Risk Management, Performance & Reporting

Buy-side compliance and risk functions to align more closely

Compliance and risk operations at some investment management firms appear likely to integrate more closely - or in some instances may even combine outright - over the course of 2010, according to projections by financial technology consultancy Aite Group.

Quantifi releases Version 9.3

London-based Quantifi, a provider of analytics and risk management products to the global credit markets, has released Version 9.3 of its pricing, hedging and risk analysis platform. Quantifi says V9.3 provides more robust risk reporting, streamlined…

Buy-side risk projects set to increase in 2010

Following mounting evidence that risk management processes in the traditional asset management and hedge fund industries proved alarmingly inadequate in the midst of the global credit crisis, investment managers are now intending to beef-up risk…

Holland Park selects Algo Risk Service

Holland Park Risk Management (HPRM), a Toronto-based independent risk management adviser to pension fund managers in the US and Canada, has signed a three-year contract for the Algo Risk Service, Algorithmics' outsourced risk management and portfolio…

Operations: the way forward

The last decade has produced a remarkable transformation in the front office - especially from a buy-side perspective - although current trends suggest that operations and risk management will hold the spotlight over the next 10 years. More than ever,…

Progressive embraces business continuity challenge

Business continuity rose to prominence in the wake of the September 11 attacks, as firms of all sizes sought to develop contingency plans as a way of mitigating the business and operational risks resulting from systems failures. By Victor Anderson*

Global IT Spending Set to Rise

NEW YORK-Budget makers in the securities and investment vertical can expect to see between a 2 percent and 4 percent increase in IT spending in 2010, depending on their geographic location, conclude the authors of a recent white paper published by…

Scrambling Toward Liquidity Risk Compliance

Since the start of the financial crisis, the U.K. Financial Services Authority (FSA) has moved swiftly to revamp the U.K.'s liquidity risk management regulatory regime. DWT speaks with P.J. Di Giammarino, CEO of industry think thank JWG-IT Group, to…

News In Numbers

Numbers

Industry Prepares

For February Options Symbology Change, OCC Announces New Test Date

Editor's Letter - Bigging-up the back office

From a buy-side perspective, the front office has traditionally been where all the sexy action takes place. And rightly so. It's the area of the business directly responsible for performance. Come to think of it, the front office is a bit like the engine…

Bottom-up reform

What little difference a year makes. Twelve months ago, financial services participants, observers and press - including yours truly - were anticipating major regulatory overhauls and new oversight of the industry following Barack Obama's election and…

Guest Editorial - Evolving to Meet New Challenges

Ray D'Arcy recaps the year in which he became president and CEO of Interactive Data Corp., and looks ahead to 2010

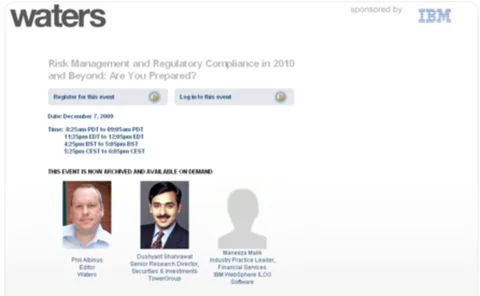

Risk Management and Regulatory Compliance in 2010 and Beyond: Are You Prepared?

Join Dushyant Shahrawat, Senior Research Director - TowerGroup, and Maneeza Malik of IBM as they discuss:

FESE: Market Transparency a Must

BRUSSELS-Market transparency and integrity were on the lips of most of exchange operators who attended the annual Federation of European Securities Exchanges (FESE) conference held in Brussels last week.

Mo’ Money, Mo’ Problems

Feature

Lucky Number 7?

OPERATING SYSTEMS

Smooth Liquidity Sailing

Waters WEBINAR