Sell-Side Technology/Analysis

Foresight Publishes Final HFT Report

Foresight, a UK government-affiliated research group located within the department for Business, Innovation and Skills (BIS), has published its final report on computer-based trading (CBT).

SEF Nuances Provide Challenges for Liquidity Aggregation

While liquidity aggregation as a practice is nothing new for market participants, the specific character of Swap Execution Facilities (SEFs) and their diversified offerings will lead to new ways of thinking for sell-side firms, research from GreySpark…

FSA's Sampson: Data Accuracy Trumps Speed

Gerald Sampson, head of the operational risk review team at the UK's Financial Services Authority (FSA), says banks should be more concerned about accuracy of data than risk aggregation speed.

Price, Value, Track: Data the Missing Link in Reformed Swaps Execution

The industry is rapidly confronting swap execution facilities (SEFs), but initiatives surrounding lesser-traded contracts and standardization are required to bring to the swaps market true transparency.

HFT: The End of the World As We Know It?

Yesterday, European lawmakers voted in favor of introducing stricter controls around the controversial practice of high-frequency trading, proposing a regulation that would require all posted orders to be kept in the market for a minimum period of half-a…

Mixed Messages: Direct Edge Equivocates on HFT

Direct Edge's message efficiency program came and went in a flash. But why? And will Nasdaq's follow?

FOA Provides Risk Management Guidelines for ESMA Compliance

The Futures and Options Association (FOA), a pan-industry representative body for firms engaged in the trading of derivatives, has published a set of guidelines aimed at providing granular detail for recent European Securities and Markets Authority (ESMA…

RBS CIO: Regulatory Arbitrage Possible, But Loopholes Closing

In August, Scott Marcar was named Royal Bank of Scotland’s (RBS’) new CIO of markets, where he will report to chief logistics officer David Shalders. Marcar recently spoke with WatersTechnology about the changing regulatory environment and the challenges…

FIX Protocol Offers Connectivity Solution for Some, But Not All SEFs

The open Financial Information Exchange Protocol (FIX) will allow a relatively painless connectivity method for order book Swap Execution Facilities (SEFs), but not those that operate on a request-for-quote (RFQ) basis, says the latest research from…

BAML Taps FTEN for European Clearing Control

Bank of America Merrill Lynch (BAML) has become the first general clearing member (GCM) to use FTEN's RiskXposure (RX) platform for its European clearing operations.

Caplin’s BladeRunner Solves HTML5 Issues, Encourages Collaboration

As HTML5 becomes adopted as the standard programming language for web-delivered software, the challenging environment of financial services has exposed some of its key development flaws. With BladeRunner, Caplin Systems believes it has solved the major…

In China, Galaxy Futures Eyes Western Push

As the oldest and largest joint venture (JV) brokerage in the Chinese market, Galaxy Futures is a high-profile representation of outward-looking securities firms within the country. Originally partnered with ABN Amro before the Dutch bank's acquisition…

Panel: Anti-Gaming Shifts to the Background

Anti-gaming techniques have become more incorporated into overall order placement strategy and are no longer the big, standalone topic they once were, according to TradeTech West panelists.

Exchanges Shouldn't Internalize For Profit, Says Headlands' Andresen

There is a difference between internalizing and internalizing for your own benefit, explains Matthew Andresen.

Who Should Pay for the New TCA?

When it came time to announce who will bear the cost of next-generation transaction cost analysis (TCA), the experts had more than one suggestion.

Quants' Conundrum: Funding Valuation Adjustment Comes Into Its Own

While firms, regulators, and academics continue to debate a suitable role for FVA, technologists and quants are forging ahead with implementations.

Prospera Praises SunGard's Social Media Surveillance Technology

Texas-based broker-dealer Prospera Financial Services has hailed the impact of SunGard's Protegent social media surveillance tool since going live with the technology in November last year.

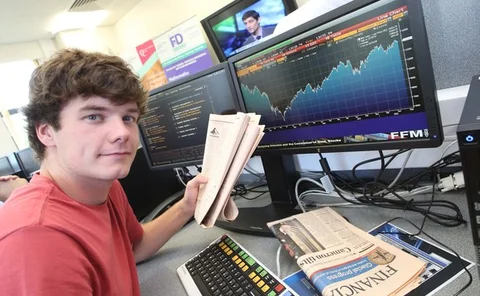

Queen's University and First Derivatives Build Trading Floor

Consultancy and software vendor First Derivatives has co-funded a mock trading floor at Queen's University Belfast, in order to provide students with a hands-on experience of a stock exchange environment.

Major Banks Complete Swap Trading Standard

The Fixed Income Connectivity Working Group (FICWG) has agreed on a set of standards for the way in which participants in swap trades will interact with execution venues, ahead of regulatory reform.

CFTC Under Fire from Asia-Pacific Regulators

Singaporean, Hong Kong and Australian bodies express concern over extraterritorial implications for OTC reform.

The Dust Settles in Knight's Arena

It's been two weeks since one of Knight Capital’s systems went haywire and nearly sunk the market-maker. Already, the situation has stabilized, and the industry can start thinking about the bigger picture.

Infographic: Major Bank Fines in 2012

A visualization of some of the largest regulatory penalties levied this year.

TSE Must Restore Confidence After Second Outage

On Tuesday, the Tokyo Stock Exchange had to halt trading for the second time in six months after a technology glitch hit its derivatives system. With the Knight fiasco fresh in public consciousness and a takeover bid with the Osaka exchange looming,…

Knight Rises—and Falls

A look at Knight Capital's rapid ascent offers a few clues, and hints for lessons to be learned, as details are still emerging from Knight Capital's NYSE algo mishap on Wednesday.