Risk

Vela Trading Continues Growth Strategy with Object Trading Acquisition

This Vela move follow’s its acquisition last month of futures and options trading specialist OptionsCity.

Citi Rolls Out Velocity Clarity Big Data on Demand with Analytics Platform

Cloud-based platform harnesses Citi big data lake, API technology seeks to ease data complexity in custody and fund services.

Colchis, Alcova Tap AQMetrics for Risk, Reg Reporting

AQMetrics has added US investment management firm Colchis Capital Management and hedge fund Alcova Asset Management as clients of its Regulatory Risk and Compliance Software platform.

Buy Side Struggles to Integrate Analytics

Linking performance attribution and risk has clear benefits, but fragmented approaches are making it hard for firms to unify processes and underlying data. Clive Davidson outlines the key challenges, and how firms are addressing them.

Fincad Adds Fintech Execs Brittan, Fite to Board

The fintech veterans will lend their experience to contribute to Fincad's growth.

Queensland Treasury Taps Wolters Kluwer for Reporting, Data Management

Regional Australian finance authority goes live on Wolters Kluwer's finance, risk and reporting technology platform

OTAS Updates Lingo with Real-Time Text Reports

OTAS adds real-time alerts to Lingo product suite to help traders capture risk and act accordingly.

A Very Data Christmas Carol: Silent Night

Max delivers his rundown of the top themes of the year... in verse!

LumRisk Taps Markit EDM Managed Service to Bolster Risk Analysis, Modeling

Markit says LumRisk's implementation reflects increasing popularity of its cloud-based platform

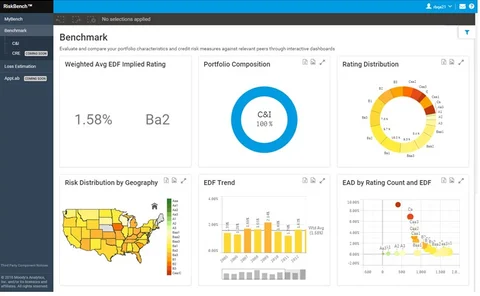

Moody's Analytics Enlists Qlik Visuals for RiskBench Credit Risk Data Analysis Tool

The tool will initially cover private companies in the US and Europe, before expanding to other asset classes and geographies.

Golden Copy: Inevitably Incorrect ... Or Not Necessarily?

When using data about risk to make predictions, or report accurately to regulators, how can one avoid being wrong?

Overcoming the FRTB Challenge

Under the Fundamental Review of the Trading Book, having quality data can mean a world of difference in capital charges. Joanna Wright reports

BNP Paribas Securities Services Aims for Wider Perspectives with ESG Risk Analytics

Environmental, social and corporate governance (ESG) becoming a key element of risk analysis and measurement as investors demand greater portfolio visibility.

Numerix Buys R2 Code Copy from S&P to Fuel Response to Banks’ ‘Transformation’ Efforts

The deal is one step towards the vendor being better able to serve the "transformation" trend unfolding among its clients.

Flexibility, Balance Key to Successful Risk Management

Asia-Pacific Buy-Side Technology Summit risk panel highlights importance of a flexible and balanced risk management system.

Statpro Builds Cloud-Based Data Management, Performance Engine

Development of the platform is being driven by the plethora of middle-office platforms creating data management challenges.

Panelists: Finance, Risk Need to be Brought Together to Improve Data Management Processes

And who should own the data? Is it possible to have one person be responsible for all of that information?

Egyptian Bank Picks Wolters Kluwer for Multiple Solutions

Departments across finance, governance, risk and compliance will use OneSumX suite

Diliger Adds Know-Your-Vendor Compliance Data to Procurement Platform

The additions to vendor surveys will help firms comply with vendor risk requirements.

Numerix Integrates OneTick into Software Suite

Numerix, a provider of cross-asset analytics for derivatives valuations and risk management, has announced the integration of tick database and complex event processing software provider OneMarketData's (OMD) OneTick enterprise data management platform…

Markit Launches KY3P Platform for Third-Party Risk Management

Barclays, HSBC and Morgan Stanley partner to bring users to hub

AxiomSL Partners with AlgoSave for IFRS 9 Challenge

IFRS 9 is a new accounting standard created to ensure risk exposure through complex instruments is well understood and reported.

Fidessa Launches Sentinel Trading Compliance System

Fidessa's sentinel trading compliance system enables asset managers to centralize their risk management capabilities.