CME, Google Ally for Cloud Market Data Access

The partnership will allow existing and potential subscribers around the world to access all CME Group data via a connection to Google Cloud.

CME Group is making real-time market data from all its marketplaces available via Google Cloud in a bid to expand its client base and the reach of its data by using a new connectivity model to simplify data access for end users.

“We are putting all our real-time data into Google Cloud, and converting all our Market Data Platform (MDP) channels into a Google service called Pub/Sub, so anyone can access them via Google from anywhere on the planet,” says Adam Honoré, executive director of data services at CME. “The specific use case for this is how do we take advantage of native cloud services to lower the barrier to accessing our data. … We are creating a low-cost global transport solution for all our market data.”

The initiative responds to customer demand to address the costs of transport, data ingest, compute power and storage. “We’ve done some work on compute and storage, and now we’re tackling transport, and ingest cost is on our roadmap,” Honoré says.

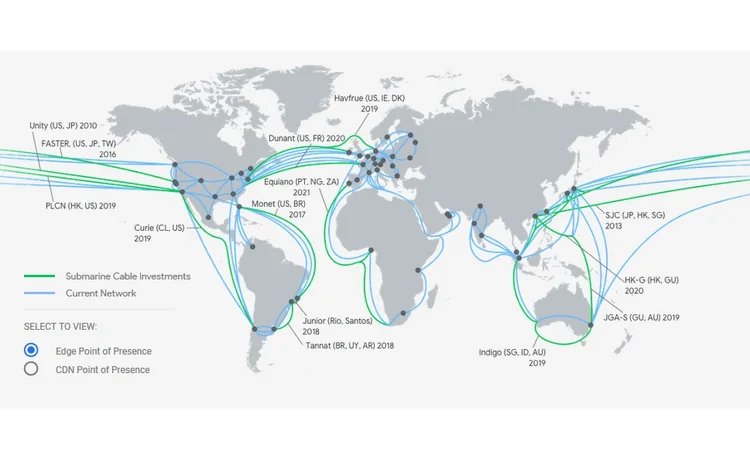

While financial markets connectivity has traditionally been the exclusive domain of specialist extranet providers, Google touts impressive credentials of its own: “We have the largest proprietary network in the world, and we continue to expand on that,” says Tais O’Dwyer, global director of financial services strategy and solutions at Google Cloud.

“Google Cloud has 20 regions [regional collections of datacenters], 61 zones [distinct compute, storage and networking resources across those regional datacenters], 134 network edge locations, and is available in more than 200 countries—plus, we’ve opened seven new cloud regions since 2018. When you think about the scale and ability to handle massive amounts of data, that’s part of our DNA. Our network and datacenters around the world have been designed to handle enormous amounts of data … at lightning speed,” she adds.

To enable the service, Google deployed a direct connect into CME’s datacenter in Aurora, Illinois, allowing CME to push data into its cloud, from where it can be accessed anywhere in the world with a connection to Google’s cloud. As a result, anyone with an existing license agreement for CME data and a Google Cloud account could connect to CME data within a day, using code from CME for connecting to Pub/Sub, Google’s cloud-based enterprise messaging middleware. New subscribers can license CME’s data via the exchange’s self-service entitlements portal.

“We maintain physical hubs in regions around the world, but we’re now extending that to anywhere with access to Google Cloud. We’ve expanded our network and capabilities with the same level of service across the world, while lessening the pain and cost of getting it there,” Honoré says.

The initiative’s cost structure also represents an experiment for CME: Though users must pay the normal fees for the data itself, instead of paying fixed charges for leased-line connectivity or rack space and cross-connects in datacenters, CME will charge a $1.49 fee per hour to access its data. While cloud access removes the need for dedicated backup and replay feeds, this model also provides the flexibility of being able to turn access on and off as needed.

The offering addresses the needs of both existing and potential clients: “We want to extend our global reach for direct connectivity. Clients say they want more direct relationships with the exchange. … But we also want new customers, so we want to make it as easy as possible for people to consume our data,” Honoré says.

The target client base for the new service runs the gamut of financial markets participants, though Honoré says it is initially aimed at firms with existing expertise in dealing with CME’s binary data format, such as software vendors, firms based outside the US, and those using CME markets for hedging.

“If you look at the ability Google has to provide real-time data around the world, this will generate interest from firms that don’t currently participate on CME’s marketplaces,” O’Dwyer says.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@waterstechnology.com or view our subscription options here: https://subscriptions.waterstechnology.com/subscribe

You are currently unable to print this content. Please contact info@waterstechnology.com to find out more.

You are currently unable to copy this content. Please contact info@waterstechnology.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@waterstechnology.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@waterstechnology.com

More on Data Management

AI strategies could be pulling money into the data office

Benchmarking: As firms formalize AI strategies, some data offices are gaining attention and budget.

Identity resolution is key to future of tokenization

Firms should think not only about tokenization’s potential but also the underlying infrastructure and identity resolution, writes Cusip Global Services’ Matthew Bastian in this guest column.

Vendors are winning the AI buy-vs-build debate

Benchmarking: Most firms say proprietary LLM tools make up less than half of their AI capabilities as they revaluate earlier bets on building in-house.

Private markets boom exposes data weak points

As allocations to private market assets grow and are increasingly managed together with public market assets, firms need systems that enable different data types to coexist, says GoldenSource’s James Corrigan.

Banks hate data lineage, but regulators keep demanding it

Benchmarking: As firms automate regulatory reporting, a key BCBS 239 requirement is falling behind, raising questions about how much lineage banks really need.

TMX eyes global expansion in 2026 through data offering

The exchange operator bought Verity last fall in an expansion of its Datalinx business with a goal of growing it presence outside of Canada.

AI-driven infused reasoning set to democratize the capital markets

AI is reshaping how market participants interact with data, lowering barriers to entry and redefining what is possible when insight is generated at the same pace as the markets.

Fintechs grapple with how to enter Middle East markets

Intense relationship building, lack of data standards, and murky but improving market structure all await tech firms hoping to capitalize on the region’s growth.