Sell-Side Technology/News

Market Stucture Consultancy KOR Group Launches

The advocacy and consulting firm, led by Christopher Nagy and David Lauer, will cover the intersection of market structure, policy, and financial technology, and will push an agenda of greater transparency in the industry.

CME to Launch European Exchange on April 27

The Chicago Mercantile Exchange (CME) Group has announced that its long-planned European derivatives exchange, CME Europe, has received regulatory approval from UK authorities, and will begin operations from April 27.

ICSDs, Custodians Develop Asset-Servicing Model for T2S

A group of international central securities depositories (ICSDs) and custodian banks have announced the joint development of a common model for asset servicing under the Target2-Securities (T2S) project.

Clearstream Bolsters Global Liquidity Hub with OTC Collateral

International central securities depository Clearstream has announced the introduction of OTC Collateral, a bilateral collateral management service, to its risk and liquidity management platform Global Liquidity Hub.

Options Reduces Latency on New Jersey Fiber

Options, the New York-based private financial cloud provider, has upgraded its route between the NJ2 Savvis facility in Weehawken, New Jersey, and the NY4 Equinix facility in Secaucus, New Jersey.

Kellner Replaces Kondo as Instinet CEO

Instinet, the New York-based agency-only broker arm of Nomura, has appointed Jonathan Kellner as CEO. He replaces Fumiki Kondo, who has been made head of Nomura Asset Management’s overseas client division in Tokyo.

Cinnober Debuts Cross-Asset Client Clearing Platform

Technology vendor Cinnober has announced the launch of TRADExpress Client Clearing, a system for consolidating the service offering at banks into a single system.

ABN Amro Launches AMG Global Platform

ABN Amro Clearing, part of ABN Amro Bank, has announced the launch of its global execution platform, ABN Amro Market Gateway Global (AMG Global), providing clients with seamless routing capabilities between Asia, the US and Europe via a single FIX…

SwapClear Names Daniel Maguire as Global Head

Daniel Maguire has been named the global head of SwapClear, LCH.Clearnet's global interest rate swap clearing business.

BT Launches New Integrated Voice Service

The telecommunications provider has launched One Voice Radianz, an integrated service that will bring together voice, mobile, and data services for financial services users of its flagship BT Radianz Cloud.

BNY Mellon CSD to Begin Securities Settlement in Luxembourg

BNY Mellon has announced its Brussels-based central securities depository (CSD) has been recognized as a securities settlement system by the Luxembourg Stock Exchange.

Dubai Murabaha Commodities Platform Adds BGC

The interdealer broker will be the first on Dubai Multi Commodities Center's (DMCC's) electronic Tradeflow system, launched in 2013, for trading in niche Islamic finance products.

AxiomSL Expands XBRL-Related Capabilities

To meet new reporting requirements related to the eXtensible Business Reporting Language (XBRL), AxiomSL has enhanced its out-of-the-box XBRL reporting solution to include taxonomy management and tweaked it to be more of a submission platform, rather…

CLS Appoints Ken Harvey Chairman of the Board

Ken Harvey has been appointed chairman of the board of directors of CLS Group and CLS Bank International, bringing over 30 years of financial expertise to the role.

Newedge Adds Ullink Post-Trade Monitoring Solution in Asia

Multi-asset broker Newedge has added UL Monitoring, a post-trade monitoring solution from connectivity and trading solution provider Ullink, to its Direct Market Access (DMA) platform in Asia.

Bats Chi-X Europe Hires Jill Griebenow as CFO

Bats Chi-X Europe has appointed Jill Griebenow as chief financial officer with immediate effect. She will be responsible for all financial controls and human resource functions, including financial planning and reporting.

CME Clearing Europe Set To Expand Swaps Support

CME Clearing Europe, the Chicago Mercantile Exchange (CME) Group's European clearing house, has received Bank of England approval to add a number of derivatives to its interest-rate swap service.

Multi-Bank Group TESI to Adopt Fix Protocol

The Fix Trading Community has announced that the Trading Enablement Standardisation Initiative (TESI), developed by Etrading Software and supported by the investment banking community, has adopted the Fix Protocol guideline in order to reduce operational…

JSCC Taps Calypso for Client-Clearing Services

The Japan Securities Clearing Corporation (JSCC), a member of the Japan Exchange Group, has gone live with Calypso Technology’s system for client clearing of JPY interest-rate swaps (IRS) and collateral management.

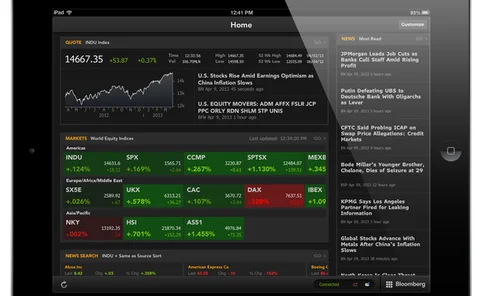

Regional Fixed Income Dealers Get Bloomberg Service

Bloomberg has unveiled its Electronic Trade Order Management Solution, or ETOMS, a managed service used by US regional broker-dealers to access and engage fixed income electronic markets as both liquidity providers and liquidity takers.

ASX Eyes Upgrade to T+2 Settlement

The Australian Securities Exchange (ASX) is considering shortening its settlement cycle for cash market trades in Australia.

UBS Executes First Interest-Rate Swap as Introducing Broker

UBS Investment Bank has completed its first trade as an introducing broker on behalf of a client via UBS Neo, the bank’s global distribution and execution services platform.

Tocom Receives ATS Approval from Hong Kong Regulator

Tocom, the Tokyo Commodity Exchange, has received regulatory approval from the Securities and Futures Commission (SFC) in Hong Kong to provide Automated Trading Services (ATS) to its clients.

Uberoi to Lead S&P Capital IQ’s Global Comms

New York-based S&P Capital IQ, an operating unit of McGraw Hill Financial, has appointed Sunny Uberoi vice president, global communications.