Luminex Plots New Path with Conditional Order Types

The buy-side venue allows firms to forego share ante in favor of “proactive” policing.

From January 22, Luminex began to introduce conditional order types, allowing users to drop trades under certain criteria, but with a distinct feature—those using conditionals will not be required to commit shares to the deal as a sign of good faith, as they currently have to do under its firm order type.

“Ultimately, our clients had said that they could send us more orders, that they want to trade on Luminex and they want to trade at 25 mil, buy-side only, but the only way to get those orders was to eliminate this impediment,” says Jonathan Clark, CEO of Luminex.

It’s a step change for the venue, which was originally created by nine investment managers—BNY Mellon, BlackRock, Capital Group, Fidelity Investments, Invesco, JPMorgan Asset Management, MFS Asset Management, State Street Global Advisors, and T. Rowe Price—at least partly because traders were getting tired of elusive, and perhaps predatory, liquidity at other alternative trading systems (ATSs).

In those cases, traders would enter orders, but they would often “fall down” as soon as negotiations started. People began to feel like they were being tricked into expressing interest in orders and betraying their trading strategies.

Luminex had a solution to the problem. Every time a trader entered a deal into the system, they were required to “be good on at least 5,000 shares,” Clark says.

“I think, by and large, people really loved the idea that this would sort of—if it didn’t eliminate fall down, then it made sure you had skin in the game, and there had to be an ante whenever you sent an order,” he says.

So what changed? If the buy-side firms trading on Luminex—around 185, at last count—were so enamored with the way it was doing business, why introduce a new order type that, at the very least, could start to introduce some of the problems Luminex was looking to solve in the first place?

“What we found over time was that this firm quantity that came with every order ultimately was inhibiting folks from trading,” says Clark. “They were saying that they loved the no-fall-down provision, but they wanted optionality, and as long as they had [shares] committed out to Luminex then they lost some of that. And from a workflow perspective, their blotters were cluttered with placements to Luminex, and what we found over time was that the benefit was being outweighed by some of the frustration around it.”

Shark Tanks

Removing the requirement to post 5,000 shares on an order hasn’t, Clark says, removed the obligation to ensure a functioning market, however. If the ATS landscape before Luminex felt like a shark tank without this firm liquidity, Luminex had to come up with something in order to protect its buy-side-only environment. Thus, the concept of promoting and demoting orders was born, along with active policing of user behavior by Luminex for customers who choose to use conditionals.

“We knew this going in, in that we knew we’d benefit from more orders, but also that a headwind could be those potential fall downs, so we’re just policing the heck out of it,” says Clark. “Now we’re in a spot where we’re having to manage connections intraday, where folks are falling down because they’re off the desk, or because they’re submitting orders where they don’t have a high intent of trading. There, we’re tracking them down, we’re asking if they saw the pop-up, if they’d like to trade. If not, we’re demoting the order. We’re taking a very proactive position with our community where we can demote an order and put it into a holding tank, which is an area where there are orders that aren’t ready to trade. When they’re ready to trade, they can promote it.”

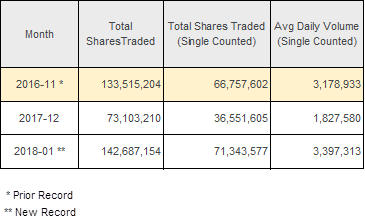

The order type appears to have had an immediate impact on the business running through Luminex’s pipes. The company claims that January 2018 was its best month of record, doubling its volumes from December and surpassing the previous benchmark set in November 2016 (see chart below).

“That high watermark had stood since November of 2016, right after the [US presidential] election, when volumes were off the charts and we benefited just like many other platforms did,” Clark says. “But this rollout, I think, helped to bring some of those folks that were on the edge and not using Luminex as much into a position where they could feel comfortable using us more, where they have the optionality, and they can expose the order.”

The venue’s other order types, which do attract the 5,000-share placement, will still be available for use. Looking ahead, Luminex will continue to roll out conditional orders to certain other order management systems, including Portware and a number of proprietary systems in the coming weeks. It is also aiming to complete a redesign of its user interface, which Clark says it hopes to unveil “toward the front end” of the second quarter.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@waterstechnology.com or view our subscription options here: https://subscriptions.waterstechnology.com/subscribe

You are currently unable to print this content. Please contact info@waterstechnology.com to find out more.

You are currently unable to copy this content. Please contact info@waterstechnology.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@waterstechnology.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@waterstechnology.com

More on Trading Tech

TMX Datalinx makes co-location optionality play with Ultra

Data arm of the Canadian stock exchange group is leveling up its co-lo capabilities to offer a range of options to clients.

NYSE plans new venue, Levy leaves Symphony, and more

The Waters Cooler: MIAX sells (most of) its derivatives exchange, BNY integrates with Morningstar on collateral, and science delights in this week’s news roundup.

Brad Levy takes the reins at ThetaRay

The now-former Symphony CEO is looking to expand the financial crime monitoring company’s global footprint.

Brokers must shift HFT servers after China colocation ban

New exchange guidance drives rush for “proximity colo” in nearby datacenters.

RBC takes European traders to the Endgame

The Canadian bank’s complex execution algorithm, increasingly popular with traders stateside, is making landfall in Europe. But the region’s fragmented markets mean adoption is not simply a matter of plug-and-play.

Banks hope new axe platform will cut bond trading costs

Dealer-backed TP Icap venture aims to disrupt dominant trio of Bloomberg, MarketAxess and Tradeweb.

Editor’s Picks: Our best from 2025

Anthony Malakian picks out 10 stories from the past 12 months that set the stage for the new year.

The next phase of AI in capital markets: from generative to agentic

A look at some of the more interesting projects involving advanced forms of AI from the past year.