News

Swift Opens Mexico City Office, Adds Executives

Ruben Galindo, previously of HSBC, and Ricardo Vigueras, previously of Banamex, have joined the messaging cooperative in its efforts to respond to increased demand in Latin America

SIX Financial Info Pushes FISD FIA Certification

The US arm of Swiss data vendor SIX Financial Information has begun mandating that its client-facing staff achieve industry association FISD's Financial Information Associate (FIA) professional certification, to demonstrate the expertise of its employees.

Eurex to Launch FX Contracts in July

Eurex, the German exchange operated by Deutsche Boerse, has announced it will offer foreign-exchange (FX) futures and FX options on six currency pairs beginning on July 7 2014.

Sprott Asset Management Picks SS&C for Settlement Notification

California-based Sprott Asset Management has selected SS&C's Technologies' SSCNet for automated settlement notification. The global network will enable trade communication between Sprott and its broker-dealers, custodian and prime brokers.

Thomson Reuters To Monitor Fatca Grandfathered Instruments

The data provider will alert users if an instrument loses its exemption from tax withholding under Fatca as a result of one of six possible types of material modifications

Nasdaq Completes eSpeed Datacenter Migration

Nasdaq OMX's eSpeed US treasuries trading platform has completed its migration to Nasdaq's datacenter in Carteret, NJ, resulting in a 100 microsecond improvement in market data distribution, and a 25 percent improvement in roundtrip order-entry response…

Horizon Integrates Azul’s Zing to its Trading Platform

Front-end trading solutions provider Horizon Software has partnered with Azul Systems to integrate Zing, Azul’s Java runtime product, to its electronic trading platform in order to enhance application productivity.

eSpeed Completes Migration to Nasdaq OMX Data Center

eSpeed, the electronic trading platform for the US fixed-income market, acquired by the Nasdaq OMX group in April 2013, has completed its migration to the Nasdaq OMX data center in Carteret, New Jersey.

4th Story Combines Market, Fundamental Analytics, Boosts Analyst Automation

San Francisco-based data and trading software developer 4th Story has unveiled a new tool for analysts and portfolio managers that runs analytics on a combination of traditional price data and fundamental information, and which also automates time…

SMA Eyes Front-Office Traders, PMs with Social Indicators Excel Add-in

Social Market Analytics, a Naperville, Illinois-based provider of trading signals derived from analysis of social media sentiment, is rolling out a Microsoft Excel spreadsheet add-in to make its proprietary S-Factor sentiment scores more accessible by…

Pragma Launches Spot FX Trading Tools

Pragma, a New York-based algo technology specialist, has released Pragma360, a suite of spot FX trading tools. Pragma360 includes algorithms, transaction cost analysis (TCA), smart order routing, risk controls, and an EMS front end.

DoubleLine Chooses Vichara for CLOs

Los Angeles-based fixed income manager DoubleLine Capital has licensed the V*CLO platform from Hoboken-based Vichara Technologies for analysis of collateralized loan obligations (CLOs) and their underlying collateral pools.

Former ISE Exec Soule Boards Redline

Jeff Soule, former head of market data at the International Securities Exchange, has joined Woburn, Mass.-based low-latency feed handler provider Redline Trading Solutions as vice president of business development, responsible for bringing new data…

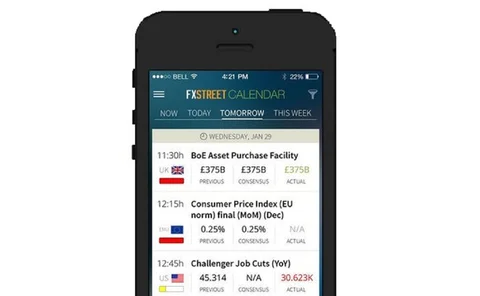

FXStreet's FXBeat Newswire Now a Premium Subscription Service

Foreign exchange news, commentary and data provider FXStreet has upgraded its FXBeat news and commentary feed to a premium service for traders and for brokers to integrate into their own trading platforms.

Volta, Venus Offer Co-Lo with AWS

Datacenter provider Volta Data Centres and fiber network vendor Venus Business Communications have partnered to offer enhanced hybrid co-location solutions via Amazon Web Services at Volta's Great Sutton Street datacenter in London, in a move to provide…

Rimes Survey: Inconsistent Buy-Side Index, Benchmark Management

Competing priorities between data end-users and those in central management functions such as IT and operations are leading to inconsistent approaches to index and benchmark data management within buy-side firms, making it harder to improve data…

Activ Preps PoP in TMX Co-Lo

Market data and ticker plant provider Activ Financial is building a point of presence (PoP) in Canadian exchange group TMX Group's co-location facility in Toronto, to provide traders subscribing to Activ's Canadian data services with low-latency access…

ICE Confirms Euronext IPO Details

The IntercontinentalExchange Group (ICE) has released plans for the intial public offering (IPO) of Euronext, the European exchange arm of NYSE Euronext, which the Atlanta-headquartered venue operator acquired in November 2013

Athens Exchange Selects Cinnober for Surveillance

The Athens Stock Exchange (Athex) has selected Cinnober's Scila Surveillance suite to handle a multi-asset monitoring environment.

Martyn Moves to OTAS for Analytics Sales

London-based analytics provider OTAS Technologies has hired Jennifer Martyn as product sales manager, responsible for driving the sales of the vendor's cloud-based OTAS analytics platform and its TraderShaper real-time microstructure analysis and trade…

Enyx, Options Ally for FPGA-Accelerated US Equities Data Distribution

Paris-based hardware-accelerated data capture and network technology vendor Enyx is enabling clients of infrastructure-as-a-service provider Options (formerly Options IT) to access its managed NXFeed ultra-low-latency market data distribution system via…

CFH Clearing, NetDania Partner on NetStation Data-Trading Platform

London-based prime brokerage firm CFH Clearing and NetDania Markets, the subsidiary of Danish foreign exchange data display and technology provider NetDania, have launched a new data and trading platform, dubbed NetStation, aimed at retail brokers.

NYSE Overhauls Non-Display Data Fees

NYSE Euronext has informed clients of changes to its non-display policy for all real-time US proprietary market data products, which includes price increases of up to 100 percent for some products, in a move to bring its fees into line with those of its…

After RFP, OPRA Renews SIAC SIP Deal

The Options Price Reporting Authority has concluded its tender process to find a technology supplier to manage its Securities Information Processor (SIP), and is expected to re-sign with incumbent provider SIAC (the Securities Industry Automation Corp.,…