OEMS

Liquid, ConvergEx Pen Agreement

OEMS provider Liquid and prime services division of ConvergEx have signed a joint marketing agreement wherein Liquid will be offered to ConvergEx's roster of hedge fund, family office, mutual fund, and registered advisor customers.

Thomson Reuters Adds FlexTrade EMS to Eikon

Thomson Reuters has integrated FlexTrade’s execution management system (EMS) and Autex indications of interest (IOI) data into its flagship desktop, Eikon.

Extending 'Continuum of Innovation', BlackRock and Tradeweb Ally on Electronic Rates Trading

A recently announced and newly-integrated electronic trading solution will fuse Tradeweb's marketplace with Aladdin for order management, pricing, and execution of interest rate products and derivatives, serving only to deepen one the industry's longest…

Krungsri AM Upgrades Charles River Implementation

The Bangkok-based asset manager is now using the ninth version of IMS, as well as Charles River's FIX Network and Data Storage offerings for electronic trading and real-time price provision at the local Stock Exchange of Thailand (SET).

Nomura AM Expands Charles River Implementation

The asset management arm of the Japanese banking giant, with 33 trillion yen ($323.5 billion) under management, has successfully migrated its equity business onto Charles River's IMS, with domestic and international fixed income, foreign exchange, and…

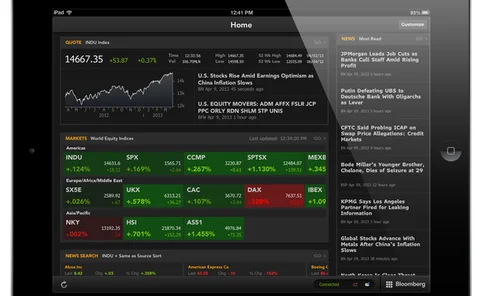

Regional Fixed Income Dealers Get Bloomberg Service

Bloomberg has unveiled its Electronic Trade Order Management Solution, or ETOMS, a managed service used by US regional broker-dealers to access and engage fixed income electronic markets as both liquidity providers and liquidity takers.

ITG Targets Emerging Hedge Funds with New OMS, EMS

Will Geyer, head of platforms at ITG, and John McKeon, managing director of platforms, discuss the broker's latest applications.

ITG Releases Trade Management Systems for Hedge Funds

New York-based execution and research broker ITG has launched a product suite for hedge funds that includes a hosted order management system (OMS) and execution management system (EMS).

Brazilian Asset Manager Switches to Eze OMS

Rio de Janeiro-based asset manager Dynamo Administração de Recursos is now live on the Eze Order Management System (OMS).

Liquid Adds Pre-Trade Risk and Compliance Tools to OEMS

Liquid Holdings, the trading and risk management platform provider to emerging hedge funds, has added new options trading capabilities, expanded global equities markets coverage, and compliance controls to its order and execution management system (OEMS)…

Invesco Chooses Portware as its EMS

Atlanta-based Invesco has selected Portware Enterprise as the centralized hub for execution management across all of its asset classes.

Asset Management Shift Inspires IT Transformation Among Middle Eastern Banks

While markets along the Persian Gulf have conspicuously built up financial infrastructure in recent years to attract foreign firms and capital, local banks elsewhere in the Middle East are bolstering their technological capacity to do precisely the…

European Insurer Uniqa Taps SimCorp for Structured Products

Austrian and Central European insurance firm Uniqa Group AG, with €26 billion in assets under management, will use XpressInstruments to manage its structured products support.

2013's Trading Technology: A Year of 'Accelerating Returns'

Readers of Waters' ongoing coverage will have noticed several themes that blossomed over the past 12 months. Some of them were predictable. But 2013 also offered up more than a few unexpected hints of opportunities to come—whether imminently, or further…

Liquid Introduces Performance Simulator for Emerging Managers

Liquid Holdings, an OEMS and risk reporting paltform provider, says the new scheme will allow nascent hedge funds to beta-test their strategies.

Wolverine Introduces Hedge Agent Applet for Executed Options

The new tool, provided through its Wolverine Execution Services (WEX) arm will allow clients on the firm's trading platform to save resources by automatically calculating hedge quantities based on current delta, and immediately sending out a…

SmartTrade Launches New FX-Focused OMS

SmartTrade Technologies has recently launched its next generation of Order Management System (OMS), focused on foreign exchange (FX).

Bank of Singapore Takes Ullink's OMS and Connectivity

Bank of Singapore has selected Ullink’s connectivity and order management systems.

Newedge Updates China Metals Platform

The multi-asset trading venue says enhancements to CN Pulse include improved pre-funding capabilities, pre-margin risk functions that mirror Chinese exchange and domestic trading practices, and offer broader access to metals markets in the country.

Munich Re's Asset Management Arm Selects SimCorp

Munich Ergo Asset Management GmbH (MEAG), the Bavarian insurance provider's $228 billion asset manager, will install SimCorp Dimension at its home office in Germany, as well as in Hong Kong and New York.

Global Prime Partners Takes Liquid OEMS

The London-based boutique brokerage known as GPP, which focuses on small buy-side shops such as hedge funds and family offices, will now offer clients Liquid's cloud-based front office and data management services.

Messaging Architecture Key as Citadel, REDI Partner on New OEMS

The pair of technology providers—both with sterling ancestry—are looking to confront a problem that, so far, has alluded a durable solution for the buy side. They are not the first to try—but from a tech perspective, the match looks promising.

Swan Wealth Advisors Takes Omex for Order Routing

The buy-side risk management specialist, with $850 million assets under management and based in Durango, Colorado, will use Omex's execution platform for implementing options strategies across its multiple custodians and sub-accounts.

Eze Software Group Enjoys Stellar Six Months

Six months is a long time in the life of a software company. Take the Eze Software Group as an example: The fledgling buy-side focused vendor – born in January this year after $56 billion private investment firm TPG stumped up the capital to acquire…