Feature

Why UPIs could spell goodbye for OTC-Isins

Critics warn UK will miss opportunity to simplify transaction reporting if it spurns UPI.

Will overnight trading in equity markets expand next year? It’s complicated.

The potential for expanded overnight trading in US equity markets sparked debate this year, whether people liked it or not.

Can AI be the solution to ESG backlash?

AI is streamlining the complexities of ESG data management, but there are still ongoing challenges.

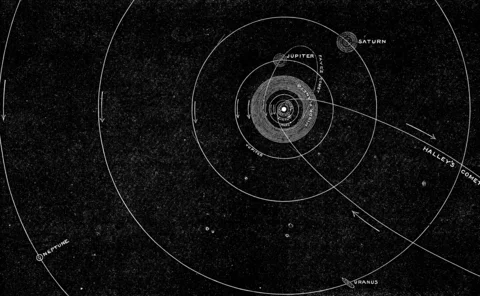

The US Treasury market preps for plumbing overhaul

Changes are coming to the US Treasury market with potential new clearing houses, access models, and more flow as the industry gets ready to meet the SEC’s first deadline for central clearing.

New GPU indexes to provide transparency into AI compute

Silicon Data, a company backed by DRW and Jump Trading, has launched its H100 and A100 indexes, providing transparency into the economics of AI compute.

Reporting overhaul: the EU’s near-impossible balancing act

Regulators must weigh their desire to streamline derivatives reporting against the need to gather crucial trade data.

DORA delay leaves EU banks fighting for their audit rights

The regulation requires firms to expand scrutiny of critical vendors that haven’t yet been identified.

Is 2027 the new 24-hour trading target?

Slew of technical issues and dearth of SEC staff compound exchanges’ reluctance for round-the-clock equity trading.

Is exchange tech ready for 24/7 markets?

Overnight trading is coming to equities markets. Venues and vendors, both new and old, are preparing for it.

Messaging’s chameleon: The changing faces and use cases of ISO 20022

The standard is being enhanced beyond its core payments messaging function to be adopted for new business needs.

A network of Cusip workarounds keeps the retirement industry humming

Restrictive data licenses—the subject of an ongoing antitrust case against Cusip Global Services—are felt keenly in the retirement space, where an amalgam of identifiers meant to ensure licensing compliance create headaches for investment advisers and…

Tech vendors, exchanges see gains from GenAI code assistants

CME Group and others report their experiences using code assist tools to generate code, support tech migrations, and speed up testing, and support functions.

ICE’s snowball effect: Intercontinental Exchange keeps leash tight on infrastructure

Voice of the CTO: Stuart Williams talks about why the exchange has been so adamant about “controlling” its infrastructure and technology, and how that helped it manage intense market volatility.

Investing in the invisible, ING plots a tech renaissance

Voice of the CTO: Less than a year in the job, Daniele Tonella delves into ING’s global data platform, gives his thoughts on the future of Agile development, and talks about the importance of “invisible controls” for tech development.

XiNG: Inside Citi’s all-encompassing risk platform

Voice of the CTO: Citi’s chief information officer, Jon Lofthouse, explains how and why the bank has extended its enterprise-wide risk platform so that every trade in any asset class goes through it.

Deutsche Bank delivers AI, client insights with ‘muscle memory’

Voice of the CTO: The German bank is taking finely honed skills and capabilities and deploying them for new and emerging use cases.

Bank of America reduces, reuses, and recycles tech for markets division

Voice of the CTO: When it comes to the old build, buy, or borrow debate, Ashok Krishnan and his team are increasingly leaning into repurposing tech that is tried and true.

CFTC takes red pen to swaps rules, but don’t call it a rollback

Lawyers and ex-regs say agency is fine-tuning and clarifying regulations, not eliminating them.

Project Condor: Inside the data exercise expanding Man Group’s universe

Voice of the CTO: The investment management firm is strategically restructuring its data and trading architecture.

Saugata Saha pilots S&P’s way through data interoperability, AI

Saha, who was named president of S&P Global Market Intelligence last year, details how the company is looking at enterprise data and the success of its early investments in AI.

‘The opaque juggernaut’: Private credit’s data deficiencies become clear

Investor demand to take advantage of the growing private credit markets is rising, despite limited data, trading mechanisms, and a lack of liquidity.