Quantum computing

The quantum leap: How investment firms are innovating with quantum tech

While banks and asset managers are already experimenting with quantum computing to optimize operations, they should also be proactive in adopting quantum-safe strategies.

Waters Wavelength Ep. 317: Bitdefender and Transilvania Quantum

This week, Bitdefender’s Adrian Coleșa and Transilvania Quantum’s Sorin Boloș join to discuss security vulnerabilities in quantum computing.

BlackRock tests ‘quantum cognition’ AI for high-yield bond picks

The proof of concept uses the Qognitive machine learning model to find liquid substitutes for hard-to-trade securities.

For AI’s magic hammer, every problem becomes a nail

A survey by Risk.net finds that banks are embracing a twin-track approach to AI in the front office: productivity tools today; transformation tomorrow.

AI co-pilot offers real-time portfolio rebalancing

WealthRyse’s platform melds graph theory, neural networks and quantum tech to help asset managers construct and rebalance portfolios more efficiently and at scale.

Who’s afraid of the big, bad AI computer?

The last two years of GenAI’s hype cycle have re-energized the conversation around what AI technology can offer. It’s also brought fears, concerns, and post-apocalyptic narratives. Nyela thinks much of it is unwarranted.

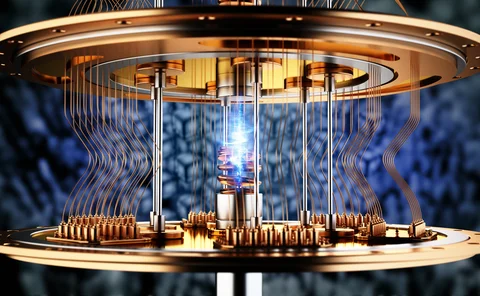

Fidelity’s quantum exploration unites theory and proof

The asset manager and Amazon have teamed to put a quantum twist on machine learning.

Standard Chartered keeps faith with quantum experimentation

The bank is aiming to future-proof itself with the ability to adopt new technology at an early stage.

AI model uses quantum math to learn like a human

Could the next big breakthrough in machine learning come from the world of finance?

Can machine learning help predict recessions? Not really

Artificial intelligence models stumble on noisy data and lack of interpretability

Waters Wrap: As quantum’s skeptics grow in number, believers need better messaging

As you explore ways to use genAI, do you benefit from having ML and NLP experts on staff who have followed AI evolution for years? Anthony thinks that’s an important question when talking about quantum exploration.

Quantum computing: a problem for another generation?

Some banks have soured on quantum exploration. Others are playing a game of wait and see.

Waters Wavelength Podcast: David Hardoon dissects language models

David Hardoon returns to talk about the field of language and how it’s the ‘heart and soul’ of artificial intelligence.

Waters Wrap: Big Tech’s subtle plans for capital markets domination

Amazon, Google, IBM and Microsoft aren't just cloud providers anymore—and their tentacles are going to spread deep into trading systems going forward.

Optical computer beats quantum tech in tricky settlement task

Microsoft’s analog technology twice as accurate compared to IBM’s quantum kit in Barclays experiment

UBS found no advantage in quantum computing—ex data chief

The Swiss bank tested various use cases in its trading business before giving up on the technology.

Waters Wavelength Podcast: Broadridge’s Tyler Derr

Broadridge’s CTO Tyler Derr joins the podcast to talk about interoperability, blockchain, and other emerging tech.

Waters Wrap: Blockchain—let’s put the hammer back in the box

With the ASX Chess DLT failure and users ignoring DTCC’s DLT option for its Trade Information Warehouse, Anthony wonders what it will take for the industry to stop touting this buzzword for non-specialized needs.

JP Morgan is testing quantum deep hedging

Researchers say the timeline has shortened for the use of models in production.

Financial firms rethink after cyber insurance premium spike

Brokers say there are signs pressure is easing, but quantum hacking threat could transform market

Mainframes still mainstream: How financial markets are embracing and evolving 'legacy' IT

Tech giant IBM is targeting security, AI, and portability in the modernization of the mainframe as firms report still retaining “the workhorse of the back office.”