North America

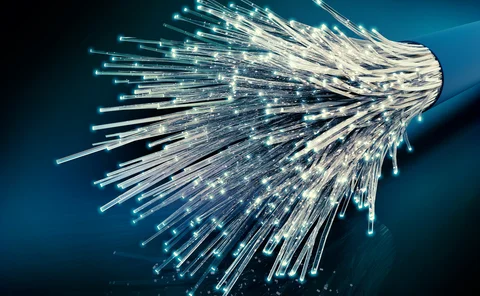

Fidelity expands open-source ambitions as attitudes and key players shift

Waters Wrap: Fidelity Investments is deepening its partnership with Finos, which Anthony says hints at wider changes in the world of tech development.

2026 will be the year agent armies awaken

Waters Wrap: Several AI experts have recently said that the next 12 months will see significant progress for agentic AI. Are capital markets firms ready for this shift from generative AI to agents?

Editor’s Picks: Our best from 2025

Anthony Malakian picks out 10 stories from the past 12 months that set the stage for the new year.

Market data costs defy cyclicality

Trading firms continue to grapple with escalating market data costs. Can innovative solutions and strategic approaches bring relief?

Will overnight trading in equity markets expand next year? It’s complicated.

The potential for expanded overnight trading in US equity markets sparked debate this year, whether people liked it or not.

AI & data enablement: A looming reality or pipe dream?

Waters Wrap: The promise of AI and agents is massive, and real-world success stories are trickling out. But Anthony notes that firms still need to be hyper-focused on getting the data foundation correct before adding layers.

Chicago datacenter outage forced clearers to turn away clients

Friday’s cooling system failure highlights cracks in tech and concentration risk of big CCPs.

Tokenization & Private Markets: Where mixed data finds a needed partner?

Waters Wrap: Reading the tea leaves, Anthony predicts BlackRock’s Preqin deal, Securitize’s IPO, and numerous public comments from industry leaders are just the tip of the iceberg.

Plaintiffs propose to represent all non-database Cusip licensees in last 7 years

If granted, the recent motion for class certification in the ongoing case against Cusip Global Services would allow end-user firms and third-party data vendors alike to join the lawsuit.

SS&C’s Bill Stone: RPA still important for agentic endeavors

The fintech is leaning on almost four decades in financial services and its many acquisitions to power AI deployment and meet the market’s needs.

As outages spread, it’s time to rethink how we view infrastructure technology

Waters Wrap: First AWS and then Azure. And these are only the most recent of significant outages. Anthony says a change is needed when it comes to calculating server migrations.

Row breaks out over cause of FX settlement fails

One European bank blames T+1 for a 50% jump in FX fails, but industry groups dispute the claims.

Bolsa Mexicana embarks on multi-year modernization project

Latin America’s second largest exchange is embracing cloud and upgrading its infrastructure in a bid to bolster its global standing, says CEO.

The US Treasury market preps for plumbing overhaul

Changes are coming to the US Treasury market with potential new clearing houses, access models, and more flow as the industry gets ready to meet the SEC’s first deadline for central clearing.

Bank of America’s GenAI plan wants to avoid ‘sins of the past’

Waters Wrap: Anthony spoke with BofA’s head of platform and head of technology to discuss how the bank is exploring new forms of AI while reducing tech debt and growing interoperability.

Will return-to-office mandates fuel market data brain drain?

The IMD Wrap: Increasingly, market data systems can be operated completely remotely. So, why are firms insisting that data professionals return to the office?

The TNS–Radianz deal hints at underlying issues in trader voice

Waters Wrap: As part of its cost-cutting program, BT shipped its Radianz unit to TNS, but the deal didn’t include its Trading & Command trader voice property. Anthony finds that interesting.

PostSig nets $4.1M seed funding to fuel expansion

The vendor will use the funding to solidify its position tracking data contracts and to expand to other contract management needs in the capital markets and beyond.

FactSet adds MarketAxess CP+ data, LSEG files dismissal, BNY’s new AI lab, and more

The Waters Cooler: Synthetic data for LLM training, Dora confusion, GenAI’s ‘blind spots,’ and our 9/11 remembrance in this week’s news roundup.

Is 2027 the new 24-hour trading target?

Slew of technical issues and dearth of SEC staff compound exchanges’ reluctance for round-the-clock equity trading.

Fintech powering LSEG’s AI Alerts dissolves

ModuleQ, a partner and investment of Refinitiv and then LSEG since 2018, was dissolved last week after it ran out of funding.