Pricing & Valuation

Expanding Structured Finance Footprint, Markit Adds CLO Tranche Pricing

Market data provider Markit will now offer evaluated prices for 5,000 investment-grade collateralized loan obligation (CLO) tranches, rated BBB or better, covering around two-thirds of the overall market.

Michael Shashoua: Pricing’s Progress

A growing drumbeat for greater transparency and credibility in the sourcing of pricing and valuations data is stirring data professionals to improve functions serving these needs. Michael explains how the industry is calling the tune.

TR Exec: "Third-Party Pricing Has Missed Out On Regulatory Push in Asia"

Regulations have helped to drive adoption of third-party pricing in the US and Europe, but this has not been the case in Asia, delegates have heard at this week's Tokyo Financial Information Summit

SIX Exec: "Model Pricing Has Important Role Despite Central Clearing"

Ian Blance, Zurich-based director of evaluated pricing at SIX Financial Information, told delegates at the Tokyo Financial Information Summit that model pricing will remain important for fixed-income assets that are infrequently traded

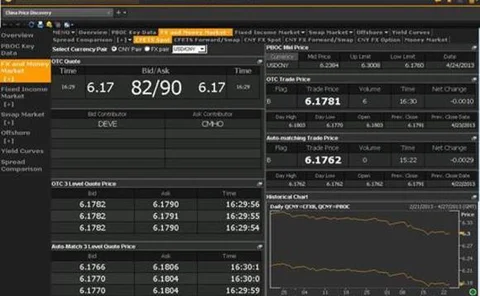

Interactive Data Expands Real-Time Offerings

The data services provider, acting on research confirming demand for the fixed-income asset class, plans to offer real-time pricing on a feed and in its Vantage platform

IRD's Editor on Pricing and Valuations Issues

Inside Reference Data editor Michael Shashoua describes the tension between keeping pricing method documentation concise and pursuing multi-sourced pricing models.

Seeking A Third Way On Pricing

Faced with issues concerning transparency and credibility of pricing and valuations, data managers must reconcile impulses to be brief and comprehensive all at once.

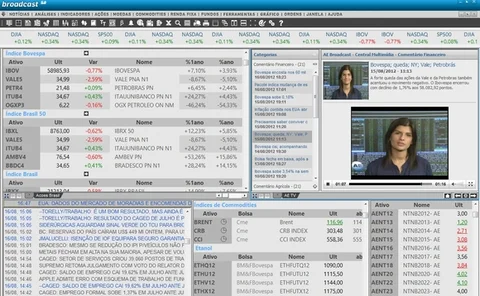

Pricing & Valuations special report

April 2013 - sponsored by: Interactive Data, Numerix, SIX Financial Information

Rising Enthusiasm for New Data Sources

Features in the April issue of Inside Reference Data find a common subtext of identifying new sources and types of data that are catching on

Easing the Evaluated Prices Regulation Burden

During an Inside Reference Data webcast, panelists discussed the steps that have been taken to improve confidence in evaluated prices and what pricing vendors can do to ease the regulatory burden on their customers, writes Nicholas Hamilton

Wells Fargo Exec: Pricing Providers Are Segmenting

Wells Fargo’s fund services unit is adapting to a different landscape for pricing sources. Michael Shashoua hears from Daniel Johnson of Wells Fargo Global Fund Services about how the firm works with clients to best serve their price data requirements

Numerix, JPMorgan Eye Cross-Asset Application of Volatility Model

A new Unspanned Stochastic Local Volatility (USLV) model, an alternative to established Heath-Jarrow-Morton (HJM) methods for modeling options volatility, looks to build on pricing analytics for credit derivatives.