Compliance Budgets Rise, But Not Fast Enough

Thomson Reuters’ survey findings show limited resources for regulatory compliance efforts

The results of Thomson Reuters' cost of compliance survey released this week highlight concerns about the use of resources, and time being spent on compliance, that are relevant to data managers whose work is the backbone of firms' efforts to be compliant with regulation.

The survey collected feedback from about 600 professionals, including compliance executives from firms in all financial services sectors in all regions of the world, between November and January. Responses generally indicate that compliance functions, especially at firms outside the global systemically important financial institution (G-SIFI) category, are "already feeling the strain of being stretched too thinly," wrote Stacey English and Susannah Hammond, authors of a report on the survey. English is head of regulatory intelligence and Hammond is senior regulatory intelligence expert at Thomson Reuters.

Still, as English and Hammond point out, coordination of interaction and alignment between control functions is lacking, and about half the compliance professionals surveyed said they or their firms are spending less than an hour per week on internal audits. Furthermore, the number of firms spending more than 10 hours a week overall on compliance is decreasing, respondents said.

Nonetheless, about 68 percent of those surveyed said they expect compliance budgets to become either slightly or significantly more in the next 12 months. Although 38 percent of all firms are dedicating a full working day each week to tracking and analyzing regulatory developments, and 15 percent spend more than 10 hours a week to review the effects of new regulatory developments and information, it's debatable whether those compliance departments are going to get enough resources to devote more time to staying state-of-the-art in regulatory compliance, or even to keep spending the amount of time they currently spend.

English and Hammond themselves appear doubtful, writing, "It is not that compliance budgets are not expected to continue to rise; it is more that, increasingly, they may not be sufficient to give beleaguered compliance functions a fighting chance of dealing with the mounting challenges." They do, however, point to one silver lining to this black cloud: Fatca. Response to the US Foreign Account Tax Compliance Act was actually taken as an opportunity to review client databases, refresh that information and fill in any gaps, in their view.

Whether the industry can or does respond to the situation that English and Hammond identify around compliance resources probably depends on more than just reacting to this evidence. Firms will have to internalize the findings and realize the business and risk management needs that are being highlighted, and gather resolve—and resources —to respond.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@waterstechnology.com or view our subscription options here: https://subscriptions.waterstechnology.com/subscribe

You are currently unable to print this content. Please contact info@waterstechnology.com to find out more.

You are currently unable to copy this content. Please contact info@waterstechnology.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@waterstechnology.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@waterstechnology.com

More on Data Management

Exchange M&A, US moratorium on AI regs dashed, Citi’s “fat-finger”-killer, and more

The Waters Cooler: Euronext-Athex, SIX-Aquis, Blue Ocean-Eventus, EDM Association, and more in this week’s news roundup.

EDM Council expands reach with Object Management Group merger

The rebranded EDM Council now includes members from industries outside financial services.

As datacenter cooling issues rise, FPGAs could help

IMD Wrap: As temperatures are spiking, so too is demand for capacity related to AI applications. Max says FPGAs could help to ease the burden being forced on datacenters.

Bloomberg introduces geopolitical country-of-risk scores to terminal

Through a new partnership with Seerist, terminal users can now access risk data on seven million companies and 245 countries.

A network of Cusip workarounds keeps the retirement industry humming

Restrictive data licenses—the subject of an ongoing antitrust case against Cusip Global Services—are felt keenly in the retirement space, where an amalgam of identifiers meant to ensure licensing compliance create headaches for investment advisers and investors.

LLMs are making alternative datasets ‘fuzzy’

Waters Wrap: While large language models and generative/agentic AI offer an endless amount of opportunity, they are also exposing unforeseen risks and challenges.

Cloud offers promise for execs struggling with legacy tech

Tech execs from the buy side and vendor world are still grappling with how to handle legacy technology and where the cloud should step in.

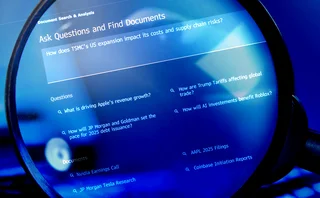

Bloomberg expands user access to new AI document search tool

An evolution of previous AI-enabled features, the new capability allows users to search terminal content as well as their firm’s proprietary content by asking natural language questions.