Feature

Big Data Is Big Stuff

The phenomenon of Big Data, now a proper noun in its own right, reflects the inexorable growth of data volumes, and the velocity and variety of those volumes, across the financial services industry, presenting market participants with a host of…

Special FX: The Evolution of e-FX Trading

Foreign-exchange trading has changed considerably over the past 10 years. Daily turnover has doubled, spreads have tightened dramatically, and the market has opened up to new entrants as never before. At the heart of this is a shift to electronic trading…

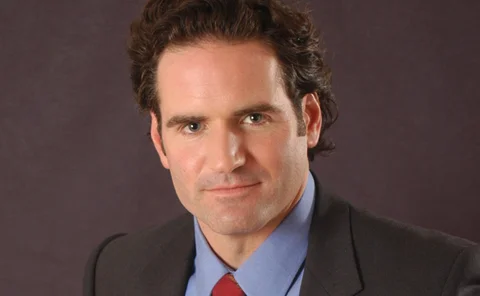

Direct Edge CEO William O'Brien Plans to Go Global

William O’Brien, who once rejected his exchange roots, took over a tiny ECN and grew it into one of the biggest equity exchanges in the world. Now he’s looking at new markets for Direct Edge. By Jake Thomases

Numbers Game: Gauging the Impact of Big Data Part II

In the February issue of Waters, the first part of this feature defined Big Data in terms of volume, variety and velocity. But what does this actually mean for the financial services industry and the technology considerations necessary for dealing with…

Call Auctions: Trading in a New Old-Fashioned Way

Call auctions are one of the oldest forms of stock trading. Plenty of people would like to have an auction option, yet no such system has existed for more than a decade. AX Trading is giving an electronic version another shot. By Jake Thomases

No Turning Back: Firms Forge Ahead on Data Quality

In light of the global regulatory environment and firms looking to become more efficient while cutting costs, data quality has become a focal point for many technologists. However, the challenges are many and there’s still confusion as to who owns the…

The Match Game

Strapline: Regulation & Standards

The Road To European Harmonization

Strapline: Regulation & Standards

Gauging Governance

Strapline: Data Management

Lingua Fatca

Strapline: Corporate Actions

Bi-Temporal Data Boon

Strapline: Data Management

First New York Securities' Jean Hill’s Blank Slate

Manhattan-based proprietary trading firm First New York brought Jean Hill on board to build its infrastructure from the ground up. However, there were several points during her career when it looked as though she was destined for any number of paths but…

Hard Coding: The Benefits and Drawbacks of FPGAs

Field-programmable gate arrays (FPGAs) are being touted in certain circles as the next wave of technology in the financial services industry, gaining adherents for their ability to perform complex tasks at previously inconceivable speeds. However, with…

Do They Only Like Me for My Algos?

Unlike bulge-bracket firms, mid-tier broker-dealers have to make tough choices about which algorithms to white label and which ones to develop themselves. They want to optimize their value to clients, but aren’t always sure what clients are looking for…

Credit Trading Gets a Kick

Icap Electronic Broking expects to see dramatic performance improvement in its BrokerTec credit-trading platform, as the firm nears the end of a two-and-a-half-year project to roll out the new global matching-engine architecture. By Rob Daly

Try Before You Buy: Firms, Vendors Employ Proofs of Concept

Technology vendors were once loath to give away their ideas for free. Financial service firms were similarly unwilling to invest in a project that might be a sunk cost. However, attitudes are changing, and it is now standard for companies to pay for…

Risk and Compliance: Driven by Data

The efficacy of risk management and compliance practices across the buy side and sell side, two of the most high-profile business drivers for the foreseeable future, is entirely contingent on the quality and consistency of the data feeding those systems…

Numbers Game: Gauging the Impact of Big Data

Big Data is growing and is clearly a driving topic in 2012. As with many recent innovations, however, its definition is amorphous. In the first of a two-part feature, Waters examines exactly what constitutes Big Data, where it comes from, and why it’s…

Centralized Data: Analytics’ Friend or Foe?

The Pleasures and Pains of Centralized Data

Facing Up To Fatca

All the signs suggest US anti-tax evasion regulations present major data challenges for firms in 2012. However, it may be possible to derive business benefits through compliance, writes Nicholas Hamilton

Running With The Rules

Strapline: Regulation & Standards

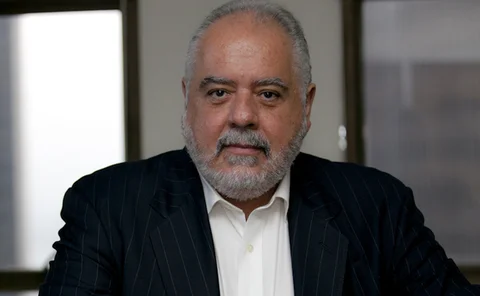

Olympian Capital Management's Renaissance

After Michael Levas started Olympian Capital Management from his kitchen table in Fort Lauderdale back in 2003, he found that in order to turn the firm into the hedge fund of his dreams he would have to find the right partner. Enter Arun Kaul. By Anthony…

Equities Mask for Derivatives

Concerned about the danger posed by leveraged OTC derivatives, regulation is forcing many of those instruments from a bilaterally traded environment to a publicly traded one. Dealers are preparing for the automation of collateral management and clearing…

Algo Trading and Fixed Income: Tilting at Windmills

Algorithmic trading is pervasive in equities and other liquid markets, but how far has it penetrated into fixed income? Some fear that the introduction of algorithmic trading strategies into bonds, fixed-income futures and other areas will engender…