News

Glenmede Taps IHS Markit for Data Management

Glenmede officials say the investment firm is embarking on a “comprehensive transformation in its approach to managing data” supported by IHS Markit.

London Stock Exchange Bolsters Fixed-Income Presence with Citi Yield Book, Indices Acquisitions

$685 million deal for analytics platform and indices business first acquisition by LSEG since collapse of Deutsche Börse merger.

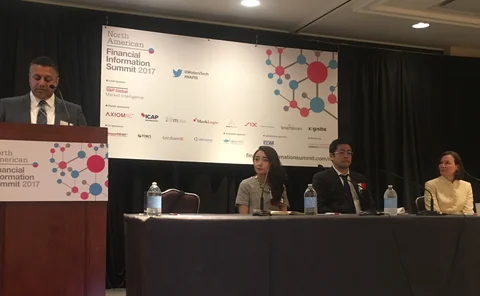

NAFIS 2017: Evolving Data Science Key to Effective Data Mining

Integrating data science projects will be key for institutions to get the most out of data in the future, but skillsets and the role of data scientist teams are still evolving. Joanne Faulkner reports.

LSE Bolsters Fixed Income Arsenal with Citi Deal

Acquisition aims to boost FTSE Russell’s appeal to fixed income clients and “enhance and complement” LSE’s Information Services data and analytics offering.

T3 Bows E8 Emerging FX Indexes

Officials say the index covering eight emerging market currencies will help investors increase exposure to these currencies.

Curex Hires FX Vet Cudahy for BizDev

Cudahy will leverage his years of experience in FX sales and trading roles at various banks to make Curex "the buy side's destination for best execution."

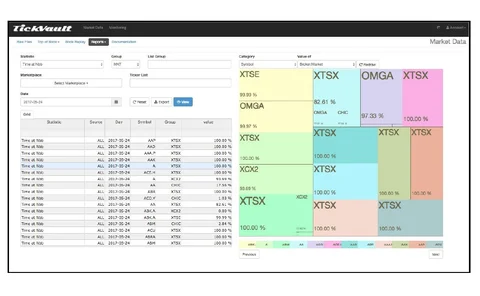

TickSmith Unveils Marketplace Analysis Tool

The new module enables market participants and exchanges to determine their performance and share of liquidity against other trading firms and exchanges.

NAFIS 2017: Firms Dip Their Toes into Data Lakes for Analytics

Panelists at the North American Financial Information Summit described the transformative potential of “data lakes” for supporting firms’ ever-increasing analytics and alternative data storage requirements. Joanne Faulkner reports.

NeoXam Appoints Execs to Head New Regional Structure

The vendor has shuffled its existing team and hired new executives to support the new structure.

Colchis, Alcova Tap AQMetrics for Risk, Reg Reporting

AQMetrics has added US investment management firm Colchis Capital Management and hedge fund Alcova Asset Management as clients of its Regulatory Risk and Compliance Software platform.

IMD/IRD Awards 2017—All the Winners and Highlights from the Evening

On the 15th anniversary of Inside Market Data's first US conference, 20 companies shared the spoils in more than 25 award categories.

GMEX, Metropolitan Stock Exchange of India to Collaborate on Capital Markets Development

Collaboration to focus on developing existing and new products within Indian capital markets with heavy technology slant.

IHS Markit Launches Outreach360 for Mifid II Outreach and Repapering

The new platform will be available via the firm’s Counterparty Manager platform to address the need for documentation management.

Credit Agricole Singapore Employs AxiomSL’s Regulatory Data Solution

Investment bank will use the solution to comply with mandates under MAS 610 and MAS 649 required by the Singaporean central bank.

Mergermarket Buys Trade Ideas Platform TIM Group to Boost Buy-Side Reach

Officials say the move highlights the growing trends towards quantitative strategies and demand for Big Data.

R3 Gets $107 Million Funding

The consortium calls the first two of three funding tranches the largest raised for distributed-ledger technology.

Moscow Exchange to Distribute Market Data to Chinese Investors

Chinese investors will now have access to MOEX market data via local data providers.

RSRCHXchange, CorpAxe Partner for Consumption Data

RSRCHXchange is to make research consumption data available through the CorpAxe platform to help consumer firms comply with the research components of the upcoming MiFID II regulation

Euronext Continues Diversification Drive into Foreign Exchange with FastMatch Acquisition

Euronext to acquire 90 percent stake in spot FX trading network FastMatch as exchanges continue their move into investment bank domain

TickSmith Unleashes Python API for Tick Data Access

TickSmith's new Python API is aimed at the needs of data scientists using open-source Python-based analysis tools.

BSO Offers Global Data Access to CME Co-Lo Clients

The arrangement will allow CME clients to connecto to other markets worldwide from CME's co-location center via BSO's network.

Best Credit Data Taps Data Vet Williams as Advisor

Williams' industry experience includes a stint at SIX Financial Information and a decade at Interactive Data.

Wolters Kluwer Nabs Citi’s Somany

Somany's years of experience at sell-side firms including Citigroup, Barclays and UBS will help the vendor "cement" its position in the regulatory solutions and reporting space, officials say.

StanChart to Join Thomson Reuters African KYC Service

Standard Chartered is the fourth bank operating in South Africa to sign up for Thomson Reuters' regional KYC service, which the vendor launched last year.