News

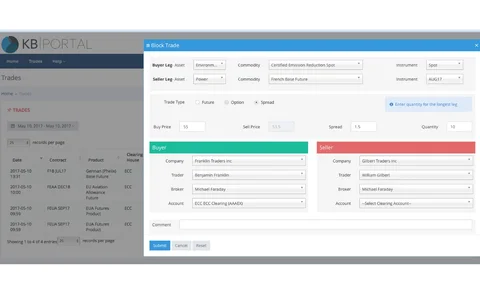

After ECC, EEX Clearing Rollout, KB Tech Eyes Data Deals

KB Tech's initial deal with ECC covers post-trade and clearing-related data, though, this may expand to other areas in future.

Oppenheimer Expands GoldenSource Deal to Hosted Services for KYC, AML

New York-based investment bank and fund manager Oppenheimer & Co has begun using hosted data management services from enterprise data management platform provider GoldenSource in conjunction with its existing in-house deployed installation of the vendor…

Finra to Sunset Oats Over a Two-Year Period

Shutting down Oats may take two years and depend on CAT data accuracy.

NEX Launches EBS JPY Benchmark Index

Benchmark will provide price information for the dollar-yen rate during Japanese trading hours.

xCelor, Ciara Ally for High-Frequency On-Server Feed Handling, Book Building

Officials say the integration will eliminate latency associated with the processes of book-building from market data feeds.

Opus Debuts Resolve KYC, Entity Data Management API

The Resolve API will make it easier for users to search for and validate company information from a range of data sources.

Thomson Reuters Adds S&P Transcripts Content

The agreement will provide Thomson Reuters' clients with access to tagged and machine-readable corporate events transcripts data from S&P.

Wolters Kluwer Adds Finance, Risk Market Manager in APAC

Officials say Ahmed's experience in addressing IFRS 9 will support the vendor's growing business in the region.

Horizon Expands Platform with Algo Trading Templates

The new strategy templates are fully customizable, giving in-house capabilities to an outsourced solution.

European Commission Puts €500,000 Into ‘Blockchain Observatory'

The project is designed to provide a further understanding of distributed-ledger technology and its impact on financial services.

Cinnober Acquires Surveillance Vendor Ancoa Software Out of Administration

UK-based surveillance technology provider bought out of administration after failing to secure necessary funding.

LiquidityBook Adds Les Vital to POEMS Team

Vital served stints at Broadridge, Eze Software and Morgan Stanley.

Thesys Moves Forward with CAT, Signs Contract with SROs

According to regulatory filings, the CAT will cost the industry $50.7 million for the fiscal year beginning November 2016.

Web Financial Nabs Naumann to Expand North American Footprint

Naumann's hire follows the appointment of former YCharts and Morningstar exec Jeremy Diamond in Chicago a year ago.

BME Grows Real-Time Index Offering

The new index series will be calculated and disseminated in real time from June 1.

ICE Partners with NPL for Atomic Timestamping

Intercontinental Exchange has linked up with UK's National Physical Laboratory to ensure co-location customers at its Basildon datacenter, home to its European derivatives exchange, meet MiFID II timestamping requirements.

Rival Systems Taps QuantHouse for Ultra-Low Latency Market Data Feed

Rival Systems has integrated QuantFEED into its Rival Trader and Rival API platforms as it looks to expand into equities.

Sell-Side Technology Awards 2017: All the Winners and Why they Won

The two final categories of this year's Sell-Side Technology Awards ─ best overall sell-side product for 2017 and best sell-side technology provider for 2017 ─ were won by Nasdaq and IHS Markit, respectively.

Sapient Launches Client Connect as Managed Service

Sapient says Client Connect will help firms automate many client-facing responsibilities and reallocate people for better efficiency.

OpenFin Looks to Grow Developer Usage with Community Edition, Open-Source Rollouts

Mazy Dar speaks with Waters about the company’s new Community Edition offering and its decision to open source its core platform.

Thomson Reuters Bows API for Desktop Apps to Access Eikon Data

The Side-by-Side Integration API will allow users and third-party application developers to incorporate content from Eikon into other applications used alongside the workstation on clients' desktops.

HSBC Taps Fenergo for Client Compliance Management

The platform will allow the bank to ensure compliance, improve onboarding times, and improve efficiency, while integrating with KYC and AML utilities.

DTCC Adds Wotton as Managing Director

Wotton will help oversee DTCC Deriv/SERV's product development and strategy.

Bloomberg Gets GLEIF LOU Nod

To avoid falling foul of MiFID II's 'No LEI, No Trade' rule, Bloomberg will make LEIs available to clients via three mechanisms.