Sell-Side Technology/News

ITRS, Excelian Partner on Murex Systems Monitoring

The monitoring software provider and specialist consultancy are collaborating on real-time system performance metrics and monitoring for cross-asset trading and risk management platform Murex.

Tass Signs Etrali for Unified Trading Communications

German institutional bond trading firm Tass Wertpapierhandelsbank GmbH (Tass) has deployed a unified trading communications solution from Etrali Trading Solutions across its trading floors in London and Hofheim, Germany.

EU-Project First Launches Social Media Sentiment Analysis Tool

An European Union-backed consortium, Project First, has launched a prototype tool for near-real-time social media sentiment analysis for financial services firms.

OptionsCity Colocates in Equinix in Frankfurt

OptionsCity, a Chicago-based provider of trading solutions for futures and options, has chosen the Equinix data center campus in Frankfurt as its hub for access to German derivatives exchange Eurex.

Saxo Bank Launches Social Trading Floor

Copenhagen-based Saxo Bank has launched the beta version of its new social media-style trading floor.

Omega Securities Inc Adds CEO, ATS

Omega Securities Inc. (OSI), operator of the Toronto-based Omega ATS, installed a new CEO in November. In February it will debut a new alternative trading system (ATS). In April that new ATS will come out with a new pricing model.

Indian Regulator Plans HFT Conference

The Securities and Exchange Board of India (Sebi) has announced plans for a two-day conference next week, aimed at discussing the market risks associated with algorithmic and high-frequency trading (HFT).

SGX to Introduce Circuit Breakers in February

The Singapore Exchange (SGX) has announced it will introduce circuit breakers in the securities market starting February 24.

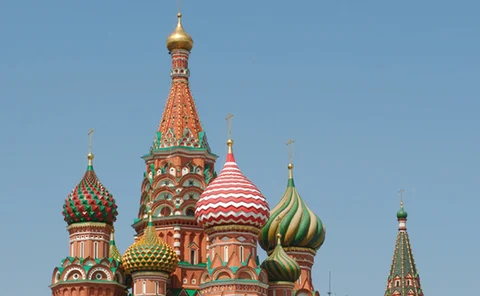

Euroclear Bank and NSD Launch Post-Trade Services for Russian Bonds

Eurolcear Bank and the Russian National Settlement Depository (NSD) are to launch their post-trade services for the Russian corporate and municipal bonds market on January 30 this year.

Etrali Partners with Natterbox for Voice Recording Solution

Etrali Trading Solutions has partnered with UK-based voice intelligence provider Natterbox to provide the first regulatory compliance solution for mobile and fixed recording, archiving and analytics services via a private cloud.

CFTC Approves Bloomberg's Swap Data Repository

Bloomberg has received provisional regulatory approval from the US Commodity Futures Trading Commission (CFTC) to operate a swap data repository (SDR).

BBH Names McGovern CIO

American private bank Brown Brothers Harriman (BBH), with $4 trillion under custody and administration, has named Michael McGovern as a managing director, chief information officer (CIO), and head of systems.

Thomson Reuters Debuts Market Surveillance Platform

Thomson Reuters has announced the release of Accelus Market Surveillance, its oversight platform for exchange-traded and over-the-counter (OTC) instruments, developed in conjunction with compliance vendor b-next.

Xtrakter Partners with CME European Trade Repository for Emir Reporting Tool

European fixed-income trade matching and regulatory reporting service provider Xtrakter has launched a transaction reporting solution, TRAX Repository Link (TRL), in a strategic alliance with the Chicago Mercantile Exchange European Trade Repository (CME…

Sell-Side Technology Awards 2014 Now Open for Entries

The Sell-Side Technology Awards 2014 are now open for entries, running until February 21.

Jyske Bank Selects DealHub for FX Distribution

Denmark-based Jyske Bank has signed DealHub for its foreign exchange (FX) pricing service distribution, FX Distribution Hub.

World Federation of Exchanges Moves to London

The World Federation of Exchanges (WFE), the trade association of 62 publicly regulated stock, futures and options exchanges, has moved its headquarters from Paris to London.

Aequitas Amends Exchange Proposals

Aspirant Canadian exchange Aequitas has amended its business plan, following criticism from the Ontario Securities Commission (OSC) that its original provisions breached market rules on fair access.

MDSL Preps Trading Cost Management Tools

UK-based MDSL is rolling out a new service aimed at helping financial firms manage their Fix trading connectivity spend, similar to how they manage market data spend using the vendor's market data management (MDM) platform.

TeraExchange Strikes Deal with Pair of European IDBs

The New Jersey-based swap execution facility (SEF) has sealed trading agreements with OTCex and RP Martin, two European interdealer brokers (IDBs) based in Paris and London, respectively.

Three Years On, Europe Agrees Mifid II

A raft of new laws regarding the operation of securities markets in Europe is a step closer to becoming a reality, after European authorities clinched a deal regarding the review of the Markets in Financial Instruments Directive (Mifid), known as Mifid…

FastMatch Selects Caplin to Develop FX Matching Platform

FastMatch, the foreign exchange (FX) electronic communication network (ECN) co-owned by BNY Mellon, Credit Suisse, and Forex Capital Markets (FXCM), has chosen Caplin Systems to develop a new electronic distribution platform for its spot-FX matching…

Zürcher Kantonalbank Taps Corvil for Enhanced Trading Performance

Zürcher Kantonalbank (ZKB), has deployed Corvil’s Operational Performance Monitoring (OPM) system to monitor the performance of its market making and foreign-exchange (FX) business, including market data quality, transaction analysis and FX order flow.

BNP Paribas, Morgan Stanley Join Eurex OTC Clear

BNP Paribas and Morgan Stanley have joined Eurex Clearing's central counterparty service for OTC derivatives, Eurex OTC Clear, for interest rate swaps (IRS).