Max Bowie

Max is editor-at-large at WatersTechnology, based in Infopro Digital's New York office.

Max joined then-Risk Waters Group (prior to its acquisition by Incisive Media) in 2000, and has worked as a reporter on Risk Magazine, FX Week, Trading Technology Week (now Sell-Side Technology) and Buy-Side IT (now Buy-Side Technology), before joining Inside Market Data as European reporter in 2003. He moved to New York as US reporter in 2005, and became editor in 2006. He was a contributor to sibling Inside Reference Data, and was founding editor of Inside Data Management, which merged the IMD and IRD newsletters into a monthly glossy magazine.

Follow Max

Articles by Max Bowie

MSCI Taps Bradbury to Market Index Data to Australian ETF Industry

ETF veteran will promote MSCI's index data to ETF investors and participants in Australia.

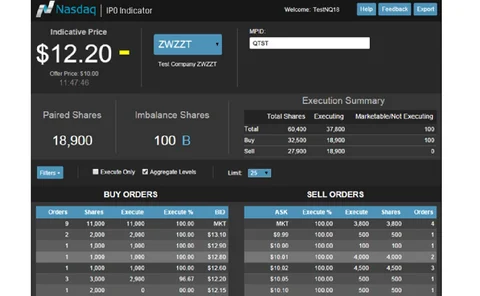

Nasdaq Rolls Out IPO Auction Data Workstation

The workstation will provide trading members with information around trading of IPOs

BondWave Boosts Trader, Advisor Capabilities

New capabilities will improve advisors' communications with investor clients and trading desks.

S&P Pays $1.375Bn to Settle Ratings ‘Fraud' Case

Under settlement, vendor admits giving high ratings to risky RMBS issues.

Nasdaq Offers Pre-Offering Order Data

Tool will increase effectiveness of pre-IPO order activity, officials say.

Icap Launches Bond Index, Publishes Index Data on Bloomberg

The broker has designed the new index to outperform stable or rising US Treasury markets.

ICE Sets Date for New London Gold Price

Officials say increased participation will ehnance the benchmark's reliability.

Fitch Fetches S&P's Whitmore to Run EMEA Biz

Vendor anticipates new hire will help open new growth opportunities.

Opening Cross: When the Most Indicative Data is the Data Itself

Is the search for information itself a form of "information leakage"?

NYSE Readies ‘Integrated’ Feed; Will Keep OpenBook, Trades, Imbalances Feeds

Testing for the new feed will beging in February, usign NYSE's harmonized XDP data protocol.

Bond ATS OpenBondX Preps Order Book, Real-Time Feed

OpenBondX, a startup alternative trading system for fixed income securities, is planning to make firm quote and trade data available via a real-time proprietary datafeed and via Bloomberg, once it rolls out a central limit order book in the second phase…

Covington Joins M&A Consultants BLC Advisors

Veteran exec Covington has 28 years of experience in the banking and financial technology industries.

Platts Speeds Commodities Data

New delivery mechanism will provide faster and easier access to Platts' commodities data.

Barchart Debuts AgriCharts OnDemand

API-based service will make it easier for developers to integrate Barchart's commodities data.

Max Bowie: Perfect Pitch: The Rise of Fintech’s Not-So-Secret Agents

Increasingly sophisticated data products need sales experts with a wide range of experience, which sometimes means going "out of house."

KVH to Connect JPX, SGX with Low-Latency Co-Lo Network

Announcement follows connectivity cooperation agreement between the exchanges.

ICE Benchmark Admin Preps Calculation Switch for ISDAFIX Rate

Officials say new methodology will "ensure market confidence" in the integrity of ISDAFIX benchmark.

S&P DJI Unveils Major Bond Index Expansion

Index provider aims to seize opportunities created by Libor scandal to restore confidence in fixed income markets.

Icap Preps Bond Pricing Service, Taps Interactive Data Evaluations

Changing bond market conditions require a new breed of pricing solutions, officials say.

Opening Cross: Market Data’s Facebook Status Would Be ‘It’s Complicated…’

As data becomes more sophisticated, data management becomes more complicated.

CBOE Hikes BBO, Depth Fees, Cuts COB Charges

Fee changes aim to support the cost of additional content, while attracting more trading.

YCharts Adds Fund Screener Tool

The screener will allow investment advisors to navigate and select frommore than 40,000 funds

Chi-X Canada Launches Web-Based Historical Data Downloads

The service will automate provision of historical data files for the ATS and its clients.