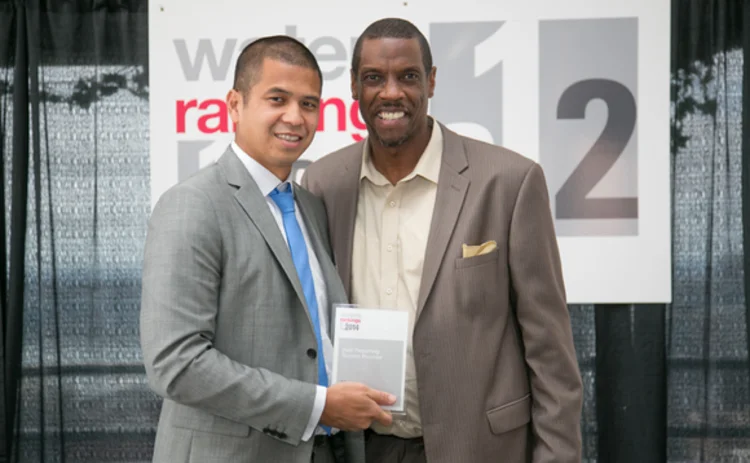

Waters Rankings 2014: Best Reporting System Provider — Eze Software Group

To describe ESG as an entity that was established apparently in double-quick time and which hit the ground running in the wake of ConvergEx Group’s decision to abandon its trading front-end business, trivializes the decisiveness and judiciousness of its buy-side battle plans from its very inception. In something of a coup, ESG, owned by Fort Worth, Texas-based private equity firm TPG Capital, acquired a pair of key front-office tools—the Eze OMS and the RealTick EMS—from the ConvergEx stable in January 2013. Then some four short months later, ESG revealed that it had also snapped up London-based Tradar, a provider of portfolio management and accounting technology, to complete a buy-side-focused technology suite to rival some of the very best names in the business: Charles River Development, Fidessa, Advent Software, and Linedata. And what an acquisition Tradar was for ESG: it has matched its Eze OMS and RealTick EMS siblings by winning a category in this year’s Waters Rankings—the best reporting system provider—even though reporting is one of its least celebrated functions. Now re-branded Tradar PMS, the platform supports scenario analysis, decision support, order management, trade processing, portfolio accounting and reporting, compliance and risk management, performance attribution, and connectivity with a range of third parties. It is, as its name suggests, something of an all-singing, all-dancing portfolio management system, spanning the front, middle, and back offices. And when combined with the firm’s Eze OMS and the RealTick EMS products, it makes for a compelling offering. Two hundred buy-side firms in over 30 countries can attest to that, a number that is set to swell appreciably in the years ahead.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@waterstechnology.com or view our subscription options here: https://subscriptions.waterstechnology.com/subscribe

You are currently unable to print this content. Please contact info@waterstechnology.com to find out more.

You are currently unable to copy this content. Please contact info@waterstechnology.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@waterstechnology.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@waterstechnology.com

More on Awards & Rankings

American Financial Technology Awards 2025 winner’s interview: Connamara Technologies

Connamara Technologies’ recent win in the AFTAs on the back of its EP3 platform

Buy-Side Technology Awards 2025 winner’s interview: CompatibL

The chairman of CompatibL discusses the reasons for the firm’s success in the Best buy-side AI platform category of the Buy-Side Technology Awards 2025.

AFTAs 2025: Best data provider—Allvue Systems

Product: Private Credit Intelligence

AFTAs 2025: Best IT team—TCW Group

Team: TCW Group’s Investment Technology Team; Project: Engineering Solutions—ABF and insurance launches during Aladdin stabilization

Buy-Side Technology Awards 2025 winner’s interview: 73 Strings

73 Strings’ win in the BST Awards 2025 Best middle-office platform category

AFTAs 2025: Most cutting-edge IT initiative—J.P. Morgan

Project: Vida Beta One

Buy-Side Technology Awards 2025 winner’s interview: S&P Global Market Intelligence

S&P Global Market Intelligence’s success in the first year the Best private markets data provider category has been on offer.