News

DTCC, Swift Top Ranking of LEI Infrastructures

The first quarterly ranking from Tabb Group puts the US legal entity identifier providers at 97% comprehensiveness for more than 140,000 records

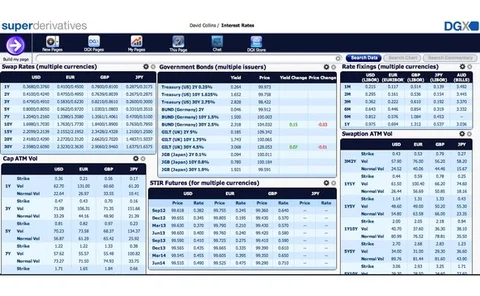

Swedish Pension Fund AP3 Rolls Out SuperDerivatives DataX, DGX Direct

Swedish national pension fund AP3, with SEK 258.5 billion ($38.7 billion) has rolled out over-the-counter pricing and risk management software vendor SuperDerivatives' DataX market data service for investment analysis and valuation, as well as the vendor…

Russia Depository Fills Information Roles

National Settlement Depository has named Alina Akchurina to run collateral management systems and hired Intesa Bank's Svyatoslav Berezin as information security director

Swedish Pension Fund AP3 Rolls Out SuperDerivatives DataX, DGX Direct

Swedish national pension fund AP3 has rolled out over-the-counter pricing and risk management software vendor SuperDerivatives' DataX market data service for investment analysis and valuation, as well as the vendor's DGX real-time market data, news and…

Deutsche Bank Adds Shannon, Marcar to Technology Team

Deutsche Bank announced two senior appointments to its technology and operations team in an effort to bolster the group’s leadership.

Data, Not Technology, is Key to Improve Market Surveillance, Says CMCRC

When it comes to market surveillance data—and not technology—is the real issue, according to the Capital Markets Cooperative Research Centre (CMCRC), a Sydney-based think tank funded by the Australian government.

Caplin Launches Mobile Trading App for FX

Caplin Systems has announced the release of its mobile trading application for foreign exchange (FX), Caplin FX Mobile.

Exegy Posts Canadian Data Peaks Portal

St. Louis, Mo.-based hardware ticker plant provider Exegy has launched a Canadian version of its MarketDataPeaks portal of historical peak data volumes, to provide financial firms investing in Canada with intraday market data rates to help inform…

Update: BGC Sets New Non-Display Data Policies

Editor's note: This story has been amended to reflect clarifications provided by BGC that the new policy will not introduce fees for "Public" datasets. Inside Market Data apologizes for the errors.

EESAT Preps Equinix NY4 Datacenter Move for COB Feeds

Chicago-based EESAT, a provider of market data on complex order book trading activity──comprising multi-leg trades between options and other asset classes──is moving its datacenter to Equinix's NY4 facility in Secaucus, NJ, to make it easier for…

GreySpark Study Yields Pre-Trade Risk Best Practices

Recently published research from London-based capital markets consultancy GreySpark Partners has yielded a number of best practices designed to help sell-side firms manage a range of risks associated with their electronic trading activities.

Bowles Joins LSEG Board

Sharon Bowles has been appointed as a non-executive director at the London Stock Exchange Group (LSEG). With the new appointment, the LSEG hopes to further its understanding and experience of UK and European politics, economics, and regulations affecting…

SimCorp Adds Data Capabilities in Dimension 5.6

Copenhagen-headquartered vendor SimCorp has announced the latest release of its flagship Dimension platform, which includes data capabilities specifically geared toward asset managers and owners.

Pricing Vet Blance Unveils Voltaire Advisors Valuation Risk Consultancy

Market data and evaluated pricing industry veteran Ian Blance has set up a new London-based company, Voltaire Advisors, to provide consulting services around valuation risk to buy-side clients and the hedge fund administrators, asset servicing firms and…

Thomson Reuters/Aite Survey: Big Data Usage Remains Limited in Capital Markets

Almost 95 percent of financial firms claim to have no experience or knowledge of Big Data, according to a survey of buy-side and sell-side firms by Aite Group on behalf of Thomson Reuters, reflecting relatively slow adoption of Big Data strategies…

JSE Reports Data Revenue Rise

The Johannesburg Stock Exchange has reported first-half data revenues of 95.4 million South African rand, a 16 percent increase over the same period last year, on overall group operating revenue of R869 million, itself a 9 percent increase over the…

Platts Expands Chinese Coal Data Deal

Energy and commodities data provider Platts has added two new price assessments for thermal coal in China as a result of expanding an existing agreement with Chinese commodities data provider Shanxi Fenwei Energy Consulting Company.

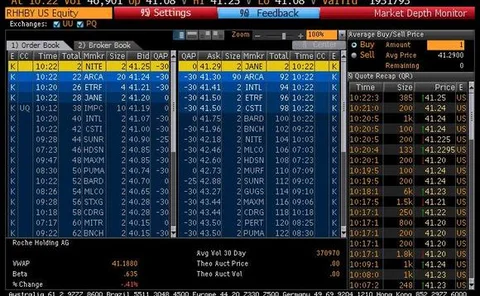

Consultancy Quanticks Repositions as Order Book Feed Processor

US-based market data consultancy Quanticks Capital Solutions has suspended its existing market data consulting and custom development business and repositioned itself as a provider of a technology platform for consolidating order book data from US…

Options Turns to Morrow for Account Management

Managed data and trading infrastructure provider Options has appointed Stephen Morrow senior vice president and global head of account management, based in Belfast, Northern Ireland.

Aegon AM Unifies Global Data Procurement

Aegon Asset Management, the investment management arm of Netherlands-based multinational life insurance, pensions and asset management company Aegon, is embarking on a project to centralize vendor management, market data and IT procurement across its…

South Korea to Raise Stock Price Movement Limit

With an eye on reviving its economy, South Korea will move the daily price movement limit on stocks from 15 to 30 percent, according to a report from Reuters.

IPC Appoints Barua as Chief Executive Officer

On Tuesday IPC, the network and trading turret provider, appointed Neil Barua as its chief executive officer with immediate effect.

TMX Preps US-Canada Microwave Network with Strike Acquisition

TMX Atrium, the network subsidiary of Canadian exchange operator TMX Group, has bought the StrikeNet low-latency microwave network business of Strike Technologies from parent group, New York-based market maker and trading technology provider Global…

CQG Unveils ‘Stripped' Data, Charting Terminal

Denver, Colo.-based data, trading and analytics software vendor CQG has released a new, low-cost market data workstation, dubbed CQG Select, to provide an alternative to more expensive terminal displays for proprietary trading firms facing cost pressures.