Quants Are Key to Judicious ESG

Meaningful data analysis is critical to the future of socially responsible investing, writes Antonia Lim of Schroders.

Capital allocators have power—and with great power comes great responsibility.

As a factor for distinguishing prudent investments, good corporate governance is paramount. In the first half of 2020, £70 billion ($89.5 billion) of net global inflows poured into investments flagged ESG (environmental, social and governance). Meanwhile, other mutual and exchange-traded funds—excluding money market funds—lost almost five times that amount.

It’s the most significant divergence seen to date. Rather

More on Data Management

As datacenter cooling issues rise, FPGAs could help

IMD Wrap: As temperatures are spiking, so too is demand for capacity related to AI applications. Max says FPGAs could help to ease the burden being forced on datacenters.

Bloomberg introduces geopolitical country-of-risk scores to terminal

Through a new partnership with Seerist, terminal users can now access risk data on seven million companies and 245 countries.

A network of Cusip workarounds keeps the retirement industry humming

Restrictive data licenses—the subject of an ongoing antitrust case against Cusip Global Services—are felt keenly in the retirement space, where an amalgam of identifiers meant to ensure licensing compliance create headaches for investment advisers and investors.

LLMs are making alternative datasets ‘fuzzy’

Waters Wrap: While large language models and generative/agentic AI offer an endless amount of opportunity, they are also exposing unforeseen risks and challenges.

Cloud offers promise for execs struggling with legacy tech

Tech execs from the buy side and vendor world are still grappling with how to handle legacy technology and where the cloud should step in.

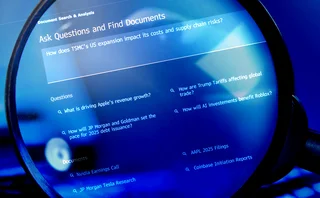

Bloomberg expands user access to new AI document search tool

An evolution of previous AI-enabled features, the new capability allows users to search terminal content as well as their firm’s proprietary content by asking natural language questions.

CDOs must deliver short-term wins ‘that people give a crap about’

The IMD Wrap: Why bother having a CDO when so many firms replace them so often? Some say CDOs should stop focusing on perfection, and focus instead on immediate deliverables that demonstrate value to the broader business.

BNY standardizes internal controls around data, AI

The bank has rolled out an internal enterprise AI platform, invested in specialized infrastructure, and strengthened data quality over the last year.