Max Bowie

Max is editor-at-large at WatersTechnology, based in Infopro Digital's New York office.

Max joined then-Risk Waters Group (prior to its acquisition by Incisive Media) in 2000, and has worked as a reporter on Risk Magazine, FX Week, Trading Technology Week (now Sell-Side Technology) and Buy-Side IT (now Buy-Side Technology), before joining Inside Market Data as European reporter in 2003. He moved to New York as US reporter in 2005, and became editor in 2006. He was a contributor to sibling Inside Reference Data, and was founding editor of Inside Data Management, which merged the IMD and IRD newsletters into a monthly glossy magazine.

Follow Max

Articles by Max Bowie

Redline Taps Chen to Drive Product Development

Former Broadridge, Thomson Financial exec joins ticker plant vendor

Opening Cross: Location, Location, Consolidation and Diversification

Today’s data industry certainly isn’t that of 25 years ago, or even a dozen years ago when I started writing about it. A key difference is the change in pace of modern markets, shifting to low-latency trading where location—i.e. proximity of trading…

Quincy Taps O’Sullivan’s USAM for US Sales Push

Oakland, Calif-based low-latency microwave connectivity and market data provider Quincy Data is to use USAM Group—a New York-based outsourced sales agency recently set up by Feargal O’Sullivan, a former sales and solutions executive at NYSE Technologies,…

Sales Agency USAM Hires in NY, Chicago

Hires will allow USAM to offer outsourced sales agents in New York and Chicago to startups

Perseus Preps Mass-Market Precision Time-Synchronization Service

Data network and trading infrastructure provider Perseus Telecom is creating a lower-level version of its High Precision Time timestamping and clock synchronization service that can be easily ordered and provisioned online for use by a wider audience…

TickSmith Makes Tick Data Analysis Tools Available on Amazon Cloud

The move will make it easier for clients to deploy data analytics in their existing Amazon cloud platforms.

Data Boiler Taps Ex-Goldman Exec as CTO

Big Data management and analytics provider Data Boiler Technologies has hired former Goldman Sachs executive Homer Cheng as chief technology officer, based in Irvine, Calif.

Nasdaq Makes Perseus Timestamping Available in Carteret Datacenter

Availability of Perseus' timestamping service will give Nasdaq clients access to multiple timing protocols

NYSE Hit by FTP Data Issues

Outage impacted clients of FTP-delivered index and weightings data from NYSE

KVH Expands Japanese Subsea Cable Connectivity

Japanese network and hosting provider KVH has created a new network link that connects local networks in Tokyo and Osaka to the Shima Cable Landing Station, where mainland network providers can connect to undersea fiber network cables.

TMX's McCrea Joins Audit Specialists JCV

Former exchange exec will help grow JCV's audit and IPR protection business.

Genscape Buys Energy Fundamentals for European Power Analysis Expansion

Energy and commodities supply data provider Genscape has acquired Swiss power fundamental data and analysis provider Energy Fundamentals for an undisclosed sum, to extend its European offering by combining the vendor's analytics and scenario analysis…

AlphaSense Grabs Gunther for Sales

San Francisco-based AlphaSense, a provider of financial search, indexing and extraction technologies for structured and unstructured content, has hired John Gunther in New York as vice president of sales, responsible for driving growth of the vendor's…

Thomson Reuters Bags Sproehnle for Benchmarks

Tobias Sproehnle has joined Thomson Reuters in London as global head of benchmark services to head the vendor's global fixings business, responsible for administering more than 70 global benchmark indexes, including the LBMA Silver Price and the Libor…

McCoubrey Trades TIM for Predictive Retail Analytics

Dianne McCoubrey has left trade ideas platform vendor TIM Group, where she was regional sales director for the Americas, to become executive director of sales at Retalon, a provider of predictive analytics for retail inventory management, merchandising…

Cleartrade Bows Settlement Price Feed for CCPs

Commodity and freight futures market Cleartrade Exchange has begun offering a feed of daily settlement prices to its partner clearinghouses.

Crowdnetic Launches Crowdfunding Data Service, Inks Digital Look Distribution Deal

Crowdnetic, a provider of data on the crowdfunded securities market has unveiled CWMarketdata, a data download service covering data from more than 4,000 active and closed 506(c) offerings, sourced from a range of crowdfunding platforms via the vendor's…

Interactive Data 7Ticks Outlines BATS-Direct Edge Connectivity Migration Support

Interactive Data will provide connectivity to matching engines operated by BATS Global Markets and Direct Edge once the merged exchanges migrate their operations to Equinix's NY5 datacenter in Secaucus, NJ in January 2015.

Data Vets Sigillo, Johnson Establish MDI ‘Data Management-as-a-Service’ Practice

New offering targets boutique firms.

Opening Cross: Putting the ‘Custom’ in ‘Customer’

Talk to a market data manager at any firm, and chances are they view vendors and exchanges as money-grubbing monsters that exist purely to squeeze revenues from their hapless clients with little thought to customer service or satisfaction.

Data Vets Sigillo, Johnson Establish MDI ‘Data Management-as-a-Service’ Practice

Market data management veterans Rich Sigillo and Cindy Johnson have set up a new company focused on providing market data expense management and optimization as a managed service for firms that are not large enough to have a dedicated market data…

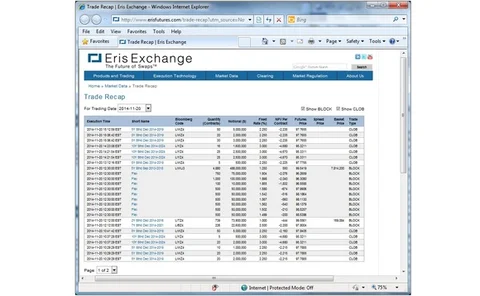

Eris Puts Futures Trade Data Online

Futures marketplace Eris Exchange recently began making real-time trade data available via a "Trade Recap" page on its website.

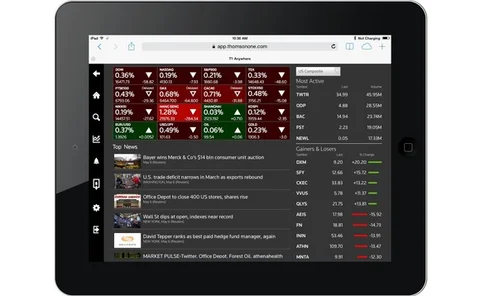

TR Expands Mobile Support for ‘Anywhere' Wealth App

Thomson Reuters has added support for new wireless platforms to its Thomson One Anywhere dynamic mobile site for its Wealth Management clients, including iPhone, Android and Blackberry Z10 smartphones.

OTAS Adds Customization, Text Generation to Analytics Platform

New OTAS Views feature will provide greater customization for clients.