A ‘Holo’ Experience: Holographic Interfaces and Innovation

Emilia David ruminates on innovation and how banks can speed up technological evolution in capital markets.

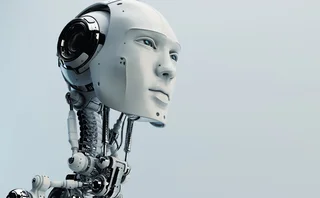

A couple of months ago, I was talking to an executive from a company that specializes in voice-trading technology. Our conversation was mostly about the future of the industry, something that I ruminated on in a feature for the September issue of Waters. As we talked, he mentioned a possibility that now doesn’t seem so far off: the advent of holo trading—holo as in hologram.

It sounded far-fetched. In my head, I imagined holo suites like those in Star Trek, but the more I thought about it, the more I came around to it. It’s interesting and different—and, dare I say it, innovative?

Holo trading won’t happen if no one’s actually thought about doing it from a practical perspective. Innovation is something that should be inherent in banks’ mentalities, but some firms are cutting their research and development departments in order to save costs. It’s understandable, of course, but the speed of technological evolution across the capital markets is staggering.

This is both good and bad. It allows new ideas to be developed and deployed more quickly, but entering into IT quagmires becomes inherently easier. While banks always look to partner with third-party technology providers as a matter of course in order to deploy already-built and tested tools, they are increasingly finding that many of the offerings they evaluate are not targeted enough for their requirements. This is why firms are setting up incubators and accelerators to help foster innovation within the industry, aiming to identify and deploy new tools and technologies that might have a material impact on their day-to-day operations. With this approach, banks are more involved and intimately familiar with new technologies from their conception, so that if and when they are acquired and deployed, their integration is that much more seamless.

Risk, Reward

Holo trading won’t happen if no one’s actually thought about doing it from a practical perspective.

There is little doubt that capital markets-focused incubators and accelerators are a good idea—they provide startups with a safe haven to develop and test their ideas, while also helping them understand how specifically their technologies might impact the industry in a production environment. But they are not without their own set of unique problems. And, given the astonishingly high failure rate among startups—as high as 90 percent—I wonder whether all the hard work is justified. Is it worth spending so much time and money on potential technologies that have an overwhelmingly good chance of failing? Clearly, the answer is yes, which is why there is so much industry talk right now about fintech startups, accelerators and incubators.

But for most, their biggest challenge is deciding when exactly to pull the plug on a startup that they believe will not make the grade. After all, as Eric Ries, the father of the lean startup methodology, argues, startups need to know how to fail quickly and cheaply rather than spending precious time and money on an idea that they know will ultimately fail anyway. Banks need to develop the same discipline so that resources are focused on those ideas most likely to succeed and not squandered on those destined to die on the test bench.

Some startups do succeed and have been assimilated into incubators’ and accelerators’ technology line-ups. Take, for example, Nasdaq’s Trading Insights unit or Deutsche Bank’s commitment to implement 50 ideas from its Innovation Lab by September of this year. While they have their challenges, they are a good way of fostering innovation. If a holographic-trading platform ever comes to fruition, doesn’t it seem logical that it would stem from a bank’s incubator, accelerator or innovation lab?

Personal relationships are important to trading, particularly in exotic and illiquid markets. Traders communicate and often build relationships that ultimately become mutually advantageous in trading. That’s why voice-based trading is still going strong despite so much investment over the years in building cutting-edge trading platforms. My colleague, Dan DeFrancesco, is focusing on virtual reality in the February issue of Waters and how it is starting to make inroads into everyday life, which could open up new opportunities for traders, even if it is in the relatively distant future. Perhaps holo-trading desks don’t seem so far off, after all.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@waterstechnology.com or view our subscription options here: https://subscriptions.waterstechnology.com/subscribe

You are currently unable to print this content. Please contact info@waterstechnology.com to find out more.

You are currently unable to copy this content. Please contact info@waterstechnology.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@waterstechnology.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@waterstechnology.com

More on Trading Tech

The total portfolio approach gains momentum: Building the right tech foundation for success

The rationale for the TPA, and the crucial role technology plays in enabling such an approach

Google, CME say they’ve proved cloud can support HFT—now what?

After demonstrating in September that ultra-low-latency trading can be facilitated in the cloud, the exchange and tech giant are hoping to see barriers to entry come down.

Institutional priorities in multi-asset investing

Private markets, broader exposures and the race for integration

BlackRock and AccessFintech partner, LSEG collabs with OpenAI, Apex launches Pisces service, and more

The Waters Cooler: CJC launches MDC service, Centreon secures Sixth Street investment, UK bond CT update, and more in this week’s news roundup.

TCB Data-Broadhead pairing highlights challenges of market data management

Waters Wrap: The vendors are hoping that blending TCB’s reporting infrastructure with Broadhead’s DLT-backed digital contract and auditing engine will be the cure for data rights management.

Robeco tests credit tool built in Bloomberg’s Python platform

This follows the asset manager’s participation in Bloomberg’s Code Crunch hackathon in Singapore, alongside other firms including LGT Investment Bank and university students.

FCA eyes equities tape, OpenAI and Capco team up, prediction markets gain steam, and more

The Waters Cooler: More tokenization, Ediphy lawsuit updates, Rimes teams up with Databricks, and more in this week’s news roundup.

Buy-side data heads push being on ‘right side’ of GenAI

Data heads at Man Group and Systematica Investments explain how GenAI has transformed the quant research process.