Anthony Malakian

Anthony joined WatersTechnology in October 2009. He is the Editor-in-Chief of WatersTechnology Group, running all editorial operations for the publication. Prior to joining WatersTechnology, he was a senior associate editor covering the banking industry at American Banker. Before that, he was a sports reporter at daily newspaper The Journal News. You can reach him at anthony.malakian@infopro-digital.com or at +646-490-3973.

Follow Anthony

Articles by Anthony Malakian

The Need for Speed: Being the Fastest Will Always be Sought After

Anthony ties the movie Top Gun to HFT, IoT and AI...naturally.

Waters Wavelength Podcast Episode 19: BNP's Growth Plans, Buy Side KYC

Dan and Anthony talk about the custody business and KYC.

Bloomberg Launches Entity Exchange to Help Buy Side Handle KYC, Onboarding Demands

Fortress Investment's David Sharpe says the platform helps to "establish relationships with new trading partners quickly and securely."

Case Study: HA&W Wealth Management Turns to BasisCode for Compliance

BasisCode Compliance, which launched a self-subscription service this week, is helping HA&W Wealth Management to more efficiently manage its compliance needs.

BNY Mellon Launches ‘Big Data' Solution for Investor Allocations, Behavioral Insights

The solution is designed to allow fund managers to gain insight into where asset owners are investing and how their strategies are changing.

The Waters Weekly Wrap: May 14-20

A look back at the best content published across all the Waters brands.

Waters Wavelength Podcast Episode 18: Dos and Don'ts for PR People

Dan and Anthony breakdown what makes a good media relations person and what doesn't.

New Client Highlights Markit's New Reg Services

Darren Thomas tells Waters the vendor is looking to roll out the services for new ISDA protocols and margin requirements.

The Buy Side Slowly Moves Toward Utilities, Managed Services

Mifid II, Fatca and new margin requirements are helping institutional players to see the benefits of centralized services.

Pimco Adds kyc.com to Onboarding Suite as Markit Preps New Reg Services

Darren Thomas tells Waters the vendor is looking to roll out the services for new ISDA protocols and margin requirements.

The Waters Weekly Wrap: May 7-13

A look back at the best content published across all the Waters brands.

Waters Wavelength Podcast Episode 17: Regulatory Landscape, Fixed Income, Blockchain

Dan and Anthony talk regulations, fixed income and blockchain.

Former UBS Tech Head Joins PE-Firm Lovell Minnick

Steven Pierson has over two decades of experience in the investment banking sector.

Waters Rankings 2016 ─ Voting Now Open

The 30 categories are open for voting for our readers now until June 5.

Machine Learning Could Address Fixed-Income Liquidity Woes

Industry experts recently discussed the potential for machine-learning techniques to help the buy side and sell side connect.

As Asia Launch Looms, Bloomberg Tradebook Sees Strongest ETF Growth in Fixed Income, Commodities

Kiran Pingali discusses Bloomberg Tradebook's Exchange-Traded-Fund (ETF) Request-for-Quote (RFQ) platform and talks about where the market is heading.

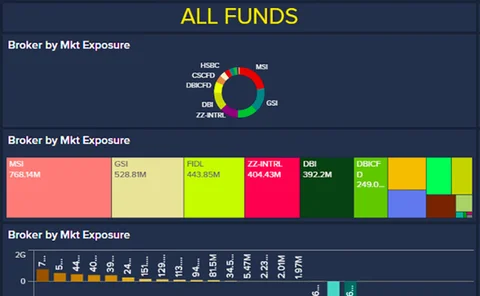

Citco Previews Soon-to-be-Launched CitcoOne Platform

The new platform was built from the ground up with a focus on data mining and visualization.

Waters Wavelength Podcast Episode 16: Sifma Ops, Nasdaq, Fixed Income

Dan talks about his trip to Miami while Anthony discusses fixed income.

The Waters Weekly Wrap: April 30 - May 6

A look back at the best content published across all the Waters brands.

Electronifie Seeks to Double Enabled Traders, Triple Active Users By Year End

Since its launch, $1.6 billion has been executed on the platform with an average trade size of $3 million.

Panelists: As All-to-All Trading Inches Forward, Single-Dealer Platforms Wither

All-to-all platforms are slowly gaining favor to address some of the ills facing the fixed-income market. But they're not cure-alls, either.

Sell-Side Technology Awards 2016: Best Cloud Provider to the Sell Side — BT

BT views its development roadmap as one that consists of Seven C’s: community, content, connectivity, compute, compliance, cybersecurity, and cost (of ownership).

Sell-Side Technology Awards 2016: Best Sell-Side Data Management Product — Markit

At the most recent Waters Rankings awards, voted on solely by end-users, Markit also took home the award for best EDM solution.

Sell-Side Technology Awards 2016: Best Data Provider to the Sell Side — Thomson Reuters

That's three in a row for Thomson Reuters in this category.