Quantifying Catastrophe After Sandy

A few months ago, I wrote an article in sibling publication Waters about measuring natural catastrophes, which looked at modeling services for insurance-linked securities—catastrophe bonds, for example. Business continuity was rather far from its focus.

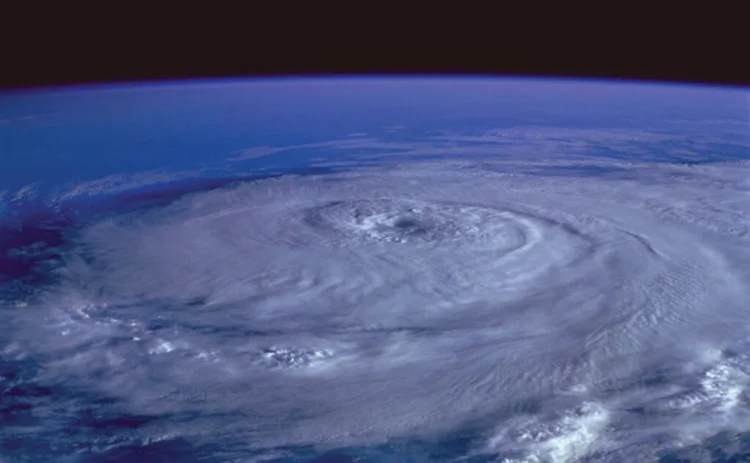

Yet as financial firms assess what happened in the lead-up to Sandy, and how well they have managed in the days after, elucidating catastrophe risk at a macro level, to inform firms' continuity plans, seems more key than ever. One risk advisory specialist, Eqecat, measures Sandy as a “one-in-10-year” event in terms of total losses, according to stochastic models shared on a conference call yesterday. Hurricane Katrina’s devastation, by comparison, was a one-in-25.

Each is signficant. While disaster recovery has become a regular priority for COO or CTOs, broader business continuity considerations suffer something of an image problem when the cost-benefit, particularly for smaller firms, isn't clear. For context, financial communications provider IPC commissioned a survey on business continuity ahead of the London Olympics this summer—a far more predictable event than Sandy that nevertheless implied at least mild risk to infrastructure. Interesting opinion emerged: Firms see little upside in girding for low-probability, high-risk events, even as clients are increasingly more likely to ask about it.

The choice still seems to be easy: Hunker down and improvise the use of mobile technology and remote access as much as possible. Assuming a widespread impact, everyone will be in the same boat, and beyond an act of fate, how bad could it be?

Bad.

One point worth considering is concentration of physical assets, and the extent to which is it possible to reroute trading activities. If less densely in the past, contemporary capital markets infrastructure—e.g., cloud providers and datacenters—remains regionally clustered, not just in New York but also throughout the many environmentally vulnerable hubs around the world, particularly in Asia. There is a reason why catastrophe modelers and insurers keep incredibly granular information about these cores: Not only are they exposed; they also continue to represent, by far, the greatest concentration of liability.

That means backup power and cooling systems are one priority, while reliable rerouting is another. The US Securities and Exchange Commission (SEC) has pushed for better redundancies at the exchanges, but the New York Stock Exchange’s aborted move to NYSE Arca on Tuesday, reportedly because of process and coding issues, shows that push has been too slow. And theirs is only the most public example.

A second question came up as I was meeting with a couple of investment managers on Tuesday, all of whom had arrived from the UK and Ireland for a conference, only to be waylaid by the hurricane.

I was asked, respectfully but rightly, why the US hasn’t buried more of its coastal power lines underground; how hospital generators can fail; and how Amtrak trains managed to design rolling stock a few years ago with Alstom, builder of France's high-speed TGV trains, for Amtrak’s Acela service, but can’t run those trains at peak speed because of very subtle, though expensive, changes required in the grade at certain crossings and curves.

One of the managers asked why the US struggles to get anything “public” quite right—at least until first responders show up to remind us what humanity is made of.

That answer probably requires a book, but for business continuity's sake, the smaller point is easy to grasp. Effective planning must rely on the peculiarities of the jurisdiction in question, beyond geology, meteorology, or the value of assets in a particular location. Age of transportation and telecommunications infrastructure, prioritization of public goods, how a particular community culturally reacts to crisis, and—as I learned from funds that specialize in cat bonds—litigiousness and indemnity laws, all become relevant. Amidst the adrenaline of disasters these characteristics seem self-evident, but in planning for them, having an anthropologist or an actuary on the team may be nearly as valuable as an engineer.

Considering those challenges, some firms may rather set down with a light footprint in their satellite offices and keep critical infrastructure nearer to home. That, of course, gets back to the first issue, only with the added virtue, or temptation, of familiarity.

Though the numbers will evolve and probably rise, Eqecat currently estimates total insured losses from Sandy will reach $20 billion on the high side, far less than Katrina. While Sandy may renew calls for a national catastrophe fund on the heels of Hurricane Irene a year earlier, Eqecat says the event “doesn’t prove a secular trend” for extreme weather forming in the Atlantic basin. Yet.

Still, many are sure to wonder. And perhaps that is for the better.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@waterstechnology.com or view our subscription options here: https://subscriptions.waterstechnology.com/subscribe

You are currently unable to print this content. Please contact info@waterstechnology.com to find out more.

You are currently unable to copy this content. Please contact info@waterstechnology.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@waterstechnology.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@waterstechnology.com

More on Trading Tech

Apac buy-side firms embrace AI, automation to optimize business processes

Survey of Apac buy-side firms shows growing AI, API and automation usage to enhance investment workflows and enable data integration

What does the future of trader voice look like?

The trader voice market has shrunk to three main players: IPC, BT, and Symphony. The battle for market share and desk real estate is pitting hardware against software.

Bloomberg Terminal’s agentic play shows rapid change in trading tech

Waters Wrap: The data giant’s conversational AI interface might seem novel, but others say having one is becoming a bare minimum in the world of trading technology.

Esma supervision proposals ensnare Bloomberg and Tradeweb

Derivatives and bonds venues would become subject to centralized supervision if the proposed reforms go through.

AllianceBernstein enlists SimCorp, BMLL and Features Analytics team up, and more

The Waters Cooler: Mondrian chooses FundGuard to tool up, prediction markets entice options traders, and Synechron and Cognition announce an AI engineering agreement in this week’s news roundup.

Ram AI’s quest to build an agentic multi-strat

The Swiss fund already runs an artificial intelligence model factory and a team of agentic credit analysts.

Fidelity expands open-source ambitions as attitudes and key players shift

Waters Wrap: Fidelity Investments is deepening its partnership with Finos, which Anthony says hints at wider changes in the world of tech development.

Market-makers seek answers about CME’s cloud move

Silence on the data center’s changes has fueled speculation over how new matching engines will handle orders.