Max Bowie

Max is editor-at-large at WatersTechnology, based in Infopro Digital's New York office.

Max joined then-Risk Waters Group (prior to its acquisition by Incisive Media) in 2000, and has worked as a reporter on Risk Magazine, FX Week, Trading Technology Week (now Sell-Side Technology) and Buy-Side IT (now Buy-Side Technology), before joining Inside Market Data as European reporter in 2003. He moved to New York as US reporter in 2005, and became editor in 2006. He was a contributor to sibling Inside Reference Data, and was founding editor of Inside Data Management, which merged the IMD and IRD newsletters into a monthly glossy magazine.

Follow Max

Articles by Max Bowie

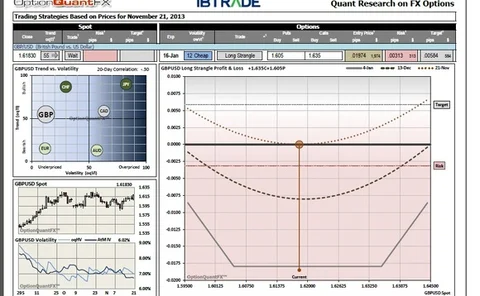

FX Bridge Preps Options Volatility Commentary

Foreign exchange spot and options trading platform provider FX Bridge Technologies is rolling out two new subscription-based FX volatility measures designed to help traders and investors identify trading opportunities in FX options and less common…

Equinix Calls Karl for Americas President Role

Datacenter and hosting provider Equinix has hired Karl Strohmeyer as president of the Americas, responsible for the vendor's management, strategy and growth plan in the region.

Redline Opens Chicago Office

Woburn, Mass.-based low-latency ticker plant and trading gateway provider Redline Trading Solutions has opened a sales and support office in Chicago at 111 West Jackson Boulevard.

Evaluation Stand-Outs

Regulatory demands push evaluated pricing providers to reveal more details of how they produce the data they have on offer. Max Bowie hears how end-users of data are collaborating closer with the providers as a result

Opening Cross: Big Data, Small Print

The London Stock Exchange's consolidated data policy could bring benefits to end-users, though in most cases, more data and delivery mechanisms still means more fees.

Tabb Builds Practice to Map DnA (Data and Analytics)

Research firm Tabb Group has set up a Data and Analytics practice to advise financial firms on opportunities to leverage emerging data management and analysis technologies and processes across their business.

Stoxx Moves Plagge from Frankfurt to NY

Index provider Stoxx's US business has appointed Jan-Carl Plagge senior market development manager, based in New York, to provide the vendor with a research and product development specialist to serve clients in North America.

Money.net Targets Institutional Clients with Deployed Terminal

New York-based low-cost financial data display provider Money.net has released a desktop version of its web-based terminal platform that the vendor hopes will position it against offerings from major market data vendors over the next two years and allow…

ICE Moves Hutcheson from Liffe to LIBOR

IntercontinentalExchange, the new owner of NYSE Euronext and its NYSE Liffe derivatives market, has appointed Liffe chief executive Finbarr Hutcheson president of ICE Benchmark Administration, the renamed NYSE Euronext Rate Administration business, which…

SpryWare Builds EESAT Feed Handler

Chicago-based low-latency feed handler and ticker plant provider SpryWare has built a feed handler for fellow Chicago vendor EESAT's Fuse feed of complex order book data.

Datacom Updates TradeView Latency Tool

East Syracuse, NY-based network and latency monitoring technology provider Datacom Systems has released version 1.5 of its TradeView FPGA-accelerated software platform.

ICE Plans to Divest NYSE Technologies; Will Keep Data Centers

IntercontinentalExchange (ICE) plans to sell much of the NYSE Euronext's NYSE Technologies data and technology business, following its acquisition of the New York-based exchange group, said ICE chairman and chief executive Jeffrey Sprecher on a…

Sprecher: ICE to Keep Datacenters, SFTI; Will Sell NYSE Technologies Assets

IntercontinentalExchange plans to divest much of the NYSE Euronext's NYSE Technologies data and technology business, following its acquisition of the New York-based exchange group, said ICE chairman and chief executive Jeffrey Sprecher on a conference…

Clarus Taps Icap Data for SEF Data Analysis

Clarus Financial Technology, a London-based provider of swaps benchmarks, reporting and analytics software, and risk management tools, is distributing benchmark derivative pricing from interdealer broker Icap as part of its SDRView Professional service…

Opening Cross: The Power of Predictive Analytics to Simplify Content Complexity

Prediction need no longer be viewed as a dark art, as the ability to more accurately predict price activity becomes a reality.

FISD's David Anderson on Progress of FIA Data Certification Program

David Anderson of industry association FISD and Atradia Consulting outlines the progress of FISD's Financial Information Associate certification program at the recent Asia-Pacific Financial Information Conference.

FISD's Tom Davin Discusses Key Takeaways from APFIC 2013

Tom Davin, managing director of industry association FISD talks about new exchanges and new initiatives from FISD in the Asia-Pacific Region, following the Asia-Pacific Financial Information Conference.

FSMLabs Debuts ‘Lightweight’ Time-Sync Appliance

Austin, Texas-based FSMLabs, a provider of time synchronization technologies for latency-sensitive trading firms, is rolling out a lightweight version of its TimeKeeper GrandMaster Clock hardware time synchronization appliance, to serve the needs of…

South Africa's McGregor BFA Buys I-Net Bridge

Cape Town-based financial data provider McGregor BFA has acquired fellow South African data vendor I-Net Bridge from Johannesburg-based publisher Times Media Group for 112.7 million rand ($11.1 million) to create an "unmatched" financial database of…

Exablaze Preps New NIC, 40GigE Support

Australian low-latency networking technology vendor Exablaze, a spin-off from highi-frequency trading firm Zomojo, is developing a stripped-down version of its ExaNIC network interface card, and is building support into its products for 40 Gigabit…

IEX Taps Savvis for Data Connectivity

US equity alternative trading system IEX Group has deployed its trading platform in datacenter and hosting provider Savvis' NJ2 facility in Weehawken, NJ, to provide access to its trading engine and market data to broker participants co-located in or…

MarketPrizm Connects to DGCX Data

MarketPrizm, the market data and trading infrastructure provider division of network provider Colt, is to offer low-latency market data from the Dubai Gold & Commodities Exchange, as well as access to trading connectivity on the United Arab Emirates…

Thomson Reuters Buys Kortes for Russian Commodities Data

Thomson Reuters has acquired Russian energy data provider Kortes to expand the level of insight into Russian commodities markets available on its Eikon desktop with the addition of Kortes' data and analytics on the Russian and CIS (Commonwealth of…