Analytics Data, Tools

Officials say combining price and fundamental data will allow clients to identify new trading opportunities.

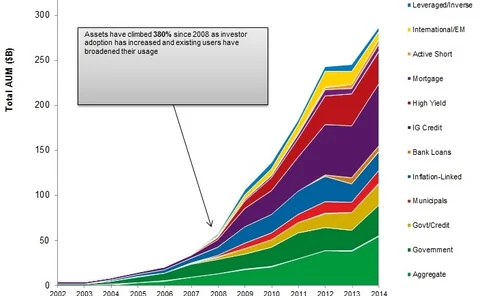

Fixed-Income ETFs: Pricing, Tech Evolve in This Rapidly Growing Space

The fixed-income ETF market is not yet 15 years old, but since 2007 the space has grown exponentially as institutional investors have taken notice of these increasingly liquid products. Anthony Malakian explores the reasons behind the interest in fixed…

Anthony Malakian: Remember, the ETF Space is Still Evolving

The rise in popularity of fixed-income ETFs will continue, despite there being 'issues' that need to be addressed.

Transaction-Cost Analysis' Fixed-Income Evolution

TCA is moving from equities into fixed-income towards becoming a real-time analysis tool.

MTS Markets Unveils BondVision US Trading Platform

Brokers can broaden their Euro government bond offerings to the buy side.

With New Tie-Up, QB Doubles Down Screen Exposure Hunt as TT Jumps Into Agency Algo Space

Algo specialist seeks greater access as client base expands.

Moody's Analytics Completes First Phase of Lewtan Integration, Plots Future Roadmap

Data and software provider Moody's Analytics, has completed the first stage of onboarding assets from Waltham, Mass. -based structured finance analytical tools and market data provider Lewtan Technologies into its Structured Finance Portal, after parent…

DealVector to Offer CoreLogic Non-Agency RMBS Metrics

BWIC board members will be able to view key metrics from CoreLogic.

KCG BondPoint Integrates With Charles River IMS

Charles River clients to begin using BondPoint throughout 2015

Enthusiasm's Up, But Corporates' Electronification Remains Work in Progress

Industry members discuss the growth of electronic trading of corporate bonds

Icap Launches Bond Index, Publishes Index Data on Bloomberg

The broker has designed the new index to outperform stable or rising US Treasury markets.

Bond ATS OpenBondX Preps Order Book, Real-Time Feed

OpenBondX, a startup alternative trading system for fixed income securities, is planning to make firm quote and trade data available via a real-time proprietary datafeed and via Bloomberg, once it rolls out a central limit order book in the second phase…

OpenBondX ATS to Launch in February

Backed by former Lime Brokerage CEO

S&P DJI Unveils Major Bond Index Expansion

Index provider aims to seize opportunities created by Libor scandal to restore confidence in fixed income markets.

Icap Preps Bond Pricing Service, Taps Interactive Data Evaluations

Changing bond market conditions require a new breed of pricing solutions, officials say.

Codestreet Secures Cash Infusion from Rochester Advisors, Cerium Technology

Funding to go towards growth of Codestreet Dealer Pool