Natural language processing

Surveillance firms experiment with computer vision for video conferencing oversight

As more firms rely on platforms like Zoom and Teams for client and workforce communications, surveillance technology providers are exploring new ways to make sure traders are compliant while working remotely.

Waters Wrap: Google’s cap markets play portends a shift in trade tech philosophies

According to Google’s Phil Moyer, the capital markets are shifting from a world where location determined liquidity, to one where accessibility will be the main differentiator for exchanges. Anthony explores what this could mean for trading firms going…

Eliminating the human touch: Examining RBC’s tech infrastructure evolution

The Canadian bank’s tech infrastructure unit is using Kubernetes as it looks to become a “truly end-to-end digital enterprise.”

Waters Wrap: Data ownership & storm clouds brewing

Thanks to technological advancement, firms are finding new ways to monetize data. While the question of “who owns the data” was never a pressing one in the past, Anthony says that there are reasons to believe that will soon change.

How NN IP uses machines to read the market—and itself

Dutch manager being acquired by Goldman uses machine learning to ‘augment’ its analysts

The bank, the vendor, the turrets and the golf day

After DBS switched suppliers, a row broke out, raising questions about entertainment and influence

Machine learning & NLP in the capital markets: Some examples from 2021

To show how ML and NLP are spreading across the industry, WatersTechnology highlights 20 stories from the last 12 months that feature unique uses of AI.

Waters Wrap: The biggest disruptors facing the capital markets as we head into 2022

In Anthony’s mind, eight topics will dominate the headlines in the New Year. They are…

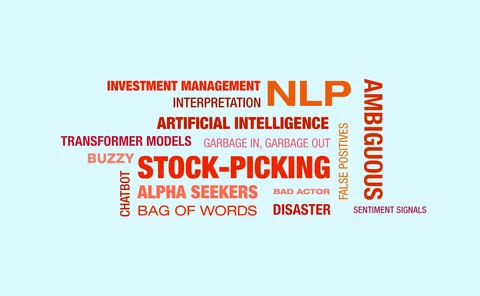

NLP for investment management: quants face a grab bag of words

Training models to interpret text can be dull; but doing it poorly can be costly.

New breed of NLP model learns finance better, study finds

Models trained by looking at sentences beat conventional approaches that contextualize words.

Waters Wrap: Nasdaq, Quandl and the next phase of the alt data craze

Anthony looks at how Nasdaq's Quandl strategy ties into other trends spreading through the market.

Vendors push voice data across the trade lifecycle

Through partnerships and acquisitions, communications vendors are integrating voice data into different parts of the trade lifecycle to offer more sophisticated analytics and easier user interfaces.

People Moves: Charles River, Causality Link, Preqin, and more

A look at some of the key people moves from this week, including Caroline O'Shaughnessy (pictured), who joins Charles River Development as Emea head.

Google aims AI at corporate actions challenges

The tech giant believes its AI tools have a multitude of applications across some of the complex data challenges of financial markets, and it’s starting with the manual and complicated world of corporate actions. Some believe it will be an uphill battle.

Machines can read, but do they understand?

A novel NLP application built on a Google transformer model can help predict ratings transitions

Waters Wrap: Cloud, AI, Interop: The evolutions driving fixed-income progress

Anthony believes these advancements will provide the opening for Big Tech firms to created outsized influence that will change financial technology forever.

FactSet, Microsoft collaborate on voice-activated analytics

The data vendor has deployed machine learning across its ETF and fund screening datasets, and plans to interoperate with other big tech firms in the future.

AI helps one investor screen targets against UN ethical goals

PanAgora has developed a two-stage process that aims to weed out the greenwashers.

Show your workings: Lenders push to demystify AI models

Machine learning could help with loan decisions—but only if banks can explain how it works. And that’s not easy.

Research management systems vie to double as data, analytics providers in one-stop-shop bid

RMS providers Sentieo and MackeyRMS feel the pressure to become quasi-data and analytics providers in their quest to cover the gamut of the buy-side research analyst workflow.

People Moves: LedgerEdge, JP Morgan, MarketAxess, Enfusion, and more

A look at some of the key people moves from this week, including Michelle Neal (pictured), who has joined enterprise software vendor LedgerEdge as CEO of US operations.

Disinformation campaigns coming to a Wall Street near you

Rebecca examines the tangled web woven between Reddit, meme stocks, and QAnon, and asks how well prepared data providers looking to jump on the meme stocks bandwagon are to recognize organized disinformation campaigns.

Waters Wrap: Broadway Technology, Symphony, and new beginnings (And other new CEOs)

Anthony takes a look at some major CEO changes from the last year, and what those moves might mean for clients of those vendors.

Brown Brothers Harriman continues AI ‘transformation’ of fund accounting unit

A new tool that helps business users test and validate their own POCs is set to join the bank’s ranks alongside its other AI projects implemented over the last two years: Linc, Guardrail, and Ants.